Wealth Building Strategies

This is a better question to ask than the typical “magic number” formula that most “first-level” thinking firms tout. Let’s review why their approach is fatally flawed, so that we can derive a more reliable method of our own based in actual reality (and funded by actual dividend payments.)

Fidelity Says What?

You should aim to have 10 times your final salary in savings.

But why? I suppose they are claiming that, if you earned $100,000 in your final year working, that you’ll want to earn this much in income every year for the rest of your life.

So, Fidelity says save a million bucks and you’re in good shape.

But how exactly is $1,000,000 supposed to throw off $100,000 in excess income annually?

Fidelity’s Strategic Dividend & Income Fund (FSDIX) pays 2.38% today. Which means, if you follow their advice to a tee, and buy their flagship income fund, you are earning $23,800 per year in income from your million-dollar stake.

That’s a start. But where exactly is the other 76.2% of you income supposed to come from?

Apparently this is up to us to figure out, because we’ve run out of sage advice from this respected investment firm. So let’s see if we can piece together a full retirement ourselves.

Shall We Also Withdraw 4% Annually?

We saved a million like they said, and we’re earning less than our neighborhood coffee barista. I presume we’re now supposed to sell shares to make up the difference. Most mainstream-following financial advisors say that we can sell 4% of our portfolio annually for income, so let’s try this.

FSDIX has returned 7.54% annually since inception, so a 4% yearly drawdown appears sustainable. However, we see three glaring pitfalls.

First, another 4% means another $40,000 per million for a total of $63,800. Still not what we are looking for.

Second, this particular fund has underperformed the S&P 500 over the last year, three years, five years and ten years. It’s also underperformed the broader market since inception (2003).

So what exactly was the point of buying a dividend fund when we were going to have to sell shares anyway? And see them appreciate less than a dumber, cheaper index fund?

FSDIX (Purple Bar) Underperforms – Always

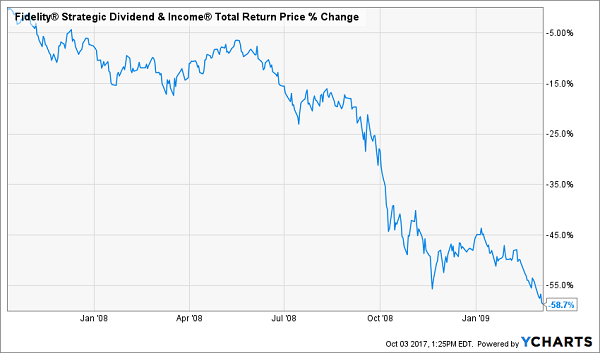

More concerning than mere mediocrity, however, is the threat of “reverse dollar cost averaging.” Peak to trough in 2008, FSDIX lost 59% of its value. If you’re selling stock for income, you’re selling more and more at lower and lower levels:

You Don’t Want to Be Selling Here

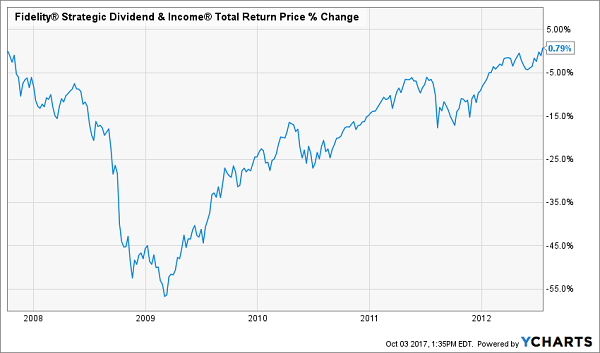

By July 2012, FSDIX investors who bought at the 2007 peak – and held 100% of their shares – had grinded their way back to even.

Buy who actually buys and holds? In reality, there are two types of investors:

- Those who bought during 2008, 2009, and 2010. They made money much sooner, because they were able to buy low.

- Those who sold during the downturn. Whether they had to sell for income, or simply got scared – many of these portfolios have still not recovered.

Back to Even (But Most Did Much Better, or Much Worse)

Dollar cost averaging is a powerful force. Make sure it’s working for you, rather than against you. Here’s how.

Fade the 4% Fallacy for a Smarter “Magic Dividend Number”

Our retirement approach is grounded in reality versus fantasy and false math. So, let’s begin with the value of your actual portfolio.

Back to the $1 million example. Let’s say we saved that money like Fidelity said to, and we still want $100,000 per year.

We’ll ditch the flawed notion of selling capital for income, and live on dividends alone. This means our portfolio’s “magic yield” is 10% annually.

But today, there’s only one safe 10% yield left on the board. And I wouldn’t recommend putting your entire portfolio in only one issue, no matter how sound its payout seems.

So, we’re faced with a decision. We can:

- Settle for less income, or

- Save (or make) more money.

While I wouldn’t recommend an entire portfolio of double-digit payers, I do like seven stocks (and funds) yielding an average of 8.3% today.

Their dividends are safe, and believe it or not, their prices are a bit undervalued to boot. This means we should enjoy price upside as well, and achieve 10%+ annual returns on these dividend machines.

Let’s talk more about these income plays, because you should be tuning out the “first-level” pundits – those who do little or no original thinking – and replacing your underperforming payers with these meaningful (and safe) 8.3% yields.

3 Ways to Safely Bank 8.3% Dividends

Most of the stocks you read about in the mainstream media that pay 5% or better are train wrecks. They have big stated yields for the wrong reason – namely, because their prices have been axed in half or worse over the past year!

For example, retailer Macy’s (M) pays 7.2% on paper. But its business model is toast. Next quarter’s payment may happen, but that’s a risky game I’m not willing to play.

Instead, I’d rather look in corners of the income world that aren’t combed over as regularly. There are three in particular that I like today. You won’t hear about them on CNBC, or read about them in the Wall Street Journal, because they don’t buy advertising like Fidelity and other firms.

Their relative obscurity is great news for us 8.3% dividend seekers.

Play #1: Closed-End Funds

If you feel trapped “grinding out” dividend income with classic 3% payers (like dividend aristocrats), you can double or even triple your payouts immediately by moving to closed-end funds, or CEFs. In fact, you can often make the switch without actually switching investments.

I’ll discuss my favorite CEFs in a minute.

Play #2: Preferred Shares

Not familiar with preferred shares? You’re not alone – most investors only consider “common” shares of stock when they look for income.

But preferreds are a great way to earn 7% and even 8% yields from the same blue chips that only pay 2% or 3% on their “common shares.”

I’ll explain preferreds – and my favorite tickers to buy – after we finish our high yield hat trick.

Play #3: Recession-Proof REITs

The IRS lets real estate investment trusts, or REITs, avoid paying income taxes if they pay out most of their earnings to shareholders. As a result these firms tend to collect rent checks, pay their bills and send most of the rest to us as a dividend. It’s a sweet deal.

Not all REITs are buys today, however – landlords with exposure to retail space should be avoided.

That’s easy enough to do. I prefer to focus on REITs that operate in recession-proof industries only. I want to receive my rent check powered dividends no matter what happens in the broader economy.

Now let’s discuss how you can get a hold of my complete “8.3% No Withdrawal Portfolio” research today, along with stock names, tickers and buy prices. Click here and I’ll share the specifics – and all of my research – with you right now.

$1T+ CLUB IS DOMINATED BY U.S. BASED ASSET MANAGERS

In the late 1700s, it was the start of the battle of stock exchanges: in 1773, the London Stock Exchange was formed, and the New York Stock Exchange was formed just 19 years later.

And while London was a preferred destination for international finance at the time, England also had laws that restricted the formation of new joint-stock companies. The law was repealed in 1825, but by then it was already too late.

In the U.S., exchanges in New York City and Philadelphia took full advantage by dealing in stocks early on. Eventually, for this and a variety of other reasons, the NYSE emerged as the most dominant exchange in the world – helping propel New York and Wall Street to the center of finance.

THE CENTER OF FINANCE

Wall Street, and the U.S. in general, is now synonymous with finance – and most of the world’s largest banks, funds, and investors maintain a presence nearby. The biggest asset management companies, which pool investments into securities such as stocks and bonds on behalf of investors, are no exception to this.

Today’s chart shows all global companies with over $1 trillion in assets under management (AUM).

Not surprisingly, all but 17.1% of assets managed by this $1 Trillion Club are overseen by companies based in the United States.

Even further, outside of Northern Trust (Chicago), Pimco (Newport Beach), and Capital Group (Los Angeles), the remaining U.S. companies are based in the Northeast specifically – either on Wall Street, or just a short drive away.

THE NEWEST ENTRANT

The newest entrant to the $1 trillion club is Norway’s sovereign wealth fund, which is managed by Norges Bank Investment Management. It’s the world’s largest sovereign wealth fund, and it was “never forecast” to get so big.

The Norwegian fund recently joined France’s Amundi ($1.6 trillion), the UK’s Legal & General ($1.3 trillion), and Japan’s Goverment Pension Investment Fund ($1.2 trillion) as non-U.S. members of this exclusive club.

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Investors are being urged to not overlook Japan’s robotic future as unfavorable demographics reportedly are fueling innovation and investment opportunities.

Investors are being urged to not overlook Japan’s robotic future as unfavorable demographics reportedly are fueling innovation and investment opportunities.

“Japan, simply put, is in the midst of a robotics revolution that will transform nearly every aspect of society and be replicated, in some shape or form, around the world given the aging populations of Europe, the U.S. and even China,” the Financial Times reported.

Japan has been pushing on the robotics frontier for years. As a result, the use of robotics has expanded beyond the Japanese factory floor to include schools, hospitals, nursing homes, airports, train stations and even temples, the FT explained.

No other country in the world has strategically embraced robots as much, with the state’s revised Japan Revitalization Strategy seeking to achieve “a new industrial revolution driven by robots,” the FT said.

The FT explained that the best way to invest is by either directly owning leading Japanese robotics manufacturers and service providers, or through the ROBO ETF, with Japanese companies comprising roughly 30 per cent of the total market capitalization.

….also:

Steve Forbes: ‘Automation Actually Enriches the Economy’

Local Mess

The Uneven Distribution of Pension Problems

Personal Storm Planning

Change Your Scenery

Chicago, Lisbon, Denver, Lugano, and Hong Kong

If you’re idly conversing with someone you don’t know well, the weather is usually a safe topic. It affects everyone in some way, so it’s a shared experience – but there’s something else, too. The weather is no one’s fault. It is what it is, so you need not worry that the other person will blame you for it. None of us can control the weather. And lately, the weather has been interesting, unless you had to live through its more extreme manifestations. Then it’s been hell. Before this week, I would’ve said that Harvey and Irma wrought devastation in Texas and Florida. But then Maria thrashed Puerto Rico and took devastation to a whole new level. I have a lot of friends who live in Puerto Rico, and I’m not sure how things are going to go for them over the next few months.

We can prepare for storms when we know they’re coming, but we can’t stop them in their tracks or change their path. That’s true for both hurricanes and the public pension problem I wrote about last week. Where pensions are concerned, we have the financial equivalents of weather satellites and hurricane hunter aircraft feeding us detailed data. We know the barometer is dropping fast. The eyewall is forming. But we can’t do much about the growing storm, except get out of the way.

Problem is, the coming pension and unfunded government liabilities storm is so big that many of us simply can’t get out of the way, at least not without great difficulty. This holds true not just for the US but for almost all of the developed world.

Financially, we’re all trapped on small, vulnerable islands. Multiple storms are coming, and evacuation is not an option. All we can do is prepare and then ride them out. But as with recent hurricanes, the brewing financial storms will have different effects from country to country and region to region.

I did a lot of thinking after we published last week’s letter – especially as I was reading your comments – and I wished I had made my warning even more alarming. Being a Prophet of Doom doesn’t come easily for me; I’m known far and wide as “the Muddle Through Guy.” I think the world economy can handle most anything and bounce back, and I still believe it will handle what’s coming over the horizon. But some parts of the economy won’t bounce at all. Quite a few people will see their life savings and ability to support themselves utterly disappear, or will be otherwise badly hurt, and through no particular fault of their own.

I mentioned last week that the next few issues of Thoughts from the Frontline would outline my vision for the next two decades. We’ll get back to that next week. But today I want to continue with the hard-hitting analysis of our public pension problems and say more about personal storm preparation. We all have some very important choices to make.

As I’ve said, the state and local pension crisis is one that we can’t just muddle through. It’s a solid wall that we’re going to run smack into.

Police officers, firefighters, teachers, and other public workers who rightly expect to receive the retirement benefits that their elected officials promised them are going to be bitterly disappointed. And the taxpayers of those jurisdictions are going to complain vigorously if their taxes are raised beyond all reason.

Pleasing both those groups is not going to be possible in this universe. Maybe in some alternate quantum alternate universe where fuzzy math works differently and lets you get away with stuff, but not here in our very real world. It just can’t happen.

So what will happen? It’s impossible to say, exactly, just as we don’t know in advance where a hurricane will make landfall: We just know enough to say the storm will be bad for whoever is caught in its path. But here’s the twist: This financial storm won’t just strike those who live on the economic margins; all of us supposedly well-protected “inland” folk are vulnerable, too.

The damage won’t be random, but neither will it be orderly or logical or just. It will be a mess. Some who made terrible decisions will come out fine. Others who did everything right will sustain severe hits. The people we ought to blame will be long out of office. Lacking scapegoats, people will invent some.

Worse, it will be a local mess. Unlike the last financial crisis where one could direct anger at faraway politicians and bankers seen only on TV, this one will play out close to home. We’ll see families forced out of homes while neighbors collect six-figure pensions. Imagine local elections that pit police officers and teachers against once-wealthy homeowners whose property values are plummeting. All will want maximum protection for themselves, at minimum risk and cost.

They can’t all win. Compromises will be the only solution – but reaching those unhappy compromises will be unbelievably ugly.

In the next few paragraphs I will illustrate the enormity of the situation with a few more details, some of which were supplied this week by readers.

The Uneven Distribution of Pension Problems

I keep using the fabulous William Gibson line that “The future is already here. It’s just unevenly distributed.” Well, paraphrasing, “The state and local pension crisis is already here; it’s just unevenly distributed.”

One reader noted that he has no sympathy for Houston when right next door, Katy, Texas, is building a $72 million football stadium for its high school.

That’s an aberration, and I might just mention that a few years back Allen, Texas, built a high school stadium for $60 million – 18,000 seats, which they fill every weekend they play. And the Eagles play really well, with several state championships in the 5A division (the biggest schools) in the last five years. There are other such examples. Sadly. I am not a fan of extravagant high school football stadiumsprograms. But then again, I am a former high school nerd turned curmudgeon.)

(Sidebar: Texas, and especially smaller towns and cities, takes its high school football and “Friday Night Lights” seriously. There is a reason that Texas high school football players are among the most highly recruited in the nation.) Though I will say that it is personally offensive that the only reason Oklahoma University can field a decent football team is because of the large number of Texas players on their team. And they have the ill grace to come in and kick UT derriere from time to time at the annual Cotton Bowl game during the Texas State Fair in October. But I’d better get back to the letter.)

Allen and Katy, coupled within contrast to Dallas and Houston, illustrate what I mean by the uneven distribution of state and local pension problems. Allen had 8,000 residents in 1980 and only 18,000 in 1990. The police department in this peaceful rural town was small in those days, and the pension benefits that built up were insignificant for a town that numbers over 100,000 today. But that’s 100,000 and growing. Allen lies in the path of massive growth spilling over from North Dallas into Plano, Frisco, McKinney, and then Allen. The city could easily double in the next 15 years. Estimates are that 10 million people will move to the North Texas area within the next 30 years, which will double or triple suburban-city and public school revenues from taxes. At times, Frisco has been the fastest growing city in America. This year, Money magazine proclaimed Allen the second-best place to live in America. Residents of Allen don’t have to worry about legacy pension issues, because the town is growing faster than whatever pension issues they have.

Ditto for Katy.

So when my reader says he doesn’t feel sorry for Houston because Katy built a $70 million high school football stadium, he needs to realize that Katy doesn’t have Houston’s legacy pension problem. Nor its high crime rate, nor all its other big-city problems. And this urban vs. suburban situation is mirrored across all the United States. The big inner cities have these monstrous legacy pension problems; and the suburbs, which have prospered on the back of the growth that has come from the big cities, feel no obligation to pitch in and help.

Residents of Houston and Dallas (and Chicago and New York and LA and on and on), on the other hand, are going to feel pain. Their taxes will keep going up, while their populations will continue to flee to the surrounding suburban areas to escape those crippling taxes and high real estate costs.

Let’s look at a few more hard facts. Pension costs already consume more than 15% of some big-city budgets, and they will be a much larger percentage in the future. That liability crowds out development and infrastructure improvement, not to mention basic services. It forces city leaders to raise taxes and impose “fees.” Let me quote from the always informative 13d letter(their emphasis):

Consider the City of Los Angeles, which Paul Hatfield, writing for City Watch L.A., recently characterized as being in a state of “virtual bankruptcy.” After a period of stability going back to 2010, violent crime grew 38% over the two-year period ending in December 2016. Citywide robberies have increased 14% since 2015. One possible reason for this uptick: the city’s population has grown while its police department has shrunk. As Hatfield explains:

The LAPD ranks have fallen below the 10,000 achieved in 2013. But the city requires a force of 12,500 to perform effectively… A key factor which limits how much can be budgeted for police services is the city’s share of pensions costs. They consume 20% of the general fund budget, up from 5% in 2002… It is difficult to increase the level of service while lugging that much baggage.

What about subway service in New York City? The system is fraying under record ridership, and trains are breaking down more frequently. There are now more than 70,000 delays every month, up from about 28,000 per month five years ago. The city’s soaring pension costs are a big factor here as well. According to a Manhattan Institute report by E.J. McMahon and Josh McGee issued in July, the city is spending over 11% of its budget on pensions. This means that since 2014, New York City has spent more on pensions that it has building and repairing schools, parks, bridges and subways, combined.

There are many large, older cities where there are more police and teachers on the pension payroll than are now working for the city. That problem is compounding, as those workers will live longer, and the pensioners typically have inflation and other escalation clauses to keep their benefits going up.

Further, most cities do not account for increases in healthcare costs (unfunded liabilities) that they will face in addition to the pensions. Candidly, this is just another “a trillion here, a trillion there” problem. Except for the fact that the trillion dollars must be dug out of state and local budgets that total only $2.5 trillion in aggregate.

Now, add in the near certainty of a recession within the next five years (and I really think sooner) and the ongoing gridlock in national politics, plus the assorted other challenges and crises we face. I won’t run down the full list – you know it well.

I’ll abbreviate since this is a family e-letter, but I just have to wonder, WTF are we going to do?

You know I don’t light my hair on fire every time someone says “Crisis!” I believe that most of the time, most of us will be fine. Together we have enough spare resources to help the people who really need it.

However, as I look out into the future I see an extraordinarily wide gap between the crisis I’ve been describing and the golden age that I truly think is coming, post-crisis. No one will find that gap easy to cross. Some of us won’t make it. Others won’t even try because they won’t see the need. They think the future will look like the past. It won’t.

Personally, I intend to make it across the gap, and I want you to get there, too. The rewards will be magnificent, but attaining them will take extensive preparation. What should you do?

I’d like to give you a 10-step checklist of all the steps you should take… but I can’t. Your situation isn’t like mine, nor is your neighbor’s situation like yours. We each have our own unique combination of talents, experience, resources, family structures, location, and more.

The best I can do is to help you see the world as I see it. And then give you some of the resources you need. Once you have them, your answers will develop naturally. You’ll be able to prepare as I would if I were in your shoes.

So how do we do that?

You’re taking step one right now by reading this letter. I hope you’re a regular reader. (I know the letter’s length got a little out of control the last couple of years. My partners and editorial team have impressed upon me the need for brevity.) So, keep reading Thoughts from the Frontlinefor my latest thoughts. And consider subscribing to the great analysis from the rest of my Mauldin Economics team – Patrick Watson, Jared Dillian, Patrick Cox, Robert Ross – we’ve got a deep bench!

Reading our analysis and recommendations helps, but it’s not enough. You have to act on it, which means you have to be confident at a deep, personal level. How do you get there?

A few months ago, my Mauldin Economics colleague Patrick Watson cited Harvard research on travel’s cognitive benefits. It seems that leaving your normal environment actually makes your brain work differently. Because you don’t know what to expect, every little act becomes a problem-solving exercise. This promotes creativity and cognitive flexibility.

With that research in mind, Patrick speculated that my extensive travel might be what sparks my energy and creativity. I don’t know for sure, but it makes a certain sort of sense. Some of my best ideas come to me while I’m on the road. Maybe seeing new places and meeting new people activates neurons I don’t normally use at home.

Getting together with people who are trying to think through the coming crisis is one of the most important things you can do. Being in a place with like-minded people who are all seeking solutions is extraordinarily productive. There is a reason the most successful investors and “family offices” regularly get together at conferences and share ideas. The open sharing and debate helps focus our critical thinking.

Now, let me get a little promotional. With what I think is justifiable reason.

Frankly, this sort of space for sharing and growing is what I try to do with my Strategic Investment Conference. I think of it as the perfect place to synchronize your unique needs and my best ideas – along with the best ideas of a unique and powerful mix of speakers. I try to get everything together in one place: You, me, and hundreds of others like us, along with my hand-selected A-list of economic, investment, and geopolitical experts. They’re the source of many of the ideas I share in these letters. At SIC, you get their latest and best thinking directly. Better yet, SIC is small enough that you can usually find the speakers in the hallway or after hours and ask them your own questions.

In addition, we have a couple of hundred “core” SIC attendees who come every year. They represent a remarkable range of talent, experience, and wisdom. Some of them really ought to be on stage. Instead, they’ll be sitting with you, and you’ll find them remarkably friendly and willing to swap ideas. We’ve seen countless business relationships form at SIC, and more happen every year.

As I think about the many challenges we’re all going to face, I want to help as many of you as possible. The Strategic Investment Conference is my best platform for doing that. So, I’m setting a personal goal to get as many first-time attendees as possible to SIC 2018. The dates are March 6–9, 2018, at the Manchester Hyatt in San Diego. It will be an amazing four days, and I want to share them with people who will appreciate them the most.

We will be opening registration in just a few weeks. We have limited space, and I don’t want to turn away our SIC veterans. That means it will be very important to register as soon as possible.

To be fair to everyone, here’s how it will work. Visit this web page and enter your name and email address. That will put you on the notification list. You aren’t committing to anything yet – we’ll alert you when registration is open and tell you how to proceed.

Note: Sign up on the notification list even if you’ve been to SIC many times. That will ensure you are among the first to know that registration is open. I don’t know how quickly people will register. Last year in Dallas we sold out, so I suggest you don’t wait too long.

Also on that page you’ll see a space where you can enter questions and comments. I really want to know why you’re coming to SIC and what you hope to learn. I’m still finalizing the agenda and speaker list, and your input will help me design a program that targets your needs.

And understand, SIC is not just about understanding the coming crisis. It’s about looking at new opportunities. The world has a fabulous abundance of opportunities for investment and diversification that are outside of the traditional money management space. If you are using a buy-and-hold, 60/40 typical portfolio as your basic investment approach, it is my personal opinion that you are not going to be happy a few years down the road. You really, really need to understand that past performance of the markets (for the last 70 years) will not be indicative of future results. The world is going to change in fundamental ways that we can’t predict but can prepare for. We are going to need to make course corrections and adapt on the fly. If you or your investment advisor can’t do that today, you need to rethink how you’re approaching your future.

Having a secure shelter doesn’t make storms any less dangerous, but it does make them less dangerous to you. Every week you put off preparing, you are running out of time to build and stock that shelter.

When I was a kid, there was a tornado shelter next door, where the local neighborhood came together when the siren sounded. We lived in Tornado Alley. I distinctly remember looking up at the sky in Bridgeport, Texas, and seeing two tornadoes, not just one. At nine years old, I wanted to stay and watch. I was completely fascinated! My mother wisely hauled me off to the shelter.

What I’m telling you is that the Great Reset is going to make the recent Great Recession look like a volatility picnic. Add in massive technological and demographic shifts. And the future of work? There’s another vast, turbulent, murky cloud right up ahead.

But let me make this emphatic point: The world is not coming to an end. It is simply changing faster and in a more extreme fashion than we have seen in the past. For those who take the proper precautions, the future is going to be exhilarating and highly rewarding. My personal mission is to help you earn that fabulous future for yourself.

Don’t be a nine-year-old kid, immobilized, gawking at tornadoes. Figure out how to build your own storm shelter, not just to withstand the coming crisis but to take advantage of the opportunitiesthat the crisis (and ultimately the Age of Transformation) will present.

The Strategic Investment Conference will help you with the knowledge and the motivation to take the next critical steps. I look forward to seeing you there.

Chicago, Lisbon, Denver, Lugano, and Hong Kong

I will be in Chicago the afternoon of September 26, meeting with clients and friends, and then I’ll speak at the Wisconsin Real Estate Alumni conference the morning of the 28th, before returning to Dallas that afternoon and flying with Shane to Lisbon the next day. My hosts are graciously giving us a few extra days to explore Lisbon, and Portugal is one of the last two Western European countries I have never been to. After this, only Luxembourg is left, so the next time I’m in Brussels or Amsterdam on a Sunday, I’m going to hop on a train and go have lunch in Luxembourg.

On Wednesday morning the 27th I will be on CNBC with my friend Rick Santelli. As usual, we’ll talk about whatever’s on the top of Rick’s mind at the moment. It makes for a hellaciously fun discussion.

I return to Dallas to speak at the Dallas Money Show on October 5–6. I will speak at an alternative investments conference in Denver on October 23–24 and return to Denver on November 6 and 7, speaking for the CFA Society and holding meetings. After a lot of small back-and-forth flights in November, I’ll end up in Lugano, Switzerland, right before Thanksgiving. Busy month! Then there will be a (currently) lightly scheduled December, followed by an early trip to Hong Kong in January. It looks like Lacy Hunt and his wife, JK, will join Shane and me there. Lacy and I will come back home exhausted from trying to keep up with the bundles of indefatigable energy that JK and Shane are.

Shane is in New Jersey with her son, so I am home alone “batching it” for a few days. Food preparation has been a little less extensive, shall we say, but the schedule is no less busy.

It’s hard to believe, but in less than two weeks I turn 68. I don’t feel the way my 30-year-old self thought I would at 68. I still think and breathe the future optimistically, if perhaps with a more cautious outlook; but I really do think that the world in general will Muddle Through and that you and I can thrive.

OK, it’s time to hit the send button. Have a great week. And maybe sit down with friends and talk about how they see the future and what they are doing to plan for it. Share your own ideas. Who knows, maybe you’ll end up helping each other in a big way.

Your planning to do more than Muddle Through analyst,

John Mauldin

subscribers@MauldinEconomics.com

The best thing that happens to us is when a great company gets into temporary trouble… We want to buy them when they’re on the operating table. – Warren Buffett

The best thing that happens to us is when a great company gets into temporary trouble… We want to buy them when they’re on the operating table. – Warren Buffett

A quick history lesson…

In 1963, the world’s largest credit card company, American Express, was involved in the ‘salad oil scandal’.

AmEx had just created a warehousing division to make loans to businesses using inventory as collateral.

A commodities trader (and known swindler) named Anthony ‘Tino’ De Angelis saw an opening for a massive fraud.

He began stockpiling his warehouses with tanks of soybean oil. He then used warehouse certificates from American Express as collateral to borrow heavily from American Express and as many as fifty other lenders.

When American Express sent inspectors to check De Angelis’ inventory, they did not notice that – except for the thin layer of oil floating on top – the tanks were filled with water.

When the fraud was finally exposed, AmEx stock crashed more than 40%. The eventual damage to the company would be US$175 million.

At the height of the fallout, an unknown 35-year-old fund manager from Omaha decided to bet big on American Express, putting 40% of his fund’s money into this one stock.

His name was Warren Buffett, now the world’s richest and most famous investor.

Buffett knew the brand power and consumer business of American Express would survive the scandal. The company’s prospects were as bright as they were before the scandal. It was a play on rising affluence levels worldwide.

More importantly, the stock was available at a bargain price. Buffett was only too happy to lap it up.

Within a year, AmEx had rebounded more than 40% and has been a compounding machine ever since.

No wonder Buffett says he likes to buy great companies when they’re on the operating table!

What can we learn from this?

Whenever you find a stock that’s been beaten down due to one specific problem in the business, ask yourself the following questions…

- Will the core business survive? In the case of American Express, the answer was yes. People were still going to use traveller’s cheques and credit cards.

- Can the balance sheet withstand the hit? Having analysed the financials, Buffett knew American Express could.

If the answer to both questions is yes and the stock has already fallen about 40%…then you might just have a big winner on your hands.

Keep the American Express example in mind when you read through this month’s Hidden Treasure report. We believe this could be a case of history repeating itself.

Editor’s Note: Warren Buffett is known as a value investor. And for good reason, as we saw today…

But that bold move back in ’63 would also put Buffett in the category of ‘contrarian investor‘.

Why?

Because he was making a bet few others had the gall to make. As the markets panicked, Buffett loaded up.

This is what smart contrarians like Buffett (and Soros and Templeton and Rogers) do. These guys make it look easy, but contrarian investing…smart contrarian investing…requires a level of discipline and fortitude that most investors simply lack.

Do you think you have what it takes to follow in their footsteps?

Beginning next week…more on how to approach the markets like a smart contrarian.

Stay tuned…