Timing & trends

The key message of this update is that gold is getting closer and closer to breaking out of a giant Head-and-Shoulders base pattern that started to form back in the middle of 2013 and to point out that it won’t be stopped from doing so by any minor short-term reaction, especially as the dollar has just broken down from a giant top pattern and looks set to plummet, notwithstanding any near-term rally to alleviate its oversold condition.

We’ll start by looking at the latest 8-year chart for gold which shows a fine flat-topped Head-and-Shoulders bottom. We can observe how a large and lengthy Right Shoulder has formed following the mid-2016 peak, that complements the large and lengthy Left Shoulder, making the pattern symmetrical, even if its component parts are a rather messy. We see how the price has risen up in recent months to challenge the resistance at the upper boundary of the pattern, and most importantly these runs at the resistance have been accompanied by a quite dramatic volume buildup, that has now driven both volume indicators to new all-time highs. This action by both volume indicators concurrently is very bullish indeed – it means that gold is destined to break out upside from this pattern into a bullmarket soon, regardless of what efforts the supposed “cartel” with their paper shenanigans make to stop it, and it’s not hard to see why given how much physical has been mopped up in recent years by countries such as China, that understand gold’s true value. Upon breaking above the nearby band of resistance, the 1st target for gold is the quite strong resistance in the $1520 – $1560 area.

On gold’s 6-month chart, however, we can see that it has had a nice run in recent weeks that has resulted in it becoming rather extended, and with sentiment readings now very bullish, we should not be surprised to see a modest pullback that would probably be occasioned by a relief rally in the dollar to alleviate its oversold condition. We can use any such pullback to do additional buying, especially of gold and silver stocks.

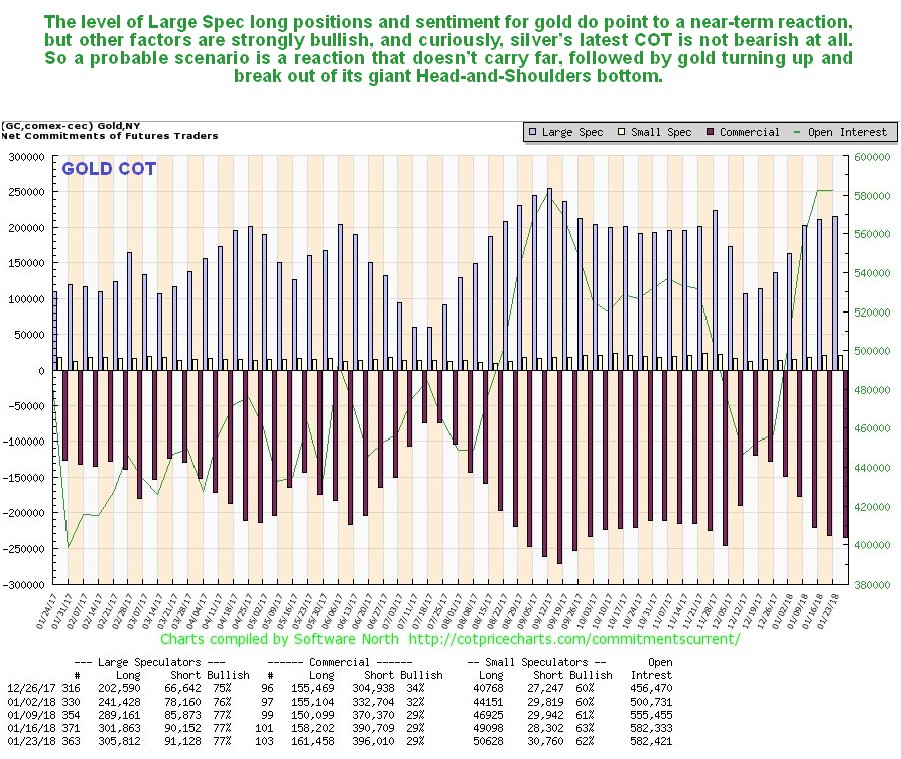

Gold’s latest COT shows that Large Spec long positions have risen to quite a high level, not enough to prevent it rallying further, but to a level that makes a reaction back more likely, and any such reaction would put gold in a stronger position to mount a sustainable breakout a little later.

Click on chart to popup a larger clearer version. The 8-year chart for the GDX shows a large Head-and-Shoulders bottom completing that parallels the one in gold itself, the main difference being that GDX is still a lot closer to its Right Shoulder lows than gold itself, which means that we are still at a good point to accumulate gold and silver stocks, and it will be even better if we see a minor dip over the short-term as shown.

On the 6-month for GDX we can see that it has had a good run since mod-December, like gold itself, but being close to resistance now and starting to roll over, there is fair chance of its dropping back some towards its moving averages, and if it does it will present an even better opportunity to buy mining stocks at better prices.

A big reason for gold getting ready to break out is the dollar having just broken down from its large Broadening Top formation, which happened over the past 2 weeks. On the 8-year chart for the dollar index we can see that this looks like a clear and decisive breakdown, and while it will be normal for it to now rally back in a deceptive manner over the near-term to the lower boundary of the Broadening Top, it should then go into decline again and drop swiftly to its initial downside target in the 80 area, as shown by the red arrow on the chart. Obviously, such a drop is very big and will have major ramifications for most markets, not least of which is the Precious Metals market.

On the latest dollar index 3-month chart we can see its breakdown move this month in detail, and we can also see how it has become very oversold on short-term oscillators, making a near-term rally to relieve this oversold condition likely. Thus it is interesting to observe that a bullish looking hammerlike candlestick formed on Thursday, and we now want to see the volume associated with this candle which we can do via a proxy, but first we should note how far any rally is likely to get – it will probably get no further than the resistance at the underside of the bear Flag that formed about a week ago, as shown on the chart, which should coincide with a minor dip by the Precious Metals sector.

The 3-month chart for dollar proxy PowerShares DB US Dollar Index Bullish Fund (UUP) shoed that at the time that hammerlike candle formed on the dollar index chart on Thursday, a large white candle formed in UUP on very strong volume, driving it Accum-Distrib line steeply higher. This is a strong sign that a relief rally is about to start in the dollar, although as detailed above, it shouldn’t get very far before the larger downtrend reasserts itself.

So there we have it – a very bullish picture for gold indeed, notwithstanding any short-term dip, and it is worth pointing out in closing that rising interest rates are good for gold, and that a reversal in the stockmarket will also be good for it, as gold will be in demand again as a safehaven, especially as Treasuries are no longer an option, and with everyone bullish on the stockmarket now, and everyone who wants in in, a reversal looks imminent.

1. Back to the Norm – Equity vs Real Estate

1. Back to the Norm – Equity vs Real Estate

by Brent Woyat

At the end of last year, the Federal Reserve Bank of San Francisco published a paper* on historical rates of return of major assets. The report also shows that average returns from real estate and equities have been roughly similar, but equity volatility has been twice that of real estate (Figure 1)

2. Don Vialoux Calls For Sold Out Commodities To Rally

with Michael Campbell

Featured Guest Don Vialoux on his favorite winter trades. One, commodities, has Don excited because that market sector that is very sold out & rising from a low point

3. Buckle Up For a Major Sea Change

Michael Campbell & Victor Adair

The CRB Index hit its All Time High in 2011 and, relative to the S+P 500 Stock Index it has fallen ~74% in the past 7 years to an 18 year low!

It’s deja vu all over again as the dollar resumed its decline against all major peers on Friday amid concerns over U.S. trade policy, after a brief rally that followed Trump’s comment on favoring a stronger dollar, setting the Bloomberg Dollar Spot Index heading for its seventh weekly loss. That would be the longest losing streak since 2010.

…also from ZeroHedge:

Will The ‘Buck’ Stop Here? The dropping Dollar is trying to hang onto a potentially important line of support.

Ed Note: Markets are driven largely by emotion & Lance Roberts goes over certains indicators that are used to measure that emotion in this excellent article – M/T Ed

I get lots of questions from readers regarding the various technical indicators discussed in our “Technically Speaking” posts and in our weekly Real Investment Reports. While we often discuss the signals these technical signals are indicating, there are often questions involving exactly what these indicators are measuring.

Technical analysis is often dismissed by investors for three reasons:

- A lack of understanding of exactly what technical analysis is,

- An inability to properly apply technical analysis to portfolio management, and;

- The media narrative that “technical analysis” doesn’t work.

There is no “one method” of technical analysis that works for everyone. Every technician uses different methods, indicators, and time-frames for their own analysis. Much depends on your personal investment time frame, risk tolerance and investing behavior.

This article will be the first of several in an attempt to clearly define some of the more common technical indicators we use in our own portfolio management practice and how we apply them.

(Note: we will be providing our specific methods of technical analysis, indicators, etc., in our forthcoming premium section of Real Investment Advice. Click here for pre-subscription information.)

We are going to start our journey with the Relative Strength Index.

What Is RSI

Over the last few weeks, there have been numerous postings about the S&P 500 index and how it has hit a historically high reading on the RSI index. My friend Adam Koos recently posted:

“The first picture below is a weekly chart (or intermediate-term) look at momentum in the S&P 500. Just one week ago, I was posting on social media and explaining that there had only been two times in the last 6-plus decades that the market had been this overbought. Thanks to the second week of January, the market is more overheated today than it has been in more than 67 years!”

…..go HERE for Larger Charts & More Analysis

Available Mon- Friday after 3:00 pm Pacific.

DOW – 4 on 625 net advances

NASDAQ COMP + 52 on 305 net advances

SHORT TERM TREND Bullish

INTERMEDIATE TERM Bullish

STOCKS: The Dow was down, but most indices were higher. The NASDAQ was a star, helped by a stellar performance by Netflix and the high techs.

Our job is very simple. We keep raising our stops on trading positions and let this monster take us where it will.

GOLD: Gold jumped $8 to a new rally high. The sagging dollar was a factor.

CHART: We had been concerned about breadth as the averages appeared to be leaving the advance decline line behind. But now it appears that this consolidation is over and breadth has now broken to a new all time high.

As usual, there are concerns. The S&P is very extended and the CBOE put call ratio was very low today. We would not be surprised by a bit of short term weakness, but the chart pattern remains bullish.

BOTTOM LINE: (Trading)

Our intermediate term system is on a buy.

System 7 We are long the SSO from 110.59. Move your stop to 120.59.

System 9 On a buy signal from Dec. 29.

NEWS AND FUNDAMENTALS: There were no economic releases of consequence on Tuesday. On Wednesday we get the PMI Composite Flash, existing home sales and oil inventories.

INTERESTING STUFF: I attribute the little I know to my not having been ashamed to ask for information, and to my rule of conversing with all descriptions of men on those topics that form their own peculiar professions and pursuits. ———John Locke

TORONTO EXCHANGE: Toronto gained 10.

BONDS: Bonds rebounded slightly.

THE REST: The dollar hit another new low. Crude oil surged to a new rally high.

Bonds –Bearish as of Jan. 9.

U.S. dollar – Bearish as of Jan 12.

Euro — Bullish as of Jan 12.

Gold —-Bullish as of Jan 12.

Silver—- Bullish as of Jan 12.

Crude oil —-Bullish as of Dec. 26.

Crude oil —-Bullish as of Dec. 26.

Toronto Stock Exchange—- Bullish as of September 20, 2017.

We are on a long term buy signal for the markets of the U.S., Canada, Britain, Germany and France.

Monetary conditions (+2 means the Fed is actively dropping rates; +1 means a bias toward easing. 0 means neutral, -1 means a bias toward tightening, -2 means actively raising rates). RSI (30 or below is oversold, 80 or above is overbought). McClellan Oscillator ( minus 100 is oversold. Plus 100 is overbought). Composite Gauge (5 or below is negative, 13 or above is positive). Composite Gauge five day m.a. (8.0 or below is overbought. 13.0 or above is oversold). CBOE Put Call Ratio ( .80 or below is a negative. 1.00 or above is a positive). Volatility Index, VIX (low teens bearish, high twenties bullish), VIX % single day change. + 5 or greater bullish. -5 or less, bearish. VIX % change 5 day m.a. +3.0 or above bullish, -3.0 or below, bearish. Advances minus declines three day m.a.( +500 is bearish. – 500 is bullish). Supply Demand 5 day m.a. (.45 or below is a positive. .80 or above is a negative). Trading Index (TRIN) 1.40 or above bullish. No level for bearish.

No guarantees are made. Traders can and do lose money. The publisher may take positions in recommended securities.

1.

1.