Timing & trends

….of the Bull Market in Gold and Silver?

On Friday, we witnessed a great plunge in gold (almost $80 – from $1560.30 to $1480.50) and silver (almost $1.7 – from $27.58 to $25.89) and we are seeing even lower prices this week.

It doesn’t matter if we look at gold from the USD perspective, the average non-USD perspective, or gold priced in individual non-USD currencies — we will see that the price has broken below the key support levels.

What about silver? On Friday, it moved insignificantly below some support levels (intraday 2011 and 2012 lows), and at this time, silver confirms the bearish outlook for gold. In fact, it’s only a few dollars above its 2008 high.

Does this mean that the bull market for gold and silver is gone for good?

The only answer my firm has to this question is a resounding “No.” And we say that because we realize that even the greatest of bull markets can at times decline significantly with no particular logical reason. We know that something like that happened over 30 years ago during the previous bull market when the price of gold dropped by almost half before it moved to the high, which was multiple times the previous one.

Forbes magazine ran an interesting piece a couple of weeks ago, which quoted a Time Magazine article: “To hoarders and speculators, gold lately has had about as much luster as a rusty tin can.”

The article itself is a bit rusty. The Great Gold Bust ran in August 1976 right at the bottom of a 50% retreat in the 1970s gold bull market. It had been only 19 months since gold purchases became legal for US citizens and, according to the article, “the price has fallen more than 40% from its peak of $198 an ounce. In three chaotic days of trading last week, gold fell $14 on the London market, reaching a 31-month low of $105.50 an ounce. Though the price recovered to $111 by week’s end, that is still a dismal figure for goldbugs, who not long ago were forecasting prices of $300.”

Back then, gold declined from $198 to $105.5 (over 46%) and then proceeded to gain 750% over the next three and a half years. The bull market didn’t end with the 46% decline. The current correction didn’t take gold that low, so if we take the similarity to the previous bull market into account, gold bulls shouldn’t worry about it too much as it seems it’s just a matter of time that gold will soar once again.

We are not thinking that the fundamental situation is now less favorable for precious metals than it was in the previous months. With QEs being launched almost regularly now, it doesn’t take a lot of analysis to figure out that the precious metals sector almost has to move higher eventually. The key point here is that the current decline — no matter how bad it may appear — is in all likelihood not the end of the current secular bull market in precious metals.

Is the decline already over? It’s a tough call, but there are charts that we can use to estimate it and some of them suggest so. Here’s one of them. (Charts courtesy of http://stockcharts.com.)

The Dow to gold ratio suggests that the bottom may be in already as the long-term resistance line has already been reached.

However, if we take a look at another chart – the one featuring the gold to bonds ratio — we get different signals.

The support level is relatively close, but it has not been reached so far and thus more declines may be seen shortly. The key point is that almost all charts suggest that the bottom is either in or close to being in.

Summing up, we think that the bull market in the precious metals market remains in place. Is the decline over yet? Mining stocks are still strongly underperforming metals, so the decline may not be over just yet, but it seems that it’s close to being over.

Thank you for reading. Have a great and profitable week!

For the full version of this essay and more, visit Sunshine Profits’ website.

Twitter: @SunshineProfits

They just showed their hands. The paper Ponzi pyramid is wobbling. It’s time to go in for the kill.

They just showed their hands. The paper Ponzi pyramid is wobbling. It’s time to go in for the kill.“We’ve traded gold for nearly four decades and we’ve never … ever… EVER… seen anything like what we’ve witnessed in the past two trading sessions,”

Dennis Gartman, via The New York Times

“This is an orchestration (the smash in gold). It’s been going on now from the beginning of April. Brokerage houses told their individual clients the word was out that hedge funds and institutional investors were going to be dumping gold and that they should get out in advance…it is the Fed’s concern with the dollar because the dollar is being printed in huge quantities at the same time that other countries are abandoning the use of the dollar as international payment.

The exchange value of the dollar is (being) threatened, and if that collapses the Fed loses control over interest rates. Then the bond market blows up, the stock market blows up, and the banks that are too big to fail, fail. So it’s an act of desperationbecause they’ve got to establish in people’s minds that the dollar is the only safe place, it is the only safe haven, not gold, not silver, and not other currencies.

And to help protect this policy they have convinced or pressured the Japanese to inflate their own currency. The Japanese are now going to print money like the Fed. They are lobbying the ECB to print more. So I see this as a dollar protection policy…I know where the gold is coming from in the market, it’s just paper. It’s naked shorts, there is no gold there. If somebody wanted to take delivery on those contracts nobody would be able to provide it. I don’t know what the source of the (physical) gold is…

..I think the power of the West has already been lost. When you have off-shored your manufacturing and professional service jobs, you’ve hollowed out your economy. So gold or no gold, the United States economy has been severely damaged and I don’t think it can recover…

This gold business (smash in price) is something to do with the dollar….They are trying to destroy gold as a (safe) haven from the dollar in order to carry on the Fed’s policy of negative real interest rates. That is what is driving the illegal policy of selling naked shorts in order to manipulate a market. If you and I were to do something like this without the government’s instruction or protection, we would be arrested. So the fact that it’s illegal, being done by the authorities, tells me thatthey are seriously worried about the dollar.”

Paul Craig Roberts, Former Assistant Secretary of the Treasury (via King World News)

After all, historically, gold has been anything but a safe investment…John Maynard Keynes famously dismissed the Gold standard as a “barbarous relic”, noting the absurdity of yoking the fortunes of a modern industrial society to the supply of a decorative metal…for a while, rising gold prices helped create some credibility for the goldbugs even as their predictions about everything else proved wrong, but now gold as an investment has turned sour, too. So will we see prominent goldbugs change their views, or at least lose a lot of their followers.

GOLD BUGS: The Gold Crash Is A Bernanke Conspiracy

EVERYONE Should Be Thrilled By The Gold Crash

7 Things That Gold Bugs Are Saying This Morning To Console Themselves

Crushed Gold Bugs Mean Squashed Growth Expectations

I’ll tell you why – because underneath all the bullshit they are spewing they know that buyers of Gold are not actually buying anything but voting against their paymaster government and bankster oligarchy. There is nothing spectacular about Gold except for its ability to reveal the truth about the scam being run by our ruling feudal masters, and this is the one and only reason why Gold and all those who buy it are so vilely derided by the establishment.

1. Exponentially increasing Government and private debt

2. Exponentially increasing money supply

3. Consistent rise in the price of items of daily need (yes I know there is no “inflation” but anybody who goes to the supermarket knows what a crock of bullshit the government CPI numbers are)

4. Rising unemployment and falling incomes

5. Corrupt government and politicians

The gold futures markets opened in New York on Friday 12th April to amonumental 3.4 million ounces (100 tonnes) of gold selling of the June futures contract in what proved to be only an opening shot. The selling took gold to the technically very important level of $1540 which was not only the low of 2012, it was also seen by many as the level which confirmed the ongoing bull run which dates back to 2000. In many traders minds it stood as a formidable support level… the line in the sand.

Two hours later the initial selling, rumored to have been routed through Merrill Lynch’s floor team, by a rather more significant blast when the floor was hit by a further 10 million ounces of selling (300 tonnes) over the following 30 minutes of trading. This was clearly not a case of disappointed longs leaving the market – it had the hallmarks of a concerted ‘short sale’, which by driving prices sharply lower in a display of ‘shock & awe’ – would seek to gain further momentum by prompting others to also sell as their positions as they hit their maximum acceptable losses or so-called ‘stopped-out’ in market parlance – probably hidden the unimpeachable (?) $1540 level.

The selling was timed for optimal impact with New York at its most liquid, while key overseas gold markets including London were open and able feel the impact. The estimated 400 tonne of gold futures selling in total equates to 15% of annual gold mine production – too much for the market to readily absorb, especially with sentiment weak following gold’s non performance in the wake of Japanese QE, a nuclear threat from North Korea and weakening US economic data. The assault to the short side was essentially saying “you are long… and wrong”.

The CME’s 10% reduction in the required gold margins in November 2012 from $9133/contract to just $7425/contract made the market more accessible to those wishing both to go long or as it transpired, to go short. Soon after we saw the first serious assault to the downside in Dec 2012, followed by further bouts in January 2013 – modest in size compared to the recent shorting but effective – it laid the ground for what was to follow. One fund in particular, based in Stamford Connecticut, was identified as the previous shorter of gold and has a history of being caught on the wrong side of the law on a few occasions. As baddies go – they fit the bill nicely.

The value of the 400 tonnes of gold sold is approximately $20 billion but because it is margined, this short bet would require them to stump up just $1b…. By forcing the market lower the Fund sought to prompt a cascade or avalanche of additional selling, proving the lie ; predictably some newswires were premature in announcing the death of the gold bull run doing, in effect, the dirty work of the shorters in driving the market lower still[1].

1. Buyers – aware that the commodity/good is available at a discounted price – beat a path to the door of whoever is foolish enough to sell it at the government mandated price. Availability at that price soon runs out.

2. The good becomes even scarcer as the costs of producing and selling it are no longer covered by the government mandated price. Aware of this, sellers withdraw from the market and demand ever higher prices for the good.

Any type of financial asset that has a counterparty – which is pretty much all the paper assets in the world – bonds, futures, any and all derivatives and yes, even the paper currency – will crash. What will they crash against? Yes, that’s right – Gold. All the world’s capital – trillions, perhaps quadrillions of it – will come rushing into the very tiny physical (NOT paper) Gold market. Remember, the world’s real physical capital – real assets such as land, oil-refineries, mines, infrastructure, etc. will not vanish, only it will be re-priced in terms of Gold and its ownership transferred to those who hold it. Since everything stays on this planet, it is a zero-sum game and the winner will be Gold. In other words, an ounce of physical Gold will command a lot more in real purchasing power than it does today. Just like a national currency is a claim on goods and assets within that country, Gold will be a claim on global goods and assets worldwide.

The futures market is nothing but a tool for the dollar managers (US Government/Fed/Bullion banks) to manage/control the price of Gold. Any rational observer with an iota of brain who has watched the gold market for any reasonable length of time can tell that the price is intentionally driven down during the Comex trading hours. If you don’t believe this, either you’re in denial or worse – collusion – and IT WILL end up costing you big time. Given the massive, concentrated and long-term (the entire past decade – they haven’t been net-long – not once – during that time period) nature of their short positions, it really isn’t that hard to deduce that the banks do not nearly have enough metal to cover their shorts and that the sole intention of the massive short position is to control the price. Whenever the price rises (or threatens to rise) the big bullion banks ala JP Morgan create massive naked shorts introducing fake supply of Gold in the market, thus driving the price down. “But the price has been rising for the past decade, hasn’t it? So how can you say they are driving it down?”, many people ask. Well, the constraint on the bullion banks has been the availability of the physical metal. If the metal is not available, the fraud of the paper market is exposed and they lose their price managing ability. So they allow the price rise to a level at which there are some weak hands willing to sell and then they hold it there till all the sellers have been exhausted (I am assuming the Fed has already sold all the US Gold during the past decade). So strong are Gold’s fundamentals that despite the massive rigging, all they have been able to do is slow its rise. The weak hands who sell the physical metal at every price rise have helped them in this endeavor. But soon, as the bond market implodes, they will run out of sellers. Treat the availability of real metal at today’s paper price a gift and buy as much as you can.

To those who think that the Comex shorts will be crushed one day and the price of paper Gold will do a moonshot, to them I will say that you are dreaming. The Comex shorts will be crushed, but not in their own casino! If and when a majority of paper Gold longs demand delivery a force majure (who do you think the US Government will side with?) will be declared with cash settlements and/or offers of equally worthless GLD shares (don’t tell me you didn’t know about this). By some accounts, this is already happening. What will happen to the paper price then? That’s right – it will utterly collapse even as the physical’s price is rocketing. Paper gold holders will dump it all to buy the physical – which, unfortunately – will most likely not be available at all…in light of the sum total of the recent developments mentioned in this update I think it is too risky to be trading right now and one should just sit 100% in physical Gold and some currency for day-to-day needs…Trading paper markets for paper gains is like picking up pennies in front of the steamroller. It’s time to stop trading and just buy the physical metal….

1. Buying physical with cash preserves your anonymity and safeguards your wealth in your hands away from the prying eyes of the looters posing as “the government”.

2. Counterparty risk is eliminated as there is none. You’re home free.

3. The fake paper market will collapse due to non-availability of the physical and non-participation of the majority. The sooner it happens, the sooner Gold will attain its true value and the emperor will be naked for all to see. This fake money system needs to collapse so the work of reallocation and rebuilding can begin. The cancerous tumor of banksters needs to be eliminated from the economy.

1] Some people may find this description of events to be too “conspiratorial”, but rest assured, if anyone does the diligence, I’m sure they won’t find things differently. This is how things are “done” in the “markets” today.

1] Some people may find this description of events to be too “conspiratorial”, but rest assured, if anyone does the diligence, I’m sure they won’t find things differently. This is how things are “done” in the “markets” today.

Gold has been taking a battering all day (written Monday April 15th). Gold is off 8.5% to $1,373.80 an ounce.

Gold has been taking a battering all day (written Monday April 15th). Gold is off 8.5% to $1,373.80 an ounce.

Commodities guru Jim Rogers isn’t buying gold yet.

He told Business Insider there were four key things driving the sell-off.

- India – The country hiked its gold import tax rate by 50% to 6% at the start of the year. This has curbed gold demand.

- Chartists – Technical analysts that have warned that gold prices will continue to fall.

- Cyprus – “Ms. Merkel is seeking re-election so she has told Cyprus and others that they should sell some of their gold to pay their debts. The Germans are tired of bailing people out and she needs to be tough.”

- Bitcoins – “The collapse of Bitcoin since most of them also own gold.”

Rogers said he hasn’t hedged his positions at the moment.

“I have repeatedly babbled about $1200-1300, but that is just because that would be a 30-35% correction which is normal in markets,” he told Business Insider. “But I am a hopeless market timer/trader.”

Rogers said he expects gold prices to fall further for the “foreseeable future” but expects “gold to eventually go higher over the decade.”

Read more: http://www.businessinsider.com/jim-rogers-normal-gold-price-correction-2013-4#ixzz2QT4nmXJv

Why hasn’t the GOLD PRICE Held Up? – Marc Faber On Bloomberg

Local gold stocks are taking a big hit this morning after the price for the precious metal fell into bear market territory in offshore trade on Friday, sinking to its lowest level since August last year. This outlook is even direr for gold. The plunge in the gold price has pushed the ASX’s gold stocks sub-index down 7.7 per cent in early trade.

Local gold stocks are taking a big hit this morning after the price for the precious metal fell into bear market territory in offshore trade on Friday, sinking to its lowest level since August last year. This outlook is even direr for gold. The plunge in the gold price has pushed the ASX’s gold stocks sub-index down 7.7 per cent in early trade.

The precious metal was trading at $US1493.45 this morning, down 4.2 per cent from local trade on Friday. US investment bank Goldman Sachs put a ”sell” on the metal last week, which sparked an early sell-off. But IG strategist Evan Lucas said it had come under even more pressure from technical selling, as it broke through the $US1522 support level to fall to $US1483. ”The bears roared even harder towards the end of last week as soft data led to analysts making the call that a period of deflation is on the cards, as the US stimulus package floods the market, but is not followed by any discernible changes to the economy,” he said. ”This outlook is even direr for gold.” Thomas Averill at Rochford Capital said gold had also fallen on the back of concerns that America and other G20 countries would criticise Japan at the upcoming G20 meeting over monetary policies that have weakened the yen and as a result, gold. ”I think you’ll see the Japanese reassure world leaders that their new monetary policy is not designed to deliberately weaken the yen,” he said. Mr Averill said it was only a short-term problem for gold, which would pick up later in the week. ”I would say that gold shouldn’t lose much more,” he said. ”The G20 meeting is a bit of a distraction, but after this week, we are predicting a resumption of the yen trade, which supports the gold price.” Burrell Stockbroking adviser Jamie Elgar said the recent rally on stock markets – Wall Street posted record highs last week – had also dampened demand for gold. ”I think gold started to come off over the last couple of months as people started becoming more confident in equities,” Mr Elgar said. ”Particularly as the economic data out of China and the US was looking pretty good.” Shares in Australia’s biggest listed gold company, Newcrest, fell 7.5 per cent this morning to $18.26. Here’s how some of the other local gold miners are performing: Kingsgate Consolidated: Down more than 12 per cent Alacer Gold: Down more than 15 per cent Precious metals investors can’t look back at this week’s declines in gold and silver and not be a little upset. But it’s important to keep in mind that nothing happened this week that reversed the decade long bullish trends for gold and silver. So, keep in mind that for over a decade gold and silver have gone up for a reason; the mismanagement of the world’s monetary system by the global central banks. That plus all financial assets today have huge counter-party risk thanks to the fraud plagued OTC derivatives market, whose notional value is in the hundreds of trillions. Physical gold and silver have no counter-party risks for their owners, and this makes them especially attractive to forward thinking investors. This lack of counterparty risk also makes the old monetary metals objects of ridicule by the global financial industry, who market fraudulent “financial assets” by the trillions of dollars, euros and other currencies. Are there any indications that central bankers have seen the error of their ways at the end of this week? Good grief no! The Bank of Japan has reaffirmed its commitment to destroy the yen as an economic asset, and the ECB is scheming to confiscate Cypress’s “excess gold reserves”. Our Doctor Bernanke is no monetary slouch either. Look at the post credit crisis Federal Reserve’s balance sheet in the chart below. Since 2008 the supply of newly created digital dollars has exploded. If US Currency in Circulation (CinC / Green Plot) lags behind the growth in digital dollars (Blue and Red Plots), it is most likely because the Earth doesn’t grow enough cotton to supply both the world’s textile mills and the US Treasury’s need for high-grade cotton based paper for its paper money production. That’s a scary thought that just might be true!

Marc Faber : Gold Decline is a Buying Opportunity

Other than selected sectors (Utilities, Consumer Staples, Consumer Discretionary, Health Care), U.S. equities and most equity markets outside of the U.S. have passed an intermediate peak. Taking profits in seasonal trades expiring near mid-April makes sense.

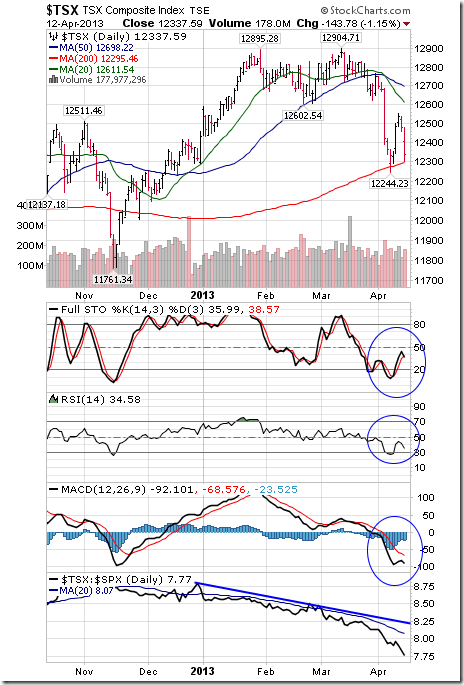

The TSX Composite Index added 5.74 points (0.05%) last week. Trend remains down. The Index remains below its 20 and 50 day moving averages. Strength relative to the S&P 500 Index remains negative. Technical score based on the above data remains 0.0. Short term momentum indicators are oversold.

…..view 47 other charts & analysis HERE