Timing & trends

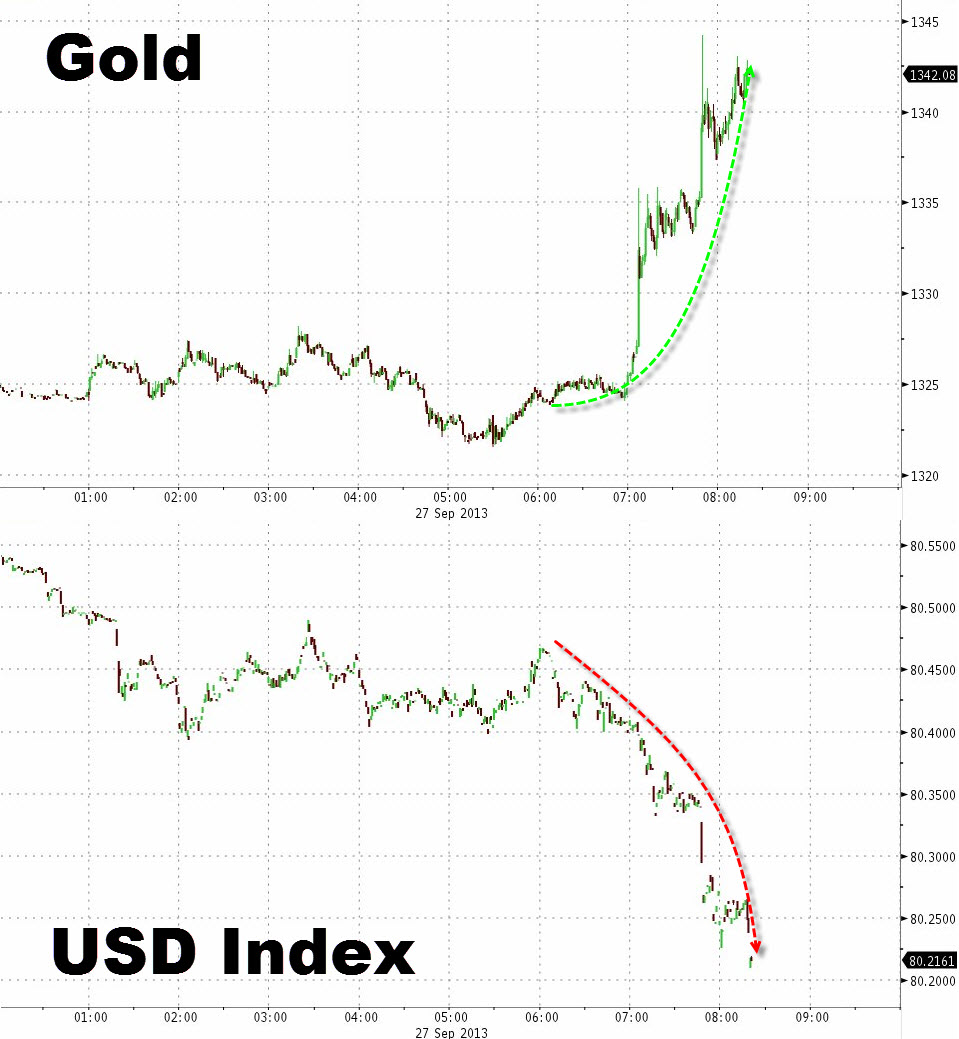

It would appear that between the fears of a government shutdown and the battle over the ‘full faith and credit’ of the US, traders have decided that the stroke-of-midnight agreement is potentially less viable this time as both parties feel the other has more to lose. The USD is being sold against all majors and gold, silver, and WTI crude is well bid as investors seek the safety of hard assets over printable fiat. Of course, that could all change on the next economic data or Washington headline… buckle up…

Chart: Bloomberg

EUR is nearing 8-month highs at 1.3550 as the USD Index presses down to near 7 months lows.

….read ZeroHedge’s feature article on Gold HERE

For the first time in history, ALL the major central banks are printing money. One of two things will occur. If they continue to print, their respective currencies will lose their purchasing power, and we’ll have inflation or even hyper-inflation. If the central banks pull back on their printing, we’ll have crashing markets and a world depression. This is the problem with creating ever more debt. Ultimately, the debt owns you, and the compounding process renders the debt situation unsustainable, which is what the CBO has just warned us about.

The underlying problem is the common man’s desire for profits — his insatiable greed. Eventually, greed becomes its own worst enemy. To “grow” the economy, you must have expanding credit. Eventually, credit, when compounded, becomes unsustainable — particularly when a nation can print all the money it wants out of thin air. Thus, the acceptance of fiat money spells the eventual death of an economy.

Below I show a chart of JP Morgan, the biggest bank in the US. Here we see a textbook head-and-shoulders pattern that I think should break down. JPM was just hit with a huge $900 million fine, based on its notorious trader, known as the “London Whale.”

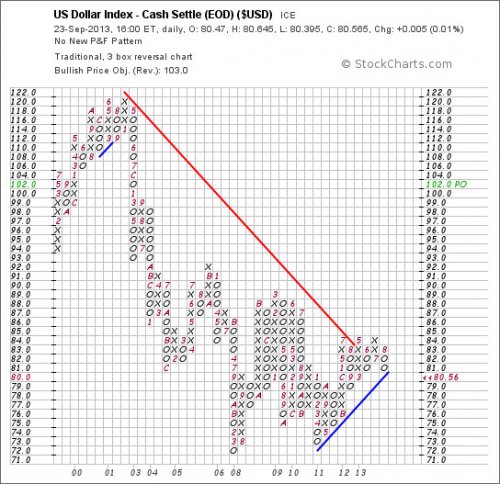

Another choice place I’m watching is the US dollar. The US dollar has dropped three boxes on the P&F chart. If the dollar hits the 79 box, it will have issued a clarion sell signal. So at any rate, I’ve got my eye on the dollar.

Here’s something that bothers me. Below we see the D-J Industrial Average. As you can see on the chart, over the last four trading sessions, the Dow has declined each day. Is this the sign of a market top that is subtly breaking down? If this declining action continues, I’ll really begin to wonder whether something ominous is in the cards.

To subscribe to Richard Russell’s Dow Theory Letters CLICK HERE.

About Richard Russell

Russell began publishing Dow Theory Letters in 1958, and he has been writing the Letters ever since (never once having skipped a Letter). Dow Theory Letters is the oldest service continuously written by one person in the business.

Russell gained wide recognition via a series of over 30 Dow Theory and technical articles that he wrote for Barron’s during the late-’50s through the ’90s. Through Barron’s and via word of mouth, he gained a wide following. Russell was the first (in 1960) to recommend gold stocks. He called the top of the 1949-’66 bull market. And almost to the day he called the bottom of the great 1972-’74 bear market, and the beginning of the great bull market which started in December 1974.

Letters are published and mailed every three weeks. We offer a TRIAL (two consecutive up-to-date issues) for $1.00 (same price that was originally charged in 1958). Trials, please one time only. Mail your $1.00 check to: Dow Theory Letters, PO Box 1759, La Jolla, CA 92038 (annual cost of a subscription is $300, tax deductible if ordered through your business).

It’s often argued that they don’t a bell at the top.

It’s often argued that they don’t a bell at the top.

I would argue that we numerous bells ringing in the financial markets today.

Carl Icahn wants Apple to leverage up to boost returns to shareholders. Apple has maintained next to no debt for the better part of ten years.

Now share price is lagging and the goal is to issue a load of debt to buy back shares. Leveraging up companies that have long had little debt is a classic market mania indicator

Hilton is trying to go public. Put another way, one of the largest commercial real estate/ hospitality chains in the world is going public after being private for over 40 years…

Why go public now? Because you can raise funds cheaply in today’s high liquidity environment and you don’t want to be holding the bag when the economy slumps again.

The large financial institutions that bought homes and real estate in the slump are looking to exit. These groups and their clients didn’t get rich by being wrong.

They’ve made their profits by buying when no one else wanted to and now they’re getting out. Hedge fund Och-Ziff, PE firm Blackstone, and others are unloading their real estate portfolios.

The smart money is getting out of the market. Fortress Investment Group, Apollo Investment Group and other large “smart money” investors are literally “selling everything” they can. They’re not doing this because they expect things to improve and the market to continue to move sharply higher.

Indeed, even investment legend Warren Buffett, who has virtually never advocated against investing in stocks (with the exception of the Tech Bubble) has stated the market is “fully valued” at today’s levels.

Buffett loves stocks. He’s made his fortune investing in them. He is a near eternal optimist. For him to state the markets are fully valued and be sitting in the single largest cash hoard of his investment life is a major indicator that stocks are topping.

If you’re looking for actionable investment strategies on playing the markets, take a look at my monthly investment newsletter, Private Wealth Advisory.

Published on the third Wednesday of every month after the market closes, Private Wealth Advisory, shows individual investors how to beat the market with well-timed unique investments.

To whit Private Wealth Advisory is the only newsletter to have shown investors 72 straight winning trades and no losers during a 12-month period.

Indeed, in the last two months alone we’ve locked in gains of 8%, 12%, 21% and even 28%… with an average holding period of 3-4 weeks.

To find out more about Private Wealth Advisory and how it can help you beat the market with your investments…

Best Regards

Graham Summers

Jobless claims beat expectations with a prints 305k vs the expectation of 325k. The fourth straight week of gains and increaslingly important number as jobs are tied to central bank policy.

Drew Zimmerman

Investment & Commodities/Futures Advisor

604-664-2842 – Direct

604 664 2900 – Main

604 664 2666 – Fax

800 810 7022 – Toll Free

The US Quarterly GDP came in at 2.48%, the print was below the expected 2.6%. In the data dependant world that we are living in, the market had little movement on the release as it was largely as expected.

Drew Zimmerman

Investment & Commodities/Futures Advisor

604-664-2842 – Direct

604 664 2900 – Main

604 664 2666 – Fax

800 810 7022 – Toll Free