Timing & trends

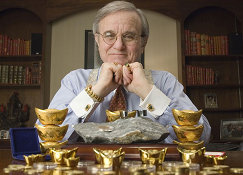

World famous gold guru Jim Sinclair is telling his followers that the gold price will soon move in ‘hundreds of dollars a day’ when the Comex changes its settlement rules as it must because the exchange is running out of physical gold.

World famous gold guru Jim Sinclair is telling his followers that the gold price will soon move in ‘hundreds of dollars a day’ when the Comex changes its settlement rules as it must because the exchange is running out of physical gold.

‘The cause of today’s spectacular rise in the gold price is the reality that with Friday continue large drop in Comex warehouse gold inventory,’ he writes. ‘No cogent argument can be formed against the reality that because of the continue fall in gold inventory that within in 90 days or sooner the Comex must change its delivery mechanism.

Cash settlement

‘The highest probability is that Comex will have to move to cash settlement rather than gold. Part of that settlement could be lots of 100,000 GLD (gold exchange traded fund) that represents the ability to exchange for gold.

‘Their problem is that if GLD is part of the settlement mechanism for the spot Comex contract that GLD will be destroyed by the convertibility. It is a truism in gold that which is convertible into gold will in fact be converted over time.

‘Gold rose today because those knowledgeable know the inevitability of the changing of the Comex contract, as it is today which calls for settlement in gold between contracting parties. There is no question this is the emancipation of physical gold from the fraud of no gold, paper gold.

‘The emancipation will cause physical gold exchanges to take birth and to be the discovery mechanism for the price of gold. This is the end of the ability to use paper gold future contracts as a mechanism to make the gold price sing and dance at the will of the manipulators.

True value

‘With manipulation coming to an end the true value of gold will be discovered by the cash exchanges that are now taking birth. The advent of the cash spot exchanges around the world is the natural demise of the Comex set up as convertible and now being converted.

‘As long as one can buy spot, pay insurance, transportation and re-casted by Rand Refinery to Asian products sold profitably, the demands for real gold are ending the hay days or even existence of the futures exchanges.

‘Gold is headed back to be traded as it was before 1973. Gold will trade well above $3,500 and those who have lived in the gold market like me for now 53 years know it. A price of $50,000 for gold is not out of the question as a result of its emancipation from fraudulent paper, no gold, paper gold.’

Gold running out

He continues: ‘The warehouse inventory of every futures gold exchanger is screaming this. The fact that there is no meaningful above ground supply of gold is screaming this. The fact that most of the central banks supply of gold is leased is screaming this.

‘There is no reason why gold cannot move up hundreds of dollars a day when the Comex changes their spot contract settlement, as they must, as they will, very soon.’

The next edition of the popular ArabianMoney investment newsletter has an exclusive interview with Jim Sinclair and edited highlights of his four-hour presentation in Vancouver on July 10th. Sign up to see this private circulation publication (click here).

I’ve spun a few yarns in recent years about my days as a naval officer; not, thank goodness, tales told by dead men, but certainly echoes from the depths of Davy Jones’ Locker. A few years ago I wrote about the time that our ship (on my watch) was almost cut in half by an auto-piloted tanker at midnight, but never have I divulged the day that the USS Diachenko came within one degree of heeling over during a typhoon in the South China Sea. “Engage emergency ballast,” the Captain roared at yours truly – the one and only chief engineer. Little did he know that Ensign Gross had slept through his classes at Philadelphia’s damage control school and had no idea what he was talking about. I could hardly find the oil dipstick on my car back in San Diego, let alone conceive of emergency ballast procedures in 50 foot seas. And so…the ship rolled to starboard, the ship rolled to port, the ship heeled at the extreme to 36 degrees (within 1 degree, as I later read in the ship’s manual, of the ultimate tipping point). One hundred sailors at risk, because of one twenty-three-year-old mechanically challenged officer, and a Captain who should have known better than to trust him.

I’ve spun a few yarns in recent years about my days as a naval officer; not, thank goodness, tales told by dead men, but certainly echoes from the depths of Davy Jones’ Locker. A few years ago I wrote about the time that our ship (on my watch) was almost cut in half by an auto-piloted tanker at midnight, but never have I divulged the day that the USS Diachenko came within one degree of heeling over during a typhoon in the South China Sea. “Engage emergency ballast,” the Captain roared at yours truly – the one and only chief engineer. Little did he know that Ensign Gross had slept through his classes at Philadelphia’s damage control school and had no idea what he was talking about. I could hardly find the oil dipstick on my car back in San Diego, let alone conceive of emergency ballast procedures in 50 foot seas. And so…the ship rolled to starboard, the ship rolled to port, the ship heeled at the extreme to 36 degrees (within 1 degree, as I later read in the ship’s manual, of the ultimate tipping point). One hundred sailors at risk, because of one twenty-three-year-old mechanically challenged officer, and a Captain who should have known better than to trust him.We survived, and a year later I exited – the Diachenko and the Navy for good – theirs and mine. I think I heard a sigh of relief as I saluted the Captain for the last time, but in memory of those nearly tragic moments, let me reprint an article posted on wikiHow, outlining exactly how to go about abandoning ship should you ever venture into the South China Sea or anywhere close to Davy’s infamous locker. The article is a bona fide and serious attempt to instruct would be passengers in a Titanic-like disaster. I found it, however, as comical as yours truly pretending to be a chief engineer in 1969. Judge for yourself…

…….read more HERE

If you think gasoline is expensive now, imagine the price when Iran and Israel start lobbing nukes at each other.

If you think gasoline is expensive now, imagine the price when Iran and Israel start lobbing nukes at each other.

Am I having a nightmare? No, I’m fully awake. That snoozing you hear is an energy market blissfully unaware of potential major war in the Middle East. The shooting could begin as soon as this year.

The world’s financial markets are completely discounting the very real possibility of an Israeli-Iranian war. Years of anger, threats and caustic rhetoric have put the so-called “experts” to sleep. Their blindness is incredibly dangerous for everyone.

Just look what’s happening RIGHT NOW. Israeli jets are already flying into Syria and Lebanon, disabling air-defense systems. Why?

To me, it’s obvious. Israel is clearing the path for a first strike against Iran’s nuclear missile launchers.

Israel’s Benjamin Netanyahu is not kidding. He will not allow Iran to have nuclear weapons. If he can’t stop them through negotiations, he will do whatever it takes.

Most people discount the possibility of an Israeli “first strike” for logistical reasons. They believe Israel would need U.S. cooperation to strike deep inside Iran. We could certainly make it easier for them. The U.S. could provide aerial refueling and other support while Israel drops the bombs.

With his nation’s very survival at stake, Netanyahu is also preparing to go it alone.

Some think Iran’s newly elected Hassan Rouhani, who takes over as president next month, will extend an olive branch. This is pure fantasy!

Rouhani is a wolf in sheep’s clothing. He was hand-picked by Iran’s Supreme Leader Ali Hosseini Khamenei to for two purposes …

First, Rouhani needs to satisfy Iran’s increasingly restless public. The massive protests of the last few years represent a real threat to Iran’s theocratic regime. The daily struggles created by economic sanctions are real. Rouhani must convince them he is working to end the country’s economic isolation.

Second, Rouhani will buy time with the Western powers by pretending to be a moderate, reasonable leader. Meanwhile the nuclear and missile programs will move forward. The Iranian regime believes that once it has nuclear warheads and missiles to deliver them, it can force an end to the devastating economic sanctions.

I believe both the U.S. and Iran underestimate Netanyahu’s willingness to go to war. One way or another, he will stop Iran from obtaining nuclear weapons.

Netanyahu’s “Face the Nation” appearance last week was a clear warning to the United States and other world powers. Incredibly, almost no one noticed. (See my publisher Brad Hoppman’s excellent July 17 analysis of the media missing the mark.)

The Obama administration is not blind. They know war between Iran and Israel is all but certain. They are doing all they can to postpone the inevitable.

The U.S. has its own reasons to stop Iran. So do other regional powers like Saudi Arabia. They simply want Israel to do the dirty work.

The good news: Iran will not have a chance to nuke Israel.

The bad news: The war to stop it will be ugly.

Here is how I think events will unfold …

- An Israeli strike on Iran nuclear facilities and missile development infrastructure will lead to …

- Vicious air war over Syrian, Lebanese and Iraqi airspace, followed by …

- An Israeli land invasion of Lebanon to neutralize Hezbollah’s rocket capacity, while …

- Iran tries to choke off oil exports through the Strait of Hormuz!

Then it will get even worse …

- Egypt’s paramilitary Muslim Brotherhood will obstruct the flow of oil through the Suez Canal.

- The final blow: an Iranian missile strike on Saudi oil fields.

When all this happens — and it will — world markets will suffer the worst one-day loss since 9/11. Crude oil could skyrocket to as high as $200. I expect to see gold make daily jumps of $100 or more.

If U.S. carrier groups in the Arabian Sea come under fire, we could see $300 oil and $2,000 gold — or even more!

I refuse to be guilty of willful blindness. That’s why I’m telling my subscribers how to prepare.

In Global Resource Hunter, I am planning hedges against the stock market’s visceral reaction to the coming Israeli strike. And my Junior Resource Millionaire subscribers will get recommendations designed to rack up substantial profits in the coming crisis. In both services, I am aiming to help members to maximize their profit potential in the wild swings we will see for both commodities and equities.

Whatever you do, keep your eyes open your eyes and prepare for the inevitable. You can survive — and even profit — from the trouble ahead. Don’t wait too long.

Best wishes,

James

Federal Reserve Chairman Ben Bernanke Thursday said falling gold prices may reflect less concern among investors about “extreme outcomes” for the economy.

Federal Reserve Chairman Ben Bernanke Thursday said falling gold prices may reflect less concern among investors about “extreme outcomes” for the economy.

“Gold is an unusual asset. It’s an asset that people hold as a sort of disaster insurance,” Mr. Bernanke said in response to a question at a Senate Banking Committee hearing.

Gold prices have dropped near three-year lows in recent weeks as the economy shows signs of improving and the Fed has clarified its plans to eventually roll back its bond-buying program.

Mr. Bernanke said those lower prices may reflect greater confidence about the economy and less concern that Fed programs will cause inflation to spike.

Still, the Fed chairman said gold isn’t such a great hedge against inflation. “Movements of gold prices don’t predict inflation very well,” he said.

Mr. Bernanke also offered a major caveat to his assertions about gold: “Nobody really understands gold prices and I don’t pretend to understand them either,” he said.

Bernanke Explains How Fed Views Inflation

There’s long been a gulf between how people view inflation and how central bankers take account of price pressures.

For most people, food and energy costs are among the most important, and most volatile, prices they confront on a daily basis. If those prices rise, that means inflation is on the march, regardless of the readings on the wide range of price data ginned up by government agencies monthly.

…..read it all HERE

Famous ‘High Low Logic Index’ is no longer bullish

Famous ‘High Low Logic Index’ is no longer bullish

A market timing indicator with a stellar long-term record is now in “sell” mode.

The last time this indicator generated a sell signal was in late 2007, just before the Great Recession.

……read more HERE