Wealth Building Strategies

As expert poker player Annie Duke explains in her book, Thinking in Bets, one of the more common mistakes amateurs make is the tendency to equate the quality of a decision with the quality of its outcome. Poker players call this trait “resulting.”

As expert poker player Annie Duke explains in her book, Thinking in Bets, one of the more common mistakes amateurs make is the tendency to equate the quality of a decision with the quality of its outcome. Poker players call this trait “resulting.”

In my own book, “Investment Mistakes Even Smart Investors Make and How to Avoid Them,” I describe this mistake as confusing before-the-fact strategy with after-the-fact outcome. In either case, it is often caused by hindsight bias: the tendency, after an outcome is known, to see it as virtually inevitable.

Duke explains: “When we say ‘I should have known that would happen,’ or, ‘I should have seen it coming,’ we are succumbing to hindsight bias.” She adds that we tend to link results with decisions even though it is easy to point out indisputable examples where the relationship between decisions and results isn’t so perfectly correlated.

For example, she writes, “No sober person thinks getting home safely after driving drunk reflects a good decision or good driving ability.” The lesson, as Duke explains, is that we aren’t wrong just because things didn’t work out, and we aren’t right just because they turned out well.

Don’t judge performance by results

“Fooled by Randomness” author Nassim Nicholas Taleb put it this way: “One cannot judge a performance in any given field by the results, but by the costs of the alternative (i.e., if history played out in a different way). Such substitute courses of events are called alternative histories. Clearly the quality of a decision cannot be solely judged based on its outcome, but such a point seems to be voiced only by people who fail (those who succeed attribute their success to the quality of their decision).”

Here’s an example from poker. With one card remaining to be drawn, there are just two players left in the hand. Player X calculates that he has an 86% chance of winning. Based on those odds, he makes a large bet. Unfortunately, he loses the hand, just as he would expect to occur 14% of the times he faced the same situation. If he engaged in resulting, he would change his betting strategy because he would conclude that it was wrong to make such a bet. However, we know that if he made the same decision each time he faced those odds, over the long term, he would be expected to come out way ahead.

Let’s look at another example of resulting. John Smith, a hypothetical investor, works for Google and has nearly his entire portfolio invested in Google stock. He became a multimillionaire based on that strategy. John believes concentrating all your eggs in one basket – a basket that, as a senior executive, he could watch closely – is the right strategy. He thought diversification was only for investors who don’t have his sophistication. Of course, many other, similar situations turned out entirely differently, despite using the same strategy of concentrating risk in what you know. That’s why the saying “the surest way to create a small fortune is to start out with a large one and concentrate your risk” offers such good counsel.

Flawed Strategy

Among the once-great companies whose stock prices collapsed are Polaroid, Eastman Kodak, Digital Equipment, Burroughs and Xerox. However, despite the fact that there are far more Polaroids than Googles – showing John’s strategy is flawed – his outcome convinced him the strategy was right.

As Duke points out, once a belief becomes lodged, it becomes very difficult to dislodge. It takes on a life of its own, leading us to notice only evidence that is confirming, and causing us to experience cognitive dissonance. We then work hard to actively discredit contradicting information, a process called motivated reasoning.

Making matters worse is that research shows being “smart” actually makes certain behavioral biases worse: The smarter you are, the better you are at constructing a narrative that supports your held belief.

Duke cites the research of Richard West, Russell Meserve and Keith Stanovich, who tested the blind-spot bias. They found we are much better at recognizing biased reasoning in others but are blind to recognizing it in ourselves.

Surprisingly, at least to me, West, Meserve and Stanovich also found that the better you were with numbers, the worse the bias – the better you are with numbers, the better you are at spinning those numbers to suit your narrative. Quoting Duke: “Our capacity for self-deception knows no boundaries.” So, what does this have to do with investing?

Invest by playing the odds

When it comes to investing, there are no clear crystal balls. Just as in poker, the best we can do is put the odds in our favor and invest (bet) accordingly.

As I recently discussed, using factor data from Dimensional Fund Advisors from 2007 through 2017, the value premium (the annual average difference in returns between value stocks and growth stocks) was -2.3%. Unfortunately, resulting, hindsight bias and recency bias led many to conclude it was a mistake to invest in, or overweight, value stocks.

Another way to look at the situation is that, over 10-year periods since 1927, value stocks outperformed growth stocks 86% of the time – the same percentage as in the aforementioned poker hand. The value premium’s now-decade-long underperformance was not unexpected, in the sense that in 14% of the alternative universes that might have shown up, we expected value stocks to underperform.

Similarly, again using Dimensional Fund Advisors data, the market-beta premium has been negative (U.S. stocks underperformed riskless one-month Treasury bills) in 9% of the 10-year periods since 1927.

In other words, investing is risky. To be successful, you must accept that fact there will be periods, even very long ones, when the right strategy leads to poor outcomes. Even at 20-year horizons, the market beta premium has been negative 3% of the time. That is why Warren Buffett has said investing is simple, but not easy. It takes discipline to earn risk premiums.

Summary

One of the hardest things for investors to do is to stay disciplined when their strategy delivers poor results. It certainly is possible that the strategy was wrong. To determine if that is the case, look to see if the assumptions behind the strategy were correct. Seek the truth, whether it aligns with your beliefs or not. For investors, the truth lies in the data. When your theory isn’t supported by the data, throw out your theory.

While it’s certainly not an investment book, investors can learn many lessons from Duke’s “Thinking in Bets.”

Larry Swedroe is the director of research forThe BAM Alliance, a community of more than 140 independent registered investment advisors throughout the country

To this date, Fiat-Chrysler (FCA) hasn’t been a leader in the current electrification of the auto industry, but the company has now announced a significant acceleration of its electric vehicle programs.

Now they say that they are “going after Tesla” with their own luxury brands. Maserati is getting the most electric additions to its lineup with 4 all-electric vehicles to be added by…. CLICK for the complete article

“We can ignore reality, but we cannot ignore the consequences of ignoring reality.” Ayn Rand. Today Gary Christensen lays out the 3 comforting beliefs are incorrect and will be proven false in coming years and what asset will have more purchasing power in the next 10 years – R. Zurrer for Money Talks

The western world has ignored economic realities for decades. It’s not a Republican or Democratic problem. Banking, power, fiat currencies, dishonest money and transfers of wealth are the issues.

The consequences of ignoring reality are uncomfortable and dangerous. However, most people prefer palatable, easy to digest and believable stories.

In the United States, the U.K., Europe, and Japan it is comforting to believe:

- Debt has increased exponentially for decades and for over 100 years in the US. We want to believe debt will grow for another century. (It won’t.)

- Governments want to borrow, spend their way into prosperity, and pretend and extend indefinitely. (Not likely.)

- It is comforting to believe our politicians and central bankers manage our countries and currencies for the benefit of the populace. (Don’t plan on it.)

- Every major country uses a central bank. It is comforting to believe central banks are necessary. That delusion benefits the banking cartel and the political and financial elite.

- It is comforting to believe gold is not necessary. Per Warren Buffett, we dig it from the ground and store it in a vault. Russians and Asians know its value and always want more.

- It is comforting to believe in paper assets, debt based assets, fairy tales and the Easter Bunny. Gold, silver, platinum, land, and other real assets survive. Gold thrives, paper dies.

These comforting beliefs are incorrect and will be proven false in coming years.

The U.S. national debt has increased from about $3 billion in 1913 to over $21,000 billion ($21 trillion) in 2018. That is an average annual increase of about 8.8% per year. A similar debt increase for another 100 years will exceed $90,000 Trillion. Delusion!

- The crisis of 2008 hinted that “peak debt” had arrived. The Fed and other central banks responded by creating more debt and took credit for saving global economies. More debt is not a solution. The coming implosion will be destructive.

- Place one penny in a savings account at 6% annual interest and allow it to grow for 1,000 years. Your $0.01 has grown to a few hundred bucks—right? No! It has grown to $202,000,000,000,000,000,000,000. (Yes, the math is correct.)

- Compound interest rapidly increases debt. Debt will not increase forever and a reckoning will occur. What is the value of a 30 year bond yielding 3%, issued by an insolvent government that cannot pay the interest without going deeper into debt?

CONSIDER:

- Central Banks: Central banks and commercial banks produce paper and digital currency units that devalue all existing currency units. Central banks create profit for their owners and the financial and political elite. They are not beneficial for most people and small businesses.

- Gold: The western financial and political elite claim gold is mostly useless. However gold has been money for thousands of years, is valued globally, and is convertible into paper and digital cash everywhere. An ounce of gold sold for about $42 in 1971 and sells for about $1,330 in March 2018 – a compounded annual increase of 7.6%.

- Debt: The debt pyramid will crash and bonds and currencies will decline toward intrinsic value. Central banks will create more currency units to “paper over” the crisis and gold will increase in price as dollars devalue.

Ignoring Reality and the Consequences:

“We can ignore reality but we cannot ignore the consequences of ignoring reality.” The consequences are:

- U.S. government spending and national debt growth are “out-of-control.” Expect continual dollar devaluation.

- Based on Fed policies and government actions, the Fed can save either the dollar’s purchasing power or the bond market. Pick one!

- Because an imploding bond market will destroy credit and the economy, expect the Fed to sacrifice the dollar, not the bond market.

- However, the Fed and the U.S. government may kill all three – the stock market, bond market and dollar – in their delusional efforts to project military power and protect the banking cartel.

- Gold and silver prices must increase as all fiat currencies devalue. Another country might back their currency with gold to prevent further devaluation. It won’t be the United States.

- The cumulative damage from past economic delusions increases gold prices. The western financial world should be worried. Trouble, trauma, and a reckoning lie ahead.

- Confidence in the dollar affects gold prices. When the dollar plummets, gold prices at $3,000, $5,000 and $10,000 will be sensible.

Which will have more purchasing power in ten years?

- An ounce of gold or 14 one-hundred dollar bills?

- An ounce of silver or a politician’s promise?

- A ten year note for $10,000 purchased in 2018 that yields less than 3%, or 7 ounces of gold?

Gary Christenson, The Deviant Investor

Call Miles Franklin at 1-800-822-8080 or WhyNotGold at 1-888-966-8465 to purchase real metals that will survive the coming debt-based asset implosion. History will not repeat, but many examples show that the purchasing power of gold will thrive while unbacked paper currencies will not.

One of the most common investing mistakes people make is in their trade allocations. This is especially true when they are going for home run type trades. Instead of investing a small amount and trying to turn it into a large amount, many investors invest a large amount, and it ends up turning into a small amount.

One of the most common investing mistakes people make is in their trade allocations. This is especially true when they are going for home run type trades. Instead of investing a small amount and trying to turn it into a large amount, many investors invest a large amount, and it ends up turning into a small amount.

Just last week I got a call from an old high school friend named Brian. He was asking me about a penny stock that was rumored to be a takeover target.

He was talking about putting half of his trading account into this trade. I told him I would never put half of my account in one trade. I also told him I would look at it for him.

After I looked at the company and analyzed the trade, I told him that I personally wouldn’t make the trade in my own account. Brian said: “If you wouldn’t make the trade, I won’t make the trade.”

A few days after that conversation, I was talking with Paul Mampilly. We were talking about trade allocations, and how many hedge funds take small allocations and have them turn into a large part of the portfolio. On the other hand, many individual investors, like my friend Brian, take a large allocation and let it become a small part of the portfolio.

Which would you rather do: Take a big investment and have it become small, or take a small investment and have it become big?

Small Investments Can Make a Huge Difference

The obvious answer to the question above is the first option. No one wants one of their large investments to become a small one.

I can show you how an allocation of as little as 2% can still have a big impact on the total return of a portfolio. But you have to have patience and discipline. You also have to be willing to take some total losses if you are going to have really big winners.

I am not just talking about 100% and 200% winners. I am talking about investments that go up 10, 12, 15-fold and more.

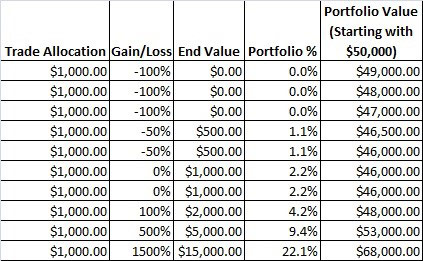

To show you how this can work, I put together the following table. The table shows how you can take 2% allocations from a $50,000 portfolio and make a great return. You can even have three 100% losses and two 50% losses, and still enjoy great overall returns.

In this scenario, we made 10 trades and allocated only 2% to each one. Three of the trades were total failures, 100% losses. Two trades were 50% losses, and two were breakeven trades. There is one 100% winner, one 500% winner and one 1,500% winner.

After all is said and done, the portfolio gained 36% with only three winning trades out of 10.

We also only used 20% of the total portfolio value to make these trades. We could repeat this same pattern four more times.

By making small allocations, we limit the downside. But there is unlimited upside.

You may be saying: “1,500% gains don’t happen very often.” And you would be right, they don’t. You have to be patient and disciplined.

As an example, let’s look at a stock that Paul and I have both traded and recommended over the past seven years or so, the Federal National Mortgage Association (OTC: FNMA). It is better known as Fannie Mae.

The stock was languishing between 20 cents and 41 cents for over a year back in 2012 and early 2013. But after the company reported $50 billion in profits in March 2013, the stock jumped sharply higher.

If you had bought in the middle of the range at 30 cents, you would have gained over 1,700%. If you bought at the low end of the range, you gained over 2,600%.

However, you would have had to have the patience to wait through the range period, and you would have had to have the discipline to see the stock jump to its peak.

Too many investors want home run trades, but don’t have the patience and discipline to actually achieve them. They get tired of waiting, or they see the stock jump by 100% or 200% and sell it before it has had the chance for the big move.

If this trade would have been in the sample portfolio above, a 2% allocation would now be worth approximately 25% of the portfolio. That is using the 1,700% gain to replace the 1,500% gain above.

Triple-Digit Gains

Gains of 100% or 200% are pretty easy to get, quite honestly.

I used to write a newsletter for penny stock investors. All of the stocks had to be under $10 and listed on an exchange. Those were the only two requirements the publisher gave me.

I looked back at the track record recently, and there were so many 200% to 300% winners.

There was one 15-trade stretch where six of the recommendations reached at least 200% gains, three of the six reached 300% and two of them were close to 400%.

However, I doubt if any subscribers actually achieved those gains.

Why? Because they weren’t willing to wait for them. I doubt they had the patience or discipline to wait.

A New Service for a New Approach: The $10 Million Portfolio

Now that I have told you about this downside-up approach to investing, I want to tell you about a new service that Paul and I are running. It isn’t fully launched yet, but it will be soon.

We are going to use our combined talents and experience to run the service, and we are going to use the methodology described above to help guide investors. We are going to suggest small allocations to aggressive trades that will take patience and discipline. But we expect the rewards to be huge.

The service is called The $10 Million Portfolio. We call it that because our goal is to help subscribers grow their portfolios from $10,000 to $10 million.

And hopefully we can change the way investors think when it comes to home run trades. We want to teach investors how to take small allocations and turn them into large portions of their portfolios.

Perhaps having two guys with over 50 years of combined investment experience will help change the way investors think.

We are all looking forward to the launch, and we can’t wait to help readers make money. But we all have to be patient.

Regards,

Rick Pendergraft

Senior Analyst, Banyan Hill Publishing

With the Federal Reserves declared intent to drive interest rates back to normal to save pension funds, a rising interest rate scenario immediately reopens that 8th wonder of the world, compound interest, as an investment strategy to pursue. This grapic pounds home the incredible power of compound interest as a wealth building strategy – R. Zurrer for Money Talks

Double Click on image Below for Larger Version