Wealth Building Strategies

For most people, the “Oracle of Omaha” needs no introduction. With a self-made net worth of $84 billion, some experts consider the 87-year-old to be the greatest investor of all-time.

Despite his incredible achievements and decades in the public eye, the modest Midwesterner is frugal, relatable, and full of humility – and his life story is an endless source of lessons to aspiring business professionals around the world.

Today’s infographic, which is done in partnership with finder.com, is Part 1 of the Warren Buffett Series, a five-part biographical series about the legendary investor.

Note: New series parts will be released each coming month. Stay tuned for future parts with our free mailing list.

Note: New series parts will be released each coming month. Stay tuned for future parts with our free mailing list.

The young Warren Buffett was clearly a special kid. He ran his first “business” when he was five years old, and he invested in his first stock when he was 11. Buffett even managed to emerge from high school richer than his teachers.

But what lessons can we learn from Buffett’s prolific childhood – and how did his experiences as a young man shape him into the magnate we know today?

FROM NUMBERS TO DOLLAR SIGNS

Even for someone as gifted and focused as Buffett, a serendipitous insight played a crucial role in charting his future course.

During a visit to the New York Stock Exchange when he was 10 years old, the sight of a young man rolling custom, handmade cigars on the floor made an outsized impact on him. In particular, Buffett realized that such a job couldn’t exist without massive amounts of money flowing through the stock market.

This unexpected epiphany planted the seed for stocks in his brain, and Warren’s long fascination with numbers soon shifted towards dollars.

THE BUFFETT GROWTH MINDSET

Warren Buffett famously spends 80% of his day reading – and the written word was just as important to his younger self. As a lad, one book that caught Buffett’s eye was One Thousand Ways to Make $1,000 by F.C. Minaker

Specifically, the book showed Buffett how $1,000 could compound over time – and that the earlier you had money working for you, the better.

An important lesson from the book? There’s a massive difference in returns between 60 and 70 year compound interest scenarios. In other words, annualized returns are just one part of the equation – but how long the money compounds is the other crucial part. This is a big part of the reason why Warren Buffett got started early.

WARREN BUFFETT’S FIRST STOCK

Through his various activities, Buffett had $120 saved by age 11. Naturally, he invested it in a stock, co-investing his sister’s money. They each bought three shares of Cities Service Preferred for $38.25 each.

The share price promptly dropped to $27, but Buffett waited it out. When it got to $40, he sold to net a small profit – however, the stock soon after went all the way to $202!

Warren calls this one of the most important moments in his life, and he learned three lessons:

- Don’t overly fixate on what he paid for the stock

- Don’t rush unthinkingly to grab a small profit. He could have made $492 if he was more patient

- He didn’t want to have responsibility for anyone else’s money unless he was sure he could succeed

These important lessons would eventually tie in well to his value investing philosophy.

ODD JOBS

The young Buffett wasn’t afraid to try new things to build up his capital. He collected golf balls, sold peanuts and popcorn, sold gum and Coca-Cola, and even created tipsheets for horse races on a typewriter.

Some of his stranger endeavors? He launched Buffett’s Approval Service and sold stamps to collectors around the country, and he also launched Buffett’s Showroom Shine – a car shining business that didn’t last too long.

WARREN’S WORK ETHIC

By the end of high school, Buffett had launched multiple businesses, sold thousands of golf balls, read at least 100 books on business, and hawked 600,000 newspapers.

This hard work led to him having a fortune of $5,000 by high school graduation time, the equivalent of $55,000 in today’s currency. He even owned land at this point, after buying 40 acres of Nebraska farmland with his newspaper profits.

KNOCKED OFF COURSE

After high school, Buffett decided he was a shoe-in for Harvard. He knew it would be stimulating for him intellectually, and that the famed business school would allow him to develop a strong network.

The only problem? He got rejected.

Instead of letting this get to him, he discovered Benjamin Graham’s book The Intelligent Investor and fell in love. It was the methodical investing framework he needed, and he would later call it the “best book about investing ever written”.

Buffett would soon be accepted at Columbia Business School, where Benjamin Graham and David Dodd taught finance. Graham became Buffett’s idol, and his second-biggest influence behind his own father.

OTHER NOTES

Part 2 of the Warren Buffett Series will be released in early January 2018.

Credits: This infographic would not be possible without the great biographies done by Roger Lowenstein (Buffett: The Making of an American Capitalist) and Alice Schroeder (The Snowball), as well as numerous other sources cataloging Buffett’s life online.

In this interview, Mr. Sprott shares his thoughts on the gold market, distinguishing between the paper market and the physical market and the current market dynamics. Eric concludes the interview by sharing advice for both new and experienced gold investors alike.

This interview was conducted in November 2017 during BullionStar’s participation at the Precious Metals Investment Symposium in Melbourne, Australia.

For more precious metals related interviews with known gold proponents such as e.g. Jim Rogers, David Morgan and Chris Powell, go to BullionStar Perspectives.

The money to be made is in non-U.S. markets, according to Jeffrey Gundlach. For long-term investors, he recommends a specific ETF.

That ETF is INDA, the iShares fund that tracks the Indian equity market. He singled out India because of the growth of its workforce and its tradition of education and technology.

“It could go up 1,000% in the next 20 years,” Gundlach said, “just like China did.” INDA is up 32% year-to-date and carries an expense ratio of 0.71%.

Gundlach is the founder and chief investment officer of Los Angeles-based DoubleLine Capital. He spoke at the Schwab IMPACT conference on November 16. His talk was titled, “2017: At the Home Stretch.”

I’ll go over what he said about the global economy and why he believes emerging markets are a compelling opportunity, along with some “insane” developments in various asset classes.

The global landscape

This has been a very easy year for investors, he said, with no volatility in bonds, although short rates have gone up. The S&P is up 17%, but he said investors would actually have been unlucky to have over-allocated to it, since some of the emerging markets have performed better.

…also:

While everyone’s been talking about the Dow’s third major milestone this year – breaking the 24,000 mark – I’m focusing on something else…

You see, there’s a new technical pattern forming in a couple of department store stocks. If it’s true and you catch it at the right time, you can make a lot of money.

But timing is everything because this pattern is a tricky one.

Make sure your kids aren’t looking over your shoulder trying to read this educational piece. If you are the squeamish type, you may not be able to get through this article in one reading. I’m going to teach you a new technical pattern with a not-so-happy name.

Let’s examine the profit potential of this macabre-sounding pattern that may be taking place on a couple of department store stocks…

The Dead Cat Bounce

The pattern gets its name from an old saying among traders that “even a dead cat will bounce if dropped from a high enough level.”

And the same for goes for stocks. Well, it goes for stocks when you’re interested in a short-term recovery-type trade, which is great for a quick profit.

A dead cat bounce (DCB) is the type of pattern that usually forms after a sustained drop in share price, let’s say six months to a year. At that point, the stock may become a turnaround candidate with the potential to be a nice performer over the long haul. But that’s just potential…

The stock being observed is still one that had a significant drop in share price over a long period of time.

These stocks are generally trading at or near a year’s low in price, so to expect them to just bounce back to previous all-time highs or start making new highs is actually not that realistic.

The term “bounce” in the name of the strategy signifies to me this will be a somewhat sharp or quick upward move. After a stock soars again, it’s not uncommon for it to fall back to Earth. In fact, it’s generally likely.

It may bounce a few times at this low and start hammering a lengthier bottoming-type technical setup like a double or triple bottom, a rounding bottom, or a cup-and-handle pattern.

But it first has to bounce, and the dead cat bounce is the first pattern to watch for when stocks are at significant lows. We use it to profit from the short-term recovery of a falling stock.

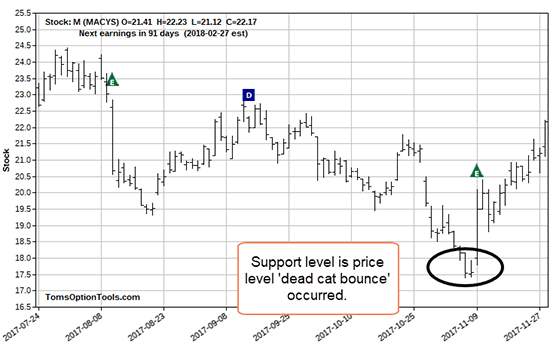

A Look at Macy’s

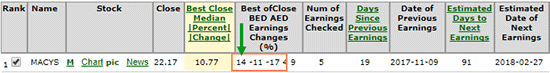

The “E” I circled indicates Macy’s Inc.’s (NYSE: M) most recent earnings report.

M stock dropped after all the previous earnings reports on the chart. Yet the stock recently bounced after its 52-week low. The previous post-earnings downward trend makes it hard to know if the latest report factored into the bounce.

Look at what my tools show as the percentage move of the stock after the last few earnings reports:

The most recent percentage move is on the left. It was better than the two preceding earnings reports. In the chart, you can also see how the stock moved over the last three earnings reports.

Earnings Whisper shows that Macy’s earnings came in better than expected at $0.23 per share versus estimates of $0.19 per share. Revenue met expectations at $5.3 billion.

The report from the earnings website also stated Macy’s expects fiscal-year earnings between $2.91 and $3.16 per share, excluding items compared to the company’s previous guidance between $2.90 and $3.15 per share.

Based upon the action in the share price, we see that investors considered it favorable news. Even Jim Cramer on CNBC called M a buy at the time.

The Cause for Concern with This Pattern

Most of the time, we only notice the dead cat bounce after it has already happened…

Around earnings reports, I encourage you to watch the price action for a stock at a 52-week low or near lows over a six-month period. I am not talking about looking for a straddle or strangle, but looking for a straight, long call option trade.

What I look for if I’ve missed the bounce (which has happened to everyone) is a retest of the price from which the stock bounced.

I look for that price to hold as a support. Since it bounced from that price once, I look for it to do so again as it will have formed a double-bottom support.

click here – you’ll get Tom’s twice-weekly Power Profit Trades delivered directly to your inbox, free of charge.

In the year 301 AD, the Roman unit of barter was the denarius, which had originally been 95% pure silver when introduced by Augustus at the end of the first century BC but by the time of Diocletian’s rule, it had moved to 50,000 denarii to a pound of gold. Ten year later, it took 120,000 denarii to buy a pound of gold and by 337, that figure was 20,000,000. What had occurred in a mere 400 years was that a slow and agonizing erosion in the purchasing power of the Roman currency accelerated to full fiat disintegration and that complete and total disregard for the denarius was attributed as one of the underlying causes of the Fall of the Roman Empire. Nothing was more evident in the underlying rot permeating Roman society, economics and national security than the refusal by the Barbarian armies to accept anything but gold as payment for their leaving the Roman legions alone. Rejection of the currency of the Roman Empire was complete and irreversible.

One of the omens of impending inflationary spirals is the tendency of those individuals controlling large swaths of wealth to reject any form of “savings” in the form of bank deposits or interest-bearing certificates. They choose instead to jettison cash or cash-equivalent instruments because of a loss of faith in the ability of local currencies to retain purchasing power. We have seen this over the ages from Weimar Germany to Zimbabwe and now Venezuela, and where gold and land were generally the tried-and-true assets of choice for those wishing to protect their wealth from the insanity and irresponsibility of governments, today in 2017 with the advent of technology and its attendant curses and wonders, the wunderkind of today have actually created their own receptacle for frightened wealth and that is the true meaning of Bitcoin and its incredible “success.”

When the chief technology engineers sat down ten years ago after watching the global bankers vaporize the financial system and then turn right around and “save” it through a massive and globally coordinated counterfeiting racket, they determined that anywhere government has control over money (as in the banking system), there could be no certainty of anything responsible or prudent whereas there was absolute certainty that corruption would exist at a systemic level. Therein lies the reason for the invention of blockchain technologies and the best-performing “asset” of 2017, Bitcoin, which is ahead an astonishing 1,000% year-to-date spurring the creation of hundreds and hundreds of “wannabes” being trotted out as heir apparents.

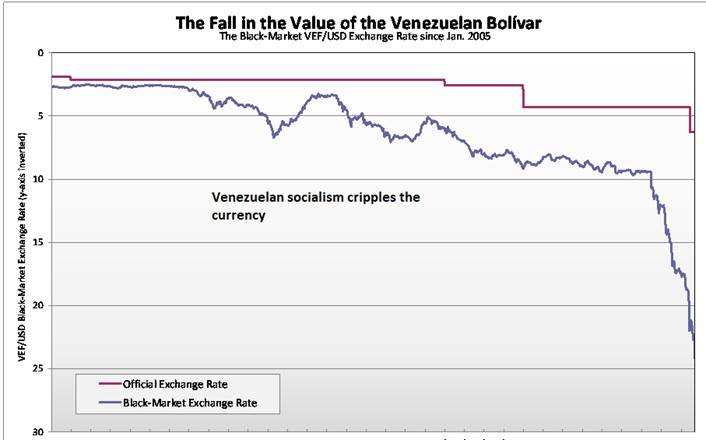

Traditionally, investors moved to the old saws, gold and silver, as safe havens for decomposing currencies and as recently as this year, we have witnessed the efficacy of wealth preservation as Venezuelan citizens that moved their savings to U.S. dollars from the bolivar avoided the most hideous of outcomes as the bolivar collapsed. This is precisely what occurs when confidence sinks to zero and hoarding of staples escalates.

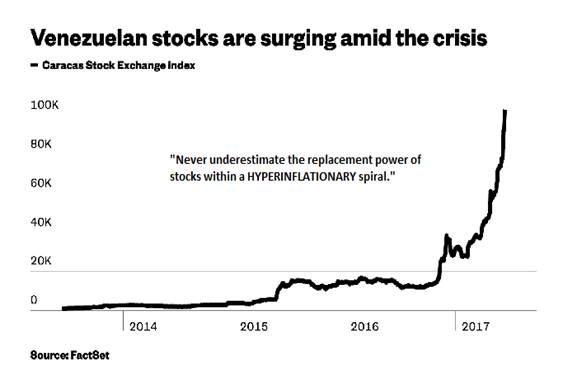

If they further diversified by converting bolivar to gold, the outcome was predictably preferable to holding cash in mattresses or term deposits in a Caracas banking institution. However, it was the early escalation in stock prices that became the harbinger of collapse in the bolivar’s purchasing power. “Never underestimate the replacement power of stocks within an inflationary spiral” the saying goes and no more relevant than when “inflation” metamorphoses into “hyperinflation” as seen recently in Venezuela.

Now, in the Western world and specifically the U.S, it is apparent that very large holders of American dollar wealth have decided that they want to have control of the currencies to which they transfer wealth, keeping it away from the interference and meddling of politicians and the global banking cartel. Whereas gold and silver, by way of physical possession were once the stores of value within which wealth sought sanctuary, government intervention and manipulation by way of the derivative exchanges sent the members of this elite class of billionaires scurrying for the ultimate alternative to the precious metals and herein lies the genesis of Bitcoin.

In my opinion, BTC represents the final chapter of the repudiation of fiat currencies by those of the Super-Wealth fraternity. They own all of the prime real estate around the world; they own all of the publicly traded behemoths listed on global stock exchanges; and they own every politician and every court of law in existence. Ergo, there was only one glaring vulnerability to which the elite class were exposed—currency risk. Now, with Bitcoin, they have removed accessibility of this product to the Rothschild-ian Mantra of “controlling a nation by controlling its currency,” which was and is the modus operandi of the banker class. The maniacal move of BTC in 2017 represents total disdain, not for Zimbabwe dollars or Venezuelan bolivars, but for U.S. dollars, euros, and yen.

Now you may have noticed that I have purposely refrained from offering predictions on the outlook for BTC and the myriad of blockchain “wannabe’s” that are being marketed like pretzels at a ball game. My inbox this week is stuffed with dozens and dozens of these deals and the more difficult to assess and analyze, the more the demand swells. It seems that scarcity outweighs logic in handicapping this type of mania to the extent that when I see junior exploration companies announcing plans to restructure into blockchain business ventures by way of a twenty-something engineering graduate two years out of school, it is eerily reminiscent of the DotCom mania of the late 90s which, by the way, marked the bottom of the gold markets and the top in the tech bubble.

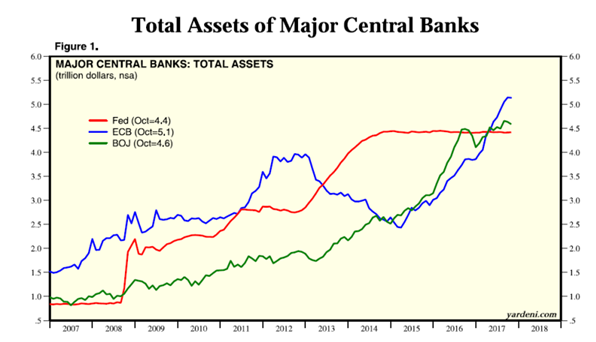

With central bank balance sheets engaged in an unrelenting escalation of credit creation, one needs look no further than the chart shown below in order to rationalize the increases being seen not just in the U.S. but around the world. All major stock markets are dancing with all-time highs as the impact of serial money-printing impacts prices. The Achilles Heel of the banker class—real estate, the ultimate collateral upon which banks are grounded—has rebounded with a vengeance in the U.S. and Europe with housing bubbles now in Canada, Australia and Sweden. That collateral so terminally impaired in 2008 is now the Mother’s Milk of the Banker Class with prices in many locations eclipsing the highs of 2005–2007. After all, that was the sole intent of Paulsen-Bernanke bailout at the bottom of the markets in 2009. A scant ten years later from a time when bankers were being hunted down in places like Iceland and Ireland, the American bankers have soared unimpeded to even greater riches than they enjoyed blowing up the sub-prime bubble.

I offer this commentary neither as a bull or a bear on BTC or this new industry called “blockchain” but rather as a 40-year observer and interpreter of market events. I am adamant in my conviction the just as central bank largesse is responsible for the asset bubbles popping up around the world, it is also the impetus for Bitcoin. More importantly, just as the turning of the leaves and the southern flight of flocks of geese are harbingers of fall and winter in the northern hemisphere, the emergence of alternative currencies replacing gold and silver as monetary sanctuaries is an underscored harbinger of the acceleration of the decomposition of the modern fiat currency regime. For traditionalists such as I (meaning “old and stubborn”), I shall opt for the certainty of possession as it pertains to physical gold and silver and the preservation of wealth. I leave this infatuation with digital havens to the younger and more daring but young or old, the message contained in the Bitcoin phenomenon is far more important than directional accuracy or investment merit. It is an omen of change in a manner far more important than the arrival of the internet or putting a man on the moon.

Think “Venezuela”. . .

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and images courtesy of Michael Ballanger.