Wealth Building Strategies

Last week, as the Nasdaq Composite Index crossed 6,000 for the first time, Robert Shiller, a Nobel laureate economist, made the rounds in the financial press.

He’s worried. Valuations are historically high. A crash is coming, eventually, he argues.

With his carefully measured tone and impeccable academic pedigree — he’s a professor at the Yale School of Management — Shiller is the perfect pundit.

Jesse Livermore, the tenacious trader immortalized in the 1923 investment classic Reminiscences of a Stock Operator, warned about pundits. He hated tips and claimed following them had lost him hundreds of thousands of dollars.

He learned to trust his own analysis. He learned to trust the power of trends and to ignore punditry.

Shiller’s concern is based on something called the Cyclically Adjusted Price-to-Earnings ratio, better known as the CAPE. It’s a valuation model that takes a conservative ten-year average of corporate earnings and divides by the comparable metric for price. And CAPE has reached levels not seen since 1929 and 2000, two dates that send shivers down most investors’ spines.

The rest of the economic story does not help the bulls’ case, either. Those periods were characterized by extremely high levels of Gross Domestic Product growth. In 2000, GDP growth was north of 4%. Last week, GDP was reported at a measly 0.7%.

It’s not the first time in recent years that the CAPE has been high. The ratio pushed near current levels in 1998. At the time, the dotcom era was in full stride. In the ensuing two years, the most speculative stocks became even more dear as prices sprinted higher. For example, adjusted for splits, Amazon (AMZN) zoomed from less than $5 in 1998 to $113 in 2000.

It’s not the first time in recent years that the CAPE has been high. The ratio pushed near current levels in 1998. At the time, the dotcom era was in full stride. In the ensuing two years, the most speculative stocks became even more dear as prices sprinted higher. For example, adjusted for splits, Amazon (AMZN) zoomed from less than $5 in 1998 to $113 in 2000.

Something like that could happen again. “We’re in an oddball enough mood,” Shiller admits.

The economist explains that President Trump is a game-changing figure, for better or worse, who wants to disrupt the underlying fundamentals of the capital markets. Changing the corporate tax code would be bullish for stocks in the near term.

However, periods of extreme optimism have an ugly common denominator, Shiller notes with a wry smile. They always lead to crashes.

Shiller is right, empirically. However, that information is not particularly useful.

Livermore understood that the most important attribute of a successful investor is the ability to hold winners. He called this “sitting tight,” and it is not as easy as it appears.

Too many investors want to sell winners quickly. They believe stock strength merits selling. Pundits preach everywhere they can find listeners. They construct models. They get on their soapbox on TV. Stocks are up, sell.

Livermore found just the opposite is true. Strength is validation an investor got it right. Investors are wise to learn to embrace this, learn from it.

They are also wise to challenge pundit assertions. Can their claims pass the test of tested scrutiny?

“Not even a world war can keep the stock market from being a bull market when conditions are bullish, or a bear market when conditions are bearish,” Livermore said. “And all a [trader] needs to know to make money is to appraise conditions.”

Understanding market conditions is one of the cornerstones of the information I provide to members. Valuation models alone are rarely useful. You need to know what to buy and when events change that warrant selling.

Our newsletters show members how to identify big trends, find the right stocks, and most important, how to sit tight for the big money. A lot more money is lost waiting for crashes than during crashes themselves.

Best wishes,

Jon Markman’s Pivotal Point

…also from Martin D. Weiss, Ph.D.:

New, Bigger Shockwaves in Europe!

FREE Workshops for MoneyTalks Listeners

You worked hard for your money, don’t let it sit dormant with some mainstream financial planner or worse, gamble it away

Diversification does not remove systemic risk, but it DOES dilute ANY chance of you making real money!

The markets are setting up for major big picture market moves into 2018. Let us show you how to position yourself for big profits.

Calgary AB – Saturday, May 6 – 11:30am – 2:30pm

Coast Hotel | 1316 33rd Street N.E. | Calgary, Alberta | T2A 6B6

Burnaby BC – Sunday, May 7 – 10:30am – 1:30pm

Delta Hotels Burnaby Conference Centre | 4331 Dominion St, | Burnaby, BC | V5G 1C7

CLICK HERE to REGISTER and for more information

Apply these powerful techniques to position yourself to make big returns:

- Leverage your returns while protecting yourself from big losses

- Profit from the next big moves in stocks, bonds, currencies, gold and oil by combining technical signals with macro fundamentals

- Discover some the key macro drivers that will decide the next major market trends

Returns in the commodities markets have improved over the past year amid stronger macroeconomic activity and supply-side tightening, and our outlook for the next 12 months has brightened.

While considerable uncertainties remain for all commodity sectors, we believe the worst market trends may be behind us. As we look ahead to the next 12 months, commodities will likely reclaim a diversifying role in portfolios, given growing inflation risks and shrinking correlations between commodities and other assets.

At this point in the business cycle, we think investors should consider positioning commodities allocations to at least match benchmark targets, if not modestly exceed them.

…continue reading this analysis & don’t miss the Investment and portfolio allocation outlook

….also from Safehaven: Fantasyland Reality Check: Fed’s Beige Book Makes Absurd Claims in at Least 3 Places

As if you need more proof that inflation is finally starting to pick up, lumber prices rose to a 12-year high last week, supported mainly by expectations that steep duties will soon be levied on cheap softwood imports from Canada. Lumber futures rose to nearly $415 per thousand board feet last Monday, a level unseen since March 2005, soon after homeownership peaked here in the U.S.

At issue is a mini-trade war between U.S. and Canadian loggers. For some time now, the American lumber industry has blamed its Canadian counterpart of unfairly dumping lumber in the U.S. that’s far below market value. Now, several factors are pushing timber prices higher. Chief among them are the likelihood of duties being raised at the Canadian border, possibly as early as next month; President Donald Trump’s calls to renegotiate NAFTA; and growing demand for new homes following the housing crisis as consumer optimism improves and millennial buyers finally seem eager to enter the market.

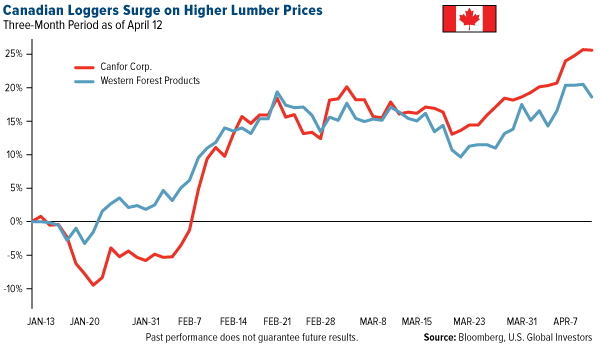

Shares of Canfor Corporation and Western Forest Products, Canada’s number two and number five lumber producers by annual output, have had a good three months, advancing 25.5 percent and 16.8 percent respectively as of April 12. Timberland-owner Weyerhaeuser has also impressed lately.

Gold Glimmers Brightly

As I told Daniela Cambone during last week’s edition of Gold Game Film, this is all very constructive for the price of gold, which has historically been used as a hedge during periods of rising inflation. The yellow metal closed above $1,270 an ounce last week for the first time since soon after the November presidential election. A “golden cross” has not yet occurred, with the 50-day moving average still below the 200-day, but such a move appears likely in the next few trading sessions if upward momentum can be sustained.

Fueled also by geopolitical tensions associated with Syria, Russia and North Korea, gold demand is on the rise, with last Tuesday’s trading volumes on gold calls surging 10 times Monday’s amount on the New York Mercantile Exchange. As I already shared with you, investor sentiment of gold during the recent European Gold Forum was particularly strong. A poll taken during the conference showed that 85 percent of attendees were bullish on the metal, with a forecast of $1,495 by year’s end.

With the U.S. ramping up military action overseas, including its dropping of a devastating bomb in Afghanistan on Thursday, many investors are lightening their risk assets in favor of “safe haven” instruments such as gold and Treasuries. The S&P 500 Index dropped below its 50-day moving average last week, signaling a slowdown in blue chip stocks.

Financials were among the biggest laggards as investors have begun to question President Trump’s ability to deregulate the banking sector. After several disappointments and setbacks, including a failure to repeal and replace Obamacare, renewed military involvement in Syria and Afghanistan might provide a welcome boost to Trump’s sluggish job approval rating.

Gold also responded positively to recent comments by Trump on U.S. dollar strength and monetary policy. Specifically, he said the dollar is “getting too strong” and later supported a low interest rate policy, suggesting he might keep Janet Yellen as the Federal Reserve chair.

Millennial Homebuyers Finally Entering the Housing Market

April is New Homes Month, and to celebrate, the National Association of Home Builders (NAHB) shared some of the significant contributions housing provides to the U.S. economy. According to the Washington, D.C.-based group, “building 100 single-family homes in a typical metro area creates 297 full-time jobs and generates $28 million in wage and business income and $11.1 million in federal, state and local tax revenue.” The sector currently accounts for 15.6 percent of U.S. gross national product (GNP).

Indeed, housing has a phenomenal multiplier effect on the economy, as I’ve pointed out before, and I’m pleased to see its recovery after nearly a decade.

Not only is consumer confidence up, but homebuilder confidence, as measured by the NAHB, hit a 12-year high in March, supported by an improving economy and President Trump’s pledge to roll back strict regulations. In February, new housing starts hit 1.29 million units, beating market expectations of 1.26 million units.

Rising mortgage rates and home prices are also likely encouraging buyers to enter the market. With the 30-year rate having recently fallen to a fresh 2017 low, we might see an even stronger surge in mortgage applications.

Declines in homeownership among lower-income, nonwhite and young adults were especially dramatic following the housing crisis, as subprime lending, which many homeowners had previously relied on, all but dried up. Homeownership rates in the U.S. steadily fell to a 50-year low, which only lengthened the recovery time of the Great Recession. According to Rosen Consulting, a real estate consulting group, the U.S. economy would have been $300 billion larger in 2016 had the housing market fully returned to its long-term level of construction and homebuying.

Millennials, or those generally born between 1981 and 1998, have been the biggest holdouts, but we’re finally starting to see that change. The cohort—the largest group of homebuyers in the U.S. right now—represented around 45 percent of all new home loans in January of this year. It’s likely we’ll see this figure rise as more millennials become better established in their careers and tire of renting.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every invest.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 3/31/17: Canfor Corp., Western Forest Products.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The S&P/Case–Shiller U.S. National Home Price Index is a composite of single-family home price indices for the nine U.S. Census divisions. It is calculated monthly, using a three-month moving average.