Timing & trends

1. On The Brink of a Terrifying Future

1. On The Brink of a Terrifying Future

What is going to happen when 51% of the US millenial generation say they’d rather live in a socialist or communist country? Michael has even more startling numbers, facts & consequences:

2. Interbank Rates Starting to Rise – Monetary Crisis is Beginning

by Martin Armstrong

Martin Armstrong reports that Interest Rates are rising significantly in several important European Markets. With Libor at its highest level since 2008 both banks and debtors face rapidly rising rates

3. How To Protect Yourself from Bubbles & Soon To Be Worthless Currencies

As Voltaire said “Paper money eventually returns to its intrinsic value — zero.”. Zero interest rates, ballooning 230 Trillion in Global Government debt, there are a lot of dangers and history tells us what we can expect. Even former Federal Reserve Chairman Alan Greenspan warns about the existing bond and stock bubbles

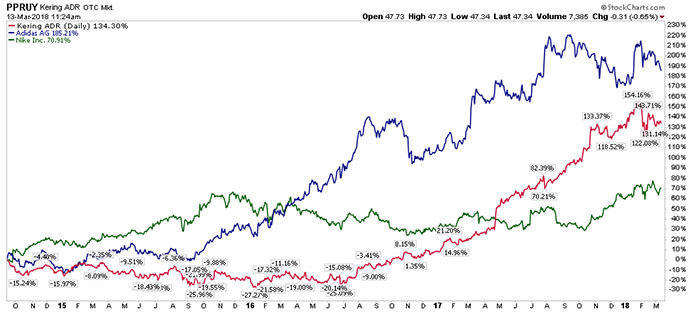

While there are fortunes being made in art and collectibles by rich investors, this particular powerful bull market is being driven by modestly funded millennials. A quick look at the chart of this developing bull market certainly indicates it has much further to go – R. Zurrer for Money Talks

A Big-Money Bull Market

It’s the market for sneakers. Yes, sneakers.

Google “Air Jordans” and you’ll see a good example of what I mean.

What you’ll find is thousands of websites like SoleCollector.com that are dedicated to tracking shoes, including those that are put out under the Air Jordan brand.

And people are making big money from buying and selling these sneakers.

For example, you could have made 900% on a pair of Air Jordan 2 Retro “Don C” shoes.

Or 426% on a pair of Air Jordan 10 Retro “Double Nickel” shoes.

Sneakers are a new category of collectibles that’s come about in the last 20 years. And prices are skyrocketing for the most collectible ones, like LeBrons.

No wonder then the business of the companies that make sneakers have been soaring for years now.

The three main companies in the sneaker business are Nike, Adidas and Puma. These are big, global brands that are doing great business, and their stocks are soaring higher too.

Market For Sneakers

Kering (OTC: PPRUY), which is the company that owns Puma, is up 134%, while Adidas AG (OTC: ADDYY) is up 185% and Nike Inc. (NYSE: NKE) is up 71%.

These returns are crushing the S&P 500, which is up just 40% in the same time period.

Now, the reason why sneakers are so hot is because of something I’ve told you about before — the coming of age of the millennial generation.

You see, it’s their buying that’s bidding up the price of Air Jordans and LeBrons … and in turn, it’s that same buying that’s making sneaker company business sales jump, and their stocks rocket higher.

I believe that the sneaker market is going to keep running higher as millennials gorge on their sneaker collections. And that in turn is going to keep revving the stocks of most sneaker companies higher.

Regards,

Paul Mampilly

Editor, Profits Unlimited

Ross Clark has specialized in technical analysis of the markets since the 1970’s. Through exhaustive historical analysis he is so good at market timing and shifts in asset allocation that Bob Hoye of Institutional Advisors brought him onboard. Today he gives quite an education in Post-Bubble environments and relates them to a current existing opportunity in Bitcoin. R. Zurrer for Money Talks

Bitcoin – Oversold and Into Support

Post-Bubble environments have some of the most repetitive characteristics as they unwind the excesses of the euphoric phase that took them into the top. Most result in lengthy bear markets (Dow 1929, Gold 1980, Nikkei 1989, NASDAQ 2000, Silver 2011, 3-D Systems 2014 & Shanghai 2015). A few manage to form new bases from which to move to new highs (Biotech’s 2015 & Canopy Growth 2016).

Excuse the busy chart

The overbought rally into January 8th (red arrows) in Bitcoin (NYXBT) and Bitcoin Investment Trust (GBTC) provided a secondary sell signal following the Sequential 13 Sell on December 19th. Prices then dropped 65%. Good interim lows at that point in ‘Post Bubble’ markets have occurred around the 50-week ema or 100-week simple moving average. . . when coupled with a weekly CCI(8) reading of -150. Bitcoin generated a reading of -149 and GBTC at -143 at the 50-week ema during the February 9th low (blue arrows).

The next action was a retracement rally to February 20th, trading temporarily above our upside target of 10,600. It created the characteristic daily overbought signal against the upper 20-day Bollinger Band (green arrows). As of Friday, it has dropped to the lower Bollinger and Keltner

bands (orange arrow). Keltner Bands are a style of volatility band using Average True Ranges and generate a smoother band.

Whatever low is created within the next few days should become the critical one. We can expect a rally back through the upper Bollinger Band and more likely to the Keltner Band (currently 11,886).

The ability to hold above the low at this point of development was the case following last July’s low at $7.73 in Canopy Growth. The biotech index (BTK) did the same thing in 2016, holding above its July low of 2807. These went on to new highs. The other six examples violated the support (red line) and went on to make multi-year lows.

Weekly charts of other bubbles.

Red arrows identify secondary daily sale after the top.

Blue arrows are oversold weekly CCI(8) readings. Green arrows are next daily overbought

signal.. Orange arrows are daily oversold at the Bollinger Band. Note how important the red support line becomes.

Slides from the World Outlook Financial Conference presentaion February 3, 2018 (Click on each Chart for Larger Version)

Opinions in this report are solely those of the author. The information herein was obtained from various sources; however, we do not guarantee its accuracy or completeness. This research report is prepared for general circulation and is circulated for general information only. It does not have regard to the specific investment objectives, financial situation, and the needs regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized.

Investors should note that income from such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or options or futures contracts. Foreign currency rates of exchange may adversely affect the value, price or income of any security or related investment mentioned in this report. In addition, investors in securities such as ADRs, whose values are influenced by the currency of the underlying security, effectively assume currency risk. Moreover, from time to time, members of the Institutional Advisors team may be long or short positions discussed in our publications.

CHARTWORKS – 3/11/2018

BOB HOYE

PUBLISHED BY INSTITUTIONAL ADVISORS

MARCH 9, 2018

The Art of The Deal

– Donald J. Trump, 1987.

BOB HOYE, INSTITUTIONAL ADVISORS

WEBSITE: www.institutionaladvisors.com 2

1. Justin Crosses The Line

1. Justin Crosses The Line

by Michael Campbell

I didn’t want to go there. After all, every Prime Minister- Harper, Martin, Chretien – has a bad week, though probably not looking as good in a costume. But then Prime Minister Trudeau crossed a diplomatic line that couldn’t be ignored.

2. Silver Investment: The Lowest Risk, Highest Return Potential vs. Stocks & Real Estate

Steve St. Angelo, is that he makes a very clear argument using graphics and fundamentals. One look at the first chart certainly tells you which of Real Estate, the Dow Jones or Silver is in the “low risk” position.

3. Todd Market Forecast: Bullish

#1 ranked Trader by Timer’s Digest with a 31.6% return for 2017 is still looking for higher stock prices and has switched to bullish Gold in last evenings letter after going bearish the US Dollar on March 2nd