As a general rule, the most successful man in life is the man who has the best information

Here’s four facts I want you to have on your screen before we get going:

- Junior resource companies, not major mining companies, own the worlds future mines. Juniors already own, and find more of, what the world’s larger mining companies need to replace reserves and grow their asset base.

- Juniors are the ones most adept at finding these future mines.

- The gold mining industry needs to discover 90 million ounces of gold every year just to stay even.

- The junior exploration sector is presently in the midst of one of the worst financing environments ever experienced by the sector.

Discovery

Despite increased exploration expenditures, a record US$8b in 2011, gold ounce discovery is not keeping up to the rate needed to replace mined ounces. The Metals Economic Group estimates that the 99 significant discoveries (defined as greater than 2 mil oz) found between 1997 and 2011 replaced only 56 percent of the gold mined during that same period.

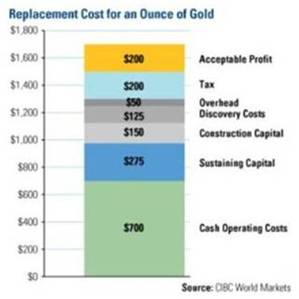

Costs

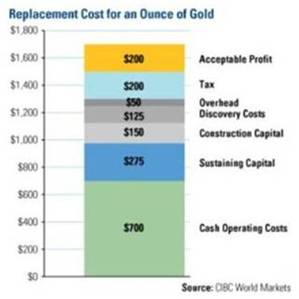

Gold ounce discovery is not keeping up, CAPEX and OPEX costs are escalating…

In 2001 and 2002 miners were producing gold for sub-$180 cash costs – the operational cost of the mine divided by the ounces of  production. By 2005 cash costs had risen 45 percent to US$250. Data from GFMS shows world gold production costs for the first half of 2009 averaged $457/oz. Average cash costs in 2011 were US$657. A complete breakdown of costs, an all-in cost figure, courtesy of CIBC, shows today’s average cash operating costs pegged at $700 an ounce.

production. By 2005 cash costs had risen 45 percent to US$250. Data from GFMS shows world gold production costs for the first half of 2009 averaged $457/oz. Average cash costs in 2011 were US$657. A complete breakdown of costs, an all-in cost figure, courtesy of CIBC, shows today’s average cash operating costs pegged at $700 an ounce.

Financing

Below is a chart I found over at The Charleston Voice website – it is the HUI expressed as a percentage of the gold price. By comparing the AMEX Gold Bugs Index (HUI) with the price of gold since 1998 they get a ratio that shows whether money flow is positive or negative for the mining sector. It shows quite clearly that money flows into miners is now very negative.

A Junior exploration company’s place in the food chain is to acquire and explore properties. Their job is to make the discoveries that the mid-tiers and majors takeover and turn into mines.

If exploration could only replace half the mined gold with record expenditures in 2011 and funding for exploration dropped by $9b from June 2011 to June 2012, and dropped drastically again from then till now, what’s in store for the future gold supply with even way less money for exploration today?

Historically, ownership of junior resource companies involved in the search for and development of precious metal deposits have offered the best leverage to rising metal prices – and they will again. Once the bullions all bought and allocated, once the market is setting gold’s price, once everyone knows mining is not going to replace even a small portion of future demand what’s going to happen?

Exactly – the shares in companies with advanced gold and silver projects are going to become very precious indeed.

Companies being considered for investment purposes should have all the following key attributes:

- Established track record

- Experienced and competent management teams

- Established mineral resources

- Projects in safe and stable jurisdictions of the world

- Strategically located properties – existing infrastructure

- Significant upside potential

But

Only you can decide the level of risk you can tolerate and how much patience you have to sit while developments, the story, plays out. It’s my opinion that a good entry point into the junior market would be a nearer term producer. Because these companies are well advanced along the development path a lot of the guesswork about grade, size, costs and metallurgy have been taken out of the equation for us.

These close to production companies have managed to reduce risk and give investors a much higher level of confidence that they will be going mining by achieving certain milestone studies:

- Preliminary Economic Assessment (PEA) or scoping studies are done to examine potential mining scenarios and economic parameters – A PEA or scoping study is an important milestone for a mineral project, it’s the first step in a company’s economic and technical examination of a proposed mine

- Preliminary feasibility studies or pre-feasibility studies (PFS) are more detailed than PEA’s and are used to determine whether or not to proceed with a detailed feasibility study. They are also used as a reality check to determine areas within the project that require more attention

- Feasibility studies (FS) will determine definitively whether or not to proceed with the project. A feasibility study or bankable feasibility provides budget figures for the project and will be the basis for raising capital to build the mine

It’s easier to be patient when you can see the physical progress towards mining, you can see every step being taken down the development path to a mine and profitability. These later development stage companies are not going to be looking for a gold or silver deposit, you won’t be sitting on the edge of your chair waiting for good, or not, assay results. No, this stage company is going to be digging up, in very short order, what’s so much in demand and selling dear – gold and silver. And they will be the first companies to have their share prices move when the freight train rush to buy gold and silver shares slams into the TSX.V.

Fact – junior resource companies, not majors, own the worlds future mines.

Fact – a precious metal company that can get into extremely profitable production today is going to be something very special.

Fact – cash flow is king, any undervalued assets will be ripe for the plucking by those with cash – it’s called merger and acquisition and for those with the cash today everything is for, and on, sale.

It’s this authors opinion that a company heading towards profitable production today is going to be a very good purchase to tuck away in your portfolio.

Northern Vertex Mining Corp. TSX.V – NEE, with its Moss gold/silver project in NW Arizona, is something special. Who out there wouldn’t appreciate owning a piece of a top shelf management team with a strong shareholder base, low share count and the ability to raise money even under difficult market conditions?

But it gets better, add in 70 percent ownership of the Moss gold/silver project:

- IRR of 118% at $1,500 Au

- IRR of 88% at $1,300 Au

- Cash cost of $490 (capital/average annual oz AuEq production $633/oz)

- Low capital costs – $26 m to build phase II, phased development approach being utilized to reduce pre-development project risk. Pilot Plant Phase I production targeted for Q2 2013. Commercial Operations Phase II production targeted for Q3 2014

- High grade, 1.29 gpt AuEq, M+I

- Low strip ratio, 1.6:1

- Phase I & II five year mine life, 5000tpd, 42,000 ozs AuEq recovered per year

- Excellent exploration potential exists to add to life of mine, the 5 year mine life is for Phase I & II only. Phase III could add an additional 5 to 7 years of mine life

There are two truly unique things about Northern Vertex and its Moss Project; firstly the ability – because of low all in costs per mined ounce – to convert ounces in the ground into CASH when other projects are being put on the shelf, and secondly the timing of production. When you think of project cost escalations, delays and outright project cancellation, the onslaught of resource nationalization, global out-of-control monetary policy and the coming supply/demand imbalance for gold and silver you have to realize Moss’s production timeline couldn’t be better or more opportune for investors.

Conclusion

Northern Vertex is truly an unknown story that is moving at light speed, on time and on budget. What they have accomplished in just over two years speaks well of this experienced committed management team and bodes well for investors future with NEE.

The world’s gold vaults are being emptied, ahead of the herd investors have already started accumulating the best junior gold stocks – the greatest gold rush of them all has quietly started.

The stealthy start of the ‘Greatest Gold Rush’ and at least one quality junior, soon to be miner of gold and silver, should be on all our radar screens. Are they on yours?

If not, maybe they should be.

Richard (Rick) Mills

Richard is the owner of Aheadoftheherd.com and invests in the junior resource/bio-tech sectors. His articles have been published on over 400 websites, including:

WallStreetJournal, USAToday, NationalPost, Lewrockwell, MontrealGazette, VancouverSun, CBSnews, HuffingtonPost, Londonthenews, Wealthwire, CalgaryHerald, Forbes, Dallasnews, SGTreport, Vantagewire, Indiatimes, ninemsn, ibtimes, businessweek.com, moneytalks and the Association of Mining Analysts.

If you’re interested in learning more about the junior resource and bio-med sectors, and quality individual company’s within these sectors, please come and visit us atwww.aheadoftheherd.com

If you are interested in advertising on Richard’s site please contact him for more information,rick@aheadoftheherd.com

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard does not own shares of Northern Vertex Mining Corp. TSX.V – NEE

Northern Vertex TSX.V – NEE is a paid advertiser on Richard’s site, aheadofthe

production. By 2005 cash costs had risen 45 percent to US$250. Data from GFMS shows world gold production costs for the first half of 2009 averaged $457/oz. Average cash costs in 2011 were US$657. A complete breakdown of costs, an all-in cost figure, courtesy of CIBC, shows today’s average cash operating costs pegged at $700 an ounce.

production. By 2005 cash costs had risen 45 percent to US$250. Data from GFMS shows world gold production costs for the first half of 2009 averaged $457/oz. Average cash costs in 2011 were US$657. A complete breakdown of costs, an all-in cost figure, courtesy of CIBC, shows today’s average cash operating costs pegged at $700 an ounce.

Austin Kiddle

Austin Kiddle