Financial writer and best-selling author Peter Sander sits down with portfolio manager Axel Merk for insights on investment considerations in light of the risks posed to the greenback.

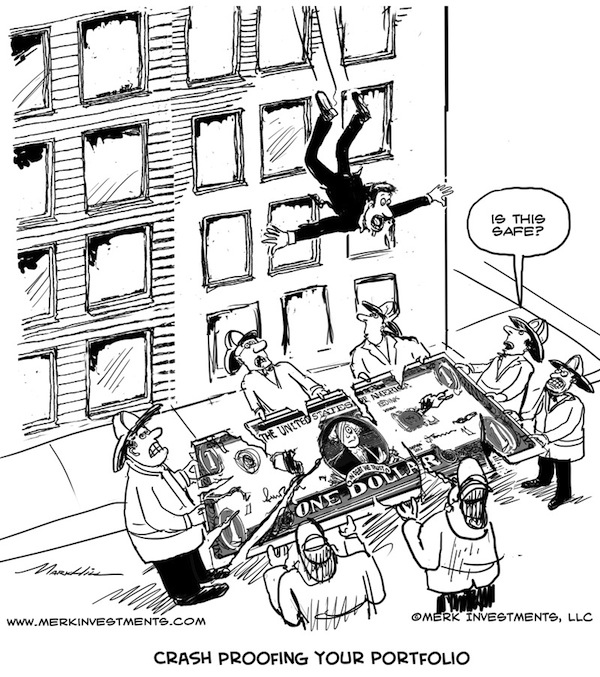

Peter: A lot of talk about a “dollar crash” keeps coming up in the blogosphere. Is it a serious threat, and if so, what should an investor do about it?

Axel: A “dollar crash” is what we call a “tail risk” event. It’s something that may or may not happen, but would have a large impact if it did happen. “Black Swan” author Nassim Nicholas Taleb calls such events “so rare as to be beyond the normal expectations in the history of finance.” Not everyone thinks the threats to the dollar are so remote, but that’s ultimately up to each investor to assess for himself or herself. My view is that if an investor believes a risk is non-negligible, it may be prudent to take it into account in one’s portfolio allocation; investment professionals may even have a fiduciary duty to do so.

Peter: Let’s dig a little deeper. Why are investors concerned about a “dollar crash,” and are those concerns justified?

Axel: The “dollar crash” scenario starts with news we’re all familiar with about unsustainable deficits. The current deficit and Congressional gridlock is the short-term story; the real long-term story is entitlements and the future trajectory of the deficit. Without entitlement reform, we may go broke.

…..read more HERE