“Japan Moves To Fire Up Japan’s Nuclear Facilities“

Japan has 50 operable nuclear reactors. Before the tsunami in 2011 that ripped apart the Fukushima complex, those 50 reactors provided about 26 percent of Japan’s electrical power generation capability. Regardless the Japanese government of the time idled those nuclear reactors.

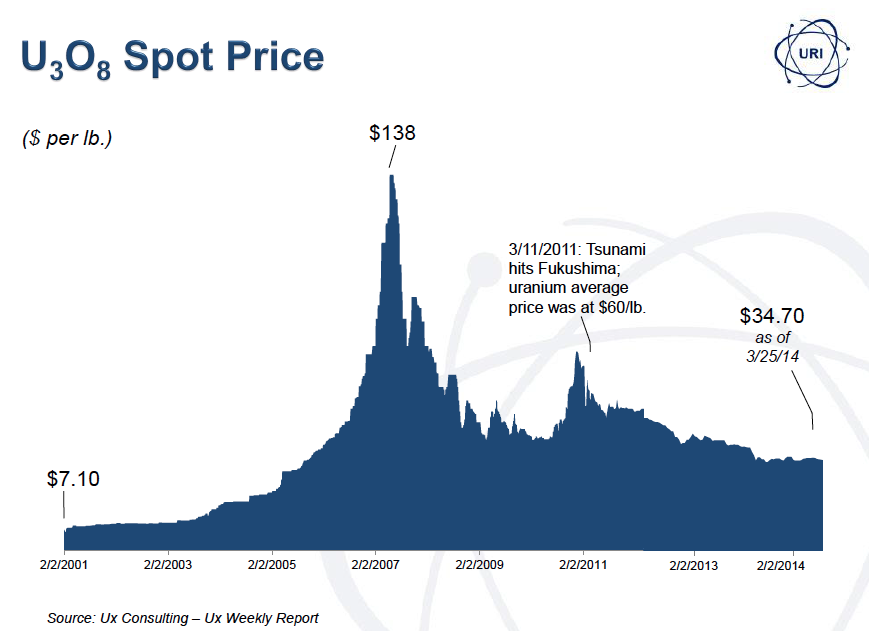

Now much to the chagrin of Japan’s embattled anti-nuclear activists, the current government of Prime Minister Shinzuo Abe is moving to restart those reactors, doubtless because they simply need the power. Even more agressively he is also going to open a Plutonium Nuclear Fuel Reprocessing Plant with an annual capacity of 800 tons of uranium or 8 tons of plutonium, enough to build as many as 2,000 bombs. Who knows what the threat of nuclear war will do for the demand of uranium, but I doubt it will be negative. Especially when you see how far uranium has fallen from it’s last top.

Ed Note: The last price April 7th was $33.75 USD/lb. To follow up to date pricing go HERE

With uranium at rock-bottom prices, its more likely you’d be following Baron Rothchild’s advice to “Buy When there’s blood in the streets” if you bought in this area than not.

Here are some of the world’s largest uranium companies by deposits:

1. Cameco is one of the world’s largest uranium producers. The company’s uranium products are used to generate electricity in nuclear energy plants around the world, providing one of the cleanest sources of energy available today.

2. Paladin Energy is a uranium production company with projects currently in Australia and two operating mines in Africa with a strategy to become a major uranium mining house.

3. Rio Tinto is one of the world’s largest uranium producers. A leading international mining group headquartered in the U.K., combining Rio Tinto plc, a London and New York Stock Exchange listed company, and Rio Tinto Limited, which is listed on the Australian Securities Exchange.

Rio Tinto’s business is finding, mining, and processing mineral resources. Major products are aluminium, copper, diamonds, thermal and metallurgical coal, uranium, gold, industrial minerals (borax, titanium dioxide and salt) and iron ore. Activities span the world and are strongly represented in Australia and North America with significant businesses in Asia, Europe, Africa and South America.

On March 2 AngloGold Ashanti agreed to acquire First Uranium‘s (OTC:FURAF), the owner of Mine Waste Solutions, a recently commissioned tailings retreatment operation located in South Africa’s Vaal River region and in the immediate proximity of AngloGold Ashanti’s own tailings facilities, for an aggregate cash consideration of $335 million.

Following the transaction, combined with AngloGold Ashanti’s Vaal River tailings (491Mt, containing 4.9Moz of gold and 92.3Mlbs of uranium), AngloGold Ashanti will own tailings facilities in the Vaal River region containing a combined mineral resource of 7.7Moz of gold and 154.4Mlbs of uranium.

AngloGold Ashanti has 20 operations in 10 countries on four continents, employed 61,242 people, including contractors and produced 4.33Moz of gold (2010: 4.52Moz), generating $6.6bn in gold income, excluding joint ventures.

4. Uranium Energy Corp is a U.S. based uranium production & exploration company operating North America’s newest uranium mine.

Their operations also include the Hobson Processing Plant, the producing Palangana Mine, the fuly permitted for production Goliad ISR Project plus 21 other exploration projects.

5. Energy Fuels Inc. is the largest U.S. conventional uranium producer

…3 exploration companies:

6. Denison is a uranium exploration and development company with interests in exploration and development projects in Canada, Zambia, Namibia, and Mongolia. Including the high grade Phoenix deposits, located on its 60% owned Wheeler project, Denison’s exploration project portfolio includes 45 projects and totals approximately 584,000 hectares in the Eastern Athabasca Basin region of Saskatchewan.

7. Uranerz Energy Corp. (URZ:TSX; URZ:NYSE.MKT) and Laramide Resources Ltd. Right now, you can get in at eight-year lows on the top uranium assets that are in the control of the juniors. Uranerz Energy has some of the top assets in the Powder River Basin that are coming into production, and Laramide has one of the top resources with over 50 million pounds (50 Mlb) near surface in Australia, which has now overturned a ban on uranium mining in the district. Now Laramide can go ahead with that Westmoreland project.

Laramide Resources Ltd. has one of the top advanced resources that provides huge leverage for an investor for the uranium price. For investors who are looking for leverage and for advanced assets, Laramide is a good candidate. There are very few candidates in the junior sector that have 100% control of such a large asset. Investors must realize that there are so few high-quality junior uranium miners. When investors and funds return, the move could be dramatic—like an elephant trying to get through the eye of a needle.