Timing & trends

The Commitments of Traders (COT) reports are nothing other than sentiment indicators, but as far as sentiment indicators go they are among the most useful. In fact, for some markets, including gold, silver, copper and the major currencies, the COT reports are by far the best indicators of sentiment. This is because they reflect how the broad category known as speculators is betting. Sentiment surveys, on the other hand, usually focus on a relatively small sample and are, by definition, based on what people say rather than on what they are doing with their money. That’s why for some markets, including the ones mentioned above, I put far more emphasis on the COT data than on sentiment surveys.

In this post I’m going to summarise the COT situations for four markets with the help of charts from an excellent resource called “Gold Charts ‘R’ Us“. I’ll be zooming in on the net positions of speculators in the futures markets, although useful information can also be gleaned from gross positions and the open interest.

Note that what I refer to as the total speculative net position takes into account the net positions of large speculators (non-commercials) and small traders (the ‘non-reportables’) and is the inverse of the commercial net position. The blue bars in the middle sections of the charts that follow indicate the commercial net position, so the inverse of each of these bars is considered to be the total speculative net position.

Let’s begin with the market that most professional traders and investors either love or hate: gold.

The following weekly chart shows that the total speculative net-long position in Comex gold futures hit an all-time high in July of 2016 (the chart only covers the past three years, but I can assure you that it was an all-time high). In July of last year the stage was therefore set for a sizable multi-month price decline, which unfolded in fits and starts over the reminder of the year. More recently, the relatively small size of the speculative net-long position in early-July of this year paved the way for a tradable rebound in the price, but by early-September the speculative net-long position had again risen to a relatively high level. Not as high as it was in July of 2016, but high enough that it was correct to view sentiment as a headwind.

There has been a roughly $100 pullback in the price from its early-September peak, but notice that there has been a relatively minor reduction in the total speculative net-long position. This suggests that speculators have been stubbornly optimistic in the face of a falling price, which is far from the ideal situation for anyone hoping for a gold rally. A good set-up for a rally would stem from the flushing-out of leveraged speculators.

The current COT situation doesn’t preclude a gold rally, but it suggests that a rally that began immediately would be limited in size to $50-$100 and limited in duration to 1-2 months.

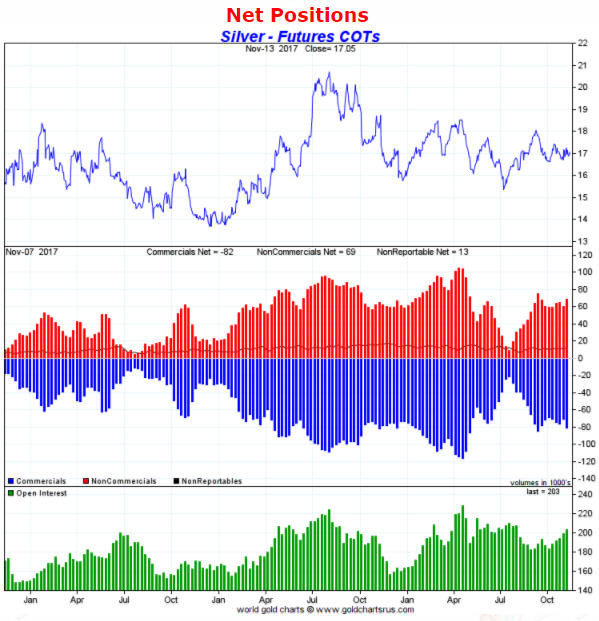

It’s a similar story with silver, in that the price decline of the past two months has been accompanied by almost no reduction in the total speculative net-long position in Comex silver futures. In other words, silver speculators are tenaciously clinging to their bullish positions in the face of price weakness. This suggests a short-term risk/reward that is neutral at best.

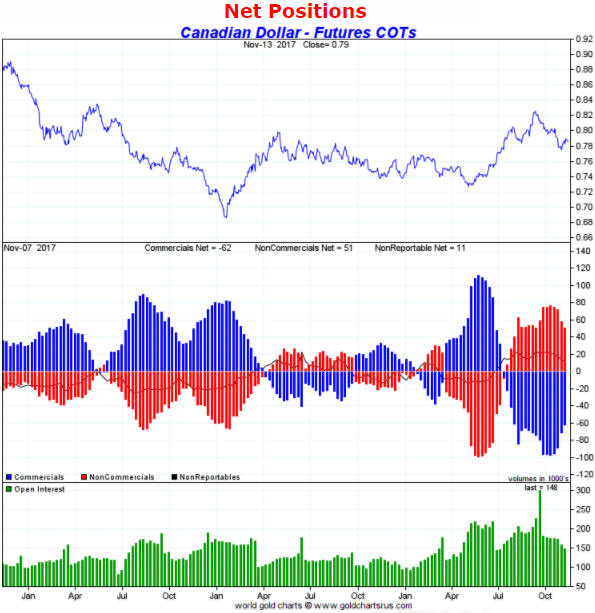

In May of this year the total speculative net-short position in Canadian dollar (C$) futures hit an all-time high, meaning that the C$’s sentiment situation was more bullish than it had ever been. This paved the way for a strong multi-month rally, but by early-September the situation was almost the exact opposite. After having their largest net-short position on record in May, by late-September speculators had built-up their largest net-long position in four years. The scene was therefore set for C$ weakness.

The speculative net-long position in C$ futures has shrunk since its September peak but not by enough to suggest that the C$’s downward correction is complete.

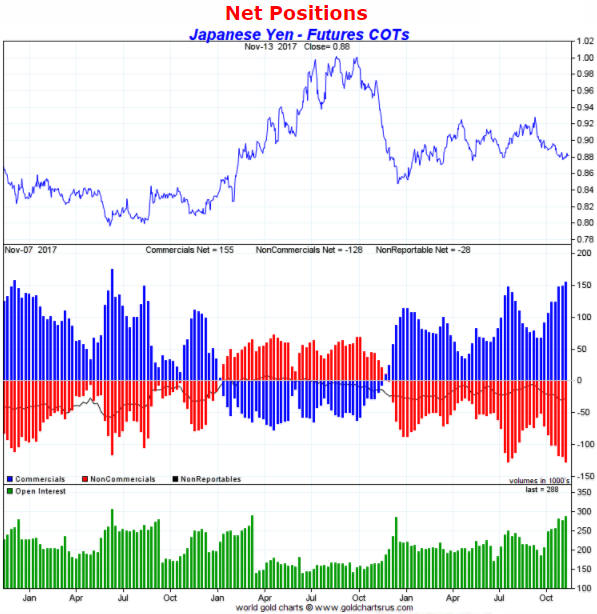

For the Yen, the sentiment backdrop is almost as supportive as it gets. This is because the speculative net-short position in Yen futures is not far from an all-time high. There are reasons outside the sentiment sphere to suspect that the Yen won’t be able to manage anything more than a minor rebound over the coming 1-2 months, but due to the supportive sentiment situation the Yen’s short-term downside potential appears to be small.

Needless to say (but I’ll say it anyway), sentiment is just one piece of a big puzzle.

From John Rubino: “We’ll Look Back At This And Cringe”

“Millions of people out there still bear the psychic scars of buying gold at $800/oz in 1980 or a tech stock at 1,000 times earnings in 1999 or a Miami condo for $1,000 per square foot in 2006.

Today’s bubble will leave some similar marks. But where those previous bubbles were narrowly focused on a single asset class, this one is so broad-based that the hangover is likely to be epic in both scope and cumulative embarrassment.”

BUBBLE? WHAT BUBBLE?

WARS: CURRENCIES AND NUCLEAR

From Timothy Alexander Guzman: “A Currency War Will Escalate”

One quote that always crosses my mind regarding the decline of the U.S. dollar and the state of geopolitics associated with it, is by Gerald Celente, founder of the Trends Research Institute who said that “When all else fails, they take you to war.”

As the U.S. dollar continues to lose its status as the world’s premiere reserve currency, the reality of a world war seems inevitable, especially when major countries such as China, Russia and Iran are making strategic moves to bypass the U.S. dollar in favor of other currencies such as China’s ‘Petro-Yuan’. China has made the decision to price oil in their own currency the “Yuan” by a new gold-backed futures contract which will change the dynamics of the world’s economy. China is preparing to launch the petro-Yuan later this year that will eventually threaten the U.S. dollar as the world’s reserve currency.”

The Gold Market – 30 Year Log Scale Graph:

From Christopher Aaron: Gold Price Forecast – First Breakout Signal Since 2008

This is interesting analysis from Christopher Aaron!

“In sum, the leading signals of gold rising versus the broad commodity index at a major price low, the downtrend break, and the trend line retest were all sequential indicators of a significant advance in prices setting up for the future.”

REGARDING SILVER:

From James Cook, President of Investment Rarities, Inc. – October 2017 newsletter:

“We’ve been buying back a lot of silver lately which is another sign of a bottom.”

The Silver Market – 30 Year Log Scale Graph:

PRINT – PRINT – PRINT: MORE DIGITAL CURRENCIES

From Robert Gore: A Crash Like We’ve Never Seen Before

“Credit creation, without restraint has papered the globe with the greatest pile of debt mankind has ever amassed.”

“When the debt bubble implodes, a global margin call will prompt forced selling, driving down all asset prices precipitously. Most of what is currently regarded as wealth will vanish.”

The S&P 500 Index – 30 Year Log Scale Graph:

(Or, the stock market goes up forever ………)

From Michael Pento:

“You still have time to extricate yourself from the lemming herd that is about to take its third 50%+ investment cliff dive since 2000.”

FREE GOLD BOOK:

Gold-Eagle has published a FREE gold e-book.

“The Definitive Gold Investing Guide” is available for download at: https://gold-eagle.lpages.co/gold-investing-guide/

The book is free in exchange for your email address.

My book “Buy Gold Save Gold! The $10K Logic” is available at Amazon.

Gary Christenson

The Deviant Investor

1. Lest We Forget

1. Lest We Forget

by Michael Campbell

Would Prime Minister Trudeau and the NDP’s Jagmet Singh be lauding Castro if they understood what our veterans fought and died for? .

2. Canada’s Clinton Inspired “Deplorable” Moment

by Michael Campbell

It took Governor General Julie Payette only a few moments to dismiss and denigrate a huge portion of the Canadian population. And the Prime Minister loved it. It’s the same attitude that has produced massive political, economic and financial repurcussions through-out the Western World.

3. New Mortgage Regs Could Lower Borrowing Power

After a lot of deliberation over the spring and summer, the Office of the Superintendant of Financial Institutions has come out with new regulations that will make it harder to qualify for mortgages once again.

Opinions in this report are solely those of the author.. The information herein was obtained from various sources;; however,, we do not guarantee its accuracy or com pleteness.. This research report is prepared for general circulation and is circulated for general information only.. It does not have regard to the specific investment objectives,, financial situation,, and the needs regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized..

Investors should note that income from such securities,, if any,, may fluctuate and t hat each security’s price or value may rise or fall.. Accordingly,, investors may receive back less than originally invested.. Past performance is not necessarily a guide to future performance.. Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or options or futures contracts.. Foreign currency rates of exchange may adversely affect the value,, price or income of any security or related investment mentioned in this report.. In addition,, investors in securities suc h as ADRs,, whose values are influenced by the currency of the underlying security,, effectively assume currency risk.. Moreover,, from time to time,, members of the Institutional Advisors team may be long or short positions discussed in our publications..

BOB HOYE,, INSTITUTIONAL ADVISORS

bhoye..iinstitutionaladvisors@@ttelus..nnet

WEBSITE

www..iinstitutionaladvisors..ccom

Segwit2x cancelled due to lack of “sufficient consensus”

The Segwit2x development team has called off any plans for the Segwit2x hard fork, previously set for mid-November. The report published only an hour ago was co-signed by the Segwit2x figureheads, including Erik Voorhees of Shapeshift fame and Jeff Garzik, the lead developer on the BTC1 repo. Jihan Wu of Bitmain, Wences Casares of Xapo and investment banker Peter Smith are also co-signatories. Mike Belshe, CEO of BitGo, sent out the email.

The report states that their goal “has always been a smooth upgrade for Bitcoin”. For anyone who has been active on social media, github repos, or even just chatting to Bitcoin evangelists, it would have been clear that the Segwit2x change was anything but a smooth “upgrade”. In a sudden turn of events, the Segwit2x figureheads stated that their dedication to keeping the Bitcoin community together trumped their beliefs over on-chain scaling and big blocks:

“… It is clear that we have not built sufficient consensus for

a clean blocksize upgrade at this time. Continuing on the current path

could divide the community and be a setback to Bitcoin’s growth. This was

never the goal of Segwit2x.”

All plans for the “upcoming” 2MB upgrade have been suspended until clear and present consensus can be achieved. The use of the term “upcoming” in the report show clear intentions to continue pushing the rhetoric of on-chain scaling and big blocks, despite the majority of the community’s focus being on scaling through off-chain solutions such as the Lightning Network.

Bitcoin price skyrockets

At the time of publishing, Bitcoin is rocketing past $7700 USD. In stark contrast, Segwit2x futures have crashed from $1.2k USD to $300 USD in under the span of an hour. This free-fall ought to continue to $0 USD, as the chainsplit tokens only have value in the event of a hard fork.

Screenshot captured 18h10 GMT

[UPDATE: Segwit2x futures noting a short-term recovery to $450 USD in the interim. The only explainable cause is unsubstantiated speculation]

While the report had intentions of mitigating potential damages to the Bitcoin community, it’s clear that many people who bought into the Segwit2x hard fork are paying the price in cold hard crypto.

In line with Bitfinex’s Chainsplit T&C, all split BT2 tokens (representing Segwit2x) will be worthless:

In the case of BT2, Segwit2x shall be deemed to exist only if a blockchain has diverged incompatibly from the Incumbent Blockchain. Any settlements of BT2 shall be to B2X. If no Segwit2x blockchain exists pursuant to these T+Cs, BT2 tokens shall be deemed to have a value equal to zero and shall be removed from the platform.

Bitcoin veterans who saw uncertainty in the Segwit2x hard fork made sure to steer clear – but newbies, enthusiastic traders hoping to make a quick buck, and those who genuinely believed in figureheads like Mike Belshe and Jeff Garzik are now suffering. It’s a tough lesson learnt in trying to circumvent decentralized governance.

“We want to thank everyone that contributed constructively to Segwit2x,

whether you were in favor or against. Your efforts are what makes Bitcoin

great. Bitcoin remains the greatest form of money mankind has ever seen,

and we remain dedicated to protecting and fostering its growth worldwide.”Mike Belshe, Wences Casares, Jihan Wu, Jeff Garzik, Peter Smith and Erik

Voorhees

These words are sure to leave a bitter taste in the mouths of those affected.

Stick to this space for further updates.

Featured image from Pexels

By Daniel Dalton via Crypto Insider