Timing & trends

Warren Buffett’s favorite indicator is telling us that stocks are more overvalued right now than they have ever been before in American history.

That doesn’t mean that a stock market crash is imminent. In fact, this indicator has been in the “danger zone” for quite some time. But what it does tell us is that stock valuations are more bloated…. CLICK for the complete article

Life would be different if you had a rich, generous aunt, wouldn’t it?

Life would be different if you had a rich, generous aunt, wouldn’t it?

If you would indulge me … imagine for a moment that you do.

We have seen a stock market over the past nine years that is simply great.

Imagine that you consulted with your rich, generous aunt at the start of the period.

Doing so would have allowed you to post better-than-market returns.

I explain why below … and tell you how long this market continues in bull mode.

Using Debt to Sweeten Profits

Brokerage customers — like you and me — can incur margin debt.

When you buy stocks through a broker, you can do so using a cash account or a margin account.

A cash account is what it sounds like. You buy stocks using the cash in your account.

If you buy using a margin account, your broker funds a portion of the investment. The portion you pay is known as the margin. The portion the broker pays is margin debt.

You can amplify your cash returns using margin debt.

Let’s think about it with an example. If you buy $1,000 of stock and it grows 13% per year for nine years, you will have $3,000 by the end of the ninth year … $3,004 to be exact.

Remember your rich aunt? She’s so sweet. Let’s call her Aunt Judy.

Pretend you only put up $200 (20%) of the initial investment … and Aunt Judy funds the rest. She tells you: “Don’t worry about it, honey. Just pay me back at some point.”

Instead of having a $2,004 profit, you would have much more. We know your original $1,000 investment is now worth $3,004. But you only funded 20% of that!

You could have invested the other $800 as well (from your original $1,000). That $800 investment is now worth $2,403.

You now have a total of $5,407. Once you reimburse the $800 you borrowed from Aunt Judy, you still have $4,607. That’s a $3,607 profit. Pretty slick. You only would have had a $2,004 profit if you fronted the whole investment yourself.

That’s how margin debt works.

If the brokerage funds a portion of your original purchase and the investment you make goes up in value, everyone wins.

Of course, the brokerage charges you some interest for the loan. It is, after all, not your sweet Aunt Judy.

But it doesn’t cost as much as your profits.

You still end up ahead during a nine-year bull market.

What Is Driving This Market Higher?

By the way, I used the 13% return on purpose.

You see, the S&P 500 Index increased 13.2% (before dividends) on average every year from the end of 2008 through 2017.

Using margin debt to invest in the market was smart over this stretch. It allowed investors to amplify their returns.

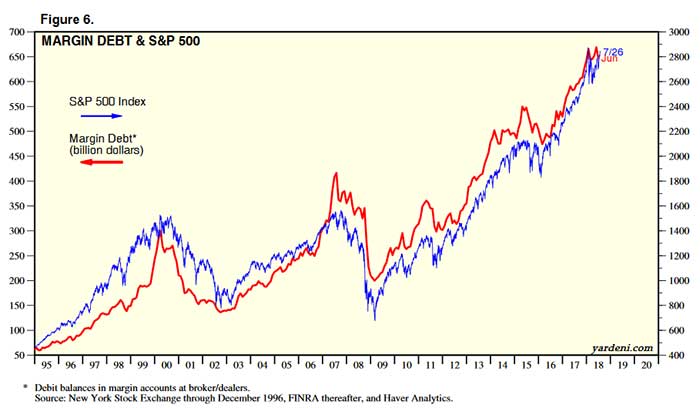

Many have been using it. Since bottoming in 2009, margin debt has more than tripled:

(Source: Yardeni Research)

As you can see, the market went up with it.

The two metrics are positively correlated. They tend to move in the same direction.

What Does This Tell Us About the Direction of the Market?

As we assess where the market is going next, margin debt is a useful tool. The market and margin debt continue to move higher today … though that will reverse at some point.

Returning to the last crisis shows why. Margin debt peaked in July 2007. The S&P 500 didn’t peak until early October of that year.

This year, margin debt posted its two highest readings ever in May and January (in that order).

Overall, both continue to post higher highs. We can see above that these numbers tend to move together.

Both are trending higher today … and this bull market will continue. If margin debt drops for several months in a row, it will be a different story … but we’re not there yet.

I told you about another indicator, the cumulative advance-decline line (ADL), in a recent essay.

I’ll continue to watch margin debt and the ADL to assess where the market is today.

In the future, I will present other metrics as well.

Good investing,

Brian Christopher

Senior Analyst, Banyan Hill Publishing

The markets have been all over the place, and investing in this environment—or in any environment—can seem intimidating. It doesn’t have to be.  Investor and precious metals expert Bob Moriarty, founder of 321 Gold, is such a risk taker and a rebel that he once flew his aircraft under the Eiffel Tower. The rebel side comes out in his contrarian approach to investing that has brought him a lot of success. David H. Smith, senior analyst for The Morgan Report, discusses the value of Bob Moriarty’s practical, straightforward information on how to invest.

Investor and precious metals expert Bob Moriarty, founder of 321 Gold, is such a risk taker and a rebel that he once flew his aircraft under the Eiffel Tower. The rebel side comes out in his contrarian approach to investing that has brought him a lot of success. David H. Smith, senior analyst for The Morgan Report, discusses the value of Bob Moriarty’s practical, straightforward information on how to invest.

“Investors have come to believe that they need to find a guru, a financial advisor, or to read articles about certain theories of investing if they are to become rich from their investments. Those notions are all wrong. There are no gurus. Financial advisors advise because they have to earn a living. If they were experts on investing, they wouldn’t need to be selling their services. The different theories about investing mostly remain interesting theories.

If you have good sense, keep an open mind and learn the basics, you don’t need all the fluff. In short, there are no experts. Nobody knows anything.

I was chatting with a friend of mine about investing, trying to make the point that we make things way too complicated. It’s easier to profit if we skip a lot of the nonsense associated with investing and go directly to the core. Investing for profit isn’t as difficult as the so-called gurus would have us believe, but like a contractor building a house, we have to start with a proper foundation.

I’ve run a successful financial website for fifteen years at 321gold.com. It started out as a way to pass on information about concepts and companies I was familiar with to friends and family, and it grew. And grew. From the beginning I was determined to cut out as much as possible of the voodoo and hocus pocus from the pieces we published, so we could attract serious investors.

As I was saying to my friend, some of the most basic bits of background in investing are missing from most investment books. The authors tend to write about their personal agendas without ever providing some of the most essential building blocks that every investor needs to know.

I’ve made money and I’ve lost money. I have made some brilliant and timely calls, and I’ve made enough boneheaded calls, and in public, that it’s obvious I’m not a crook or a shill.

If you are going to be a successful carpenter, someone needs to teach you how to buy and hold a hammer in the correct way so your nails go in straight. If you are going to be a successful investor you need to know some of the basics about investments that are rarely found in books. We learn them through trial and error, and that makes for both bad carpentry and poor investing.”

So begins veteran investor Bob Moriarty, the founder of 321 Gold, in his book,Nobody Knows Anything.

of entering the battle and leaving it, whether dead, wounded or alive.

– Dr. Alexander Elder

Investing is a battlefield. If you plan to emerge a winner, then it’s time to fully accept this fact and arm yourself with the proper weapons—internal and external—before placing your hard-earned cash on the line. Investing success rests upon understanding and following a select set of critical behaviors that can protect and enrich you through bull and bear runs alike.

Here are four examples of advice that Bob Moriarty has given over the years:

May 14, 2001: For months I have been searching for some sign that we’ve seen the bottom for the precious metals. I am a contrarian investor. I want to invest when no one else sees opportunity. A piece on CNN convinced me the top was at hand for the stock market. In March of last year, CNN did a story on a group of prisoners in a jail cell in Maryland who were holding stock picking contests. When inmates finally become stock investors, believe me, you have everyone invested who could possibly be investors and the top is here.

The precious metals stocks are as nearly the opposite as can be found. They just couldn’t go down much further from here. Many small gold stocks don’t have 10 trades a day. That’s not slow, that’s dead. Some small stocks go several days without a trade at all. How could you possibly have fewer people interested? (Result? The stock market topped, with the Nasdaq losing 50% in nine months while gold rocketed from $267 to $1923 ten years later.)

April 25, 2011: I was an investor in the 1970s in both gold and silver. I started buying gold at $35 and silver around $5 an ounce. I sold out all my silver in January of 1980 a week too early at $35 as it rocketed to $50.25 an ounce at the open on January 21, 1980. It went parabolic and basically that’s all you need to know…(Speaking about his call from a month earlier, on March 25: “For certain I was dead wrong about the timing and the price. Silver has rocketed from $38 and change when I wrote the piece to over $47 now. But lots of people get lots of things wrong about silver.”)

Bob then proceeded to write one of his longest and most informative ever columns on the subject, laying out the evidence for all willing think about it. (Result? Silver topped a day later, just below $50, and went into a 4.5 year bear market, dropping below $14/ounce.)

January 25, 2018: The price of various commodities is a lot like dancing. Sometimes you lead, sometimes you follow. But for so many different commodities to be at an extreme of sentiment at the same time is highly unusual. (Result? He mentioned an even dozen different commodities. All twelve turned within a few days.)

June 28, 2018: For several months I have been beating the drum saying that there would be a tradable low for the precious metals in the June/July timeframe. The way to be fairly certain would be using the Commitment of Traders report and Daily Sentiment Indicator to mark an extreme of sentiment. I was looking for the DSI to go below 10 and the COTs to reflect major bearish sentiment among speculators…Silver has gotten as low as 10 in Mid-May…I would prefer to see a bigger extreme of emotion but there are times you have to take what you get, not what you want.

(Result? As of this writing, time will tell, but if just three of the four of Bob Moriarty’s calls listed above—archived on his http://www.321gold.com—notched “correct,” that’s 75%. And as the saying goes, “If it’s not a record, it’s a damn good average”!)

So do you get a sense that just maybe, his latest book,Nobody Knows Anything. Investing Basics: Learn to Ignore the Experts, the Gurus and Other Fools, might hold the key(s) to elevating your future financial success well above the mundane—and keeping it there? The point Bob Moriarty makes again and again is that he is neither an expert nor a guru. He just uses the same information available to all investors, based on a solid knowledge of the basics—which remain unknown to most investors.

Repetition of the Basics is the Path to Excellence

Nobody Knows Anything can be bought for a relative pittance—just $3.99 on Kindle or $9.99 in soft cover.

This is an abridged version of our Daily Report.

Lack of risk appetite

Discretionary stocks are at a multi-month low relative to defensive Staples.

That sign of risk-off behavior is unusual with the S&P near a high but has not been a good excuse to sell stocks.

Another trend ended

The small-cap Russell 2000 ended a long streak above its 50-day average. When recently setting a new high, the ends of similar streaks led to more weakness for small-cap stocks in particular, not necessarily the broader market.

Mass exodus

Investors have pulled more than $40 billion from equity funds in 8 weeks. That’s the most since 2016 and ranks near other extremes in the past 15 years.

The latest Commitments of Traders report was released, covering positions through Tuesday

The 3-Year Min/Max Screen shows basically the same extremes as last week, as “smart money” hedgers continue to build on multi-year or record long positions in coffee and the Swiss franc.

Google is trying to make history again, this time with a massive subsea cable project that would be the first one traversing the Atlantic and not solely owned by a telecommunications company…. CLICK for the complete article