European bank shares are down for the second day following a last minute bailout package aimed at Italian banks one day before a stress test showed Monte dei Paschi would be insolvent in an adverse scenario.

The ECB’s stress tests published on Friday showed Monte dei Paschi has a huge capital shortfall, with the bank’s Common Equity Tier 1 (CET1) ratio of negative2.44 percent.

Forget the adverse scenario bit, Monte dei Paschi, Italy’s third largest bank and oldest bank in the world is insolvent in any realistic scenario.

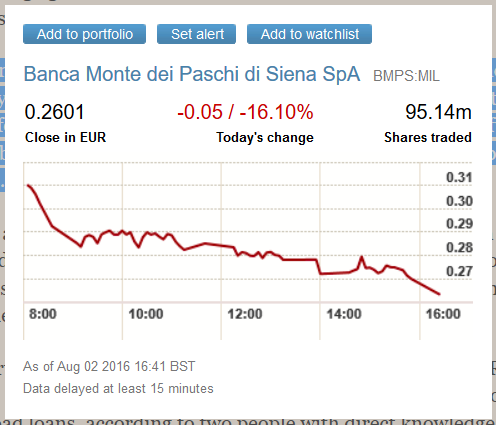

Monte dei Paschi Down 16% Today