Last updated Apr 5 at 6:30pm

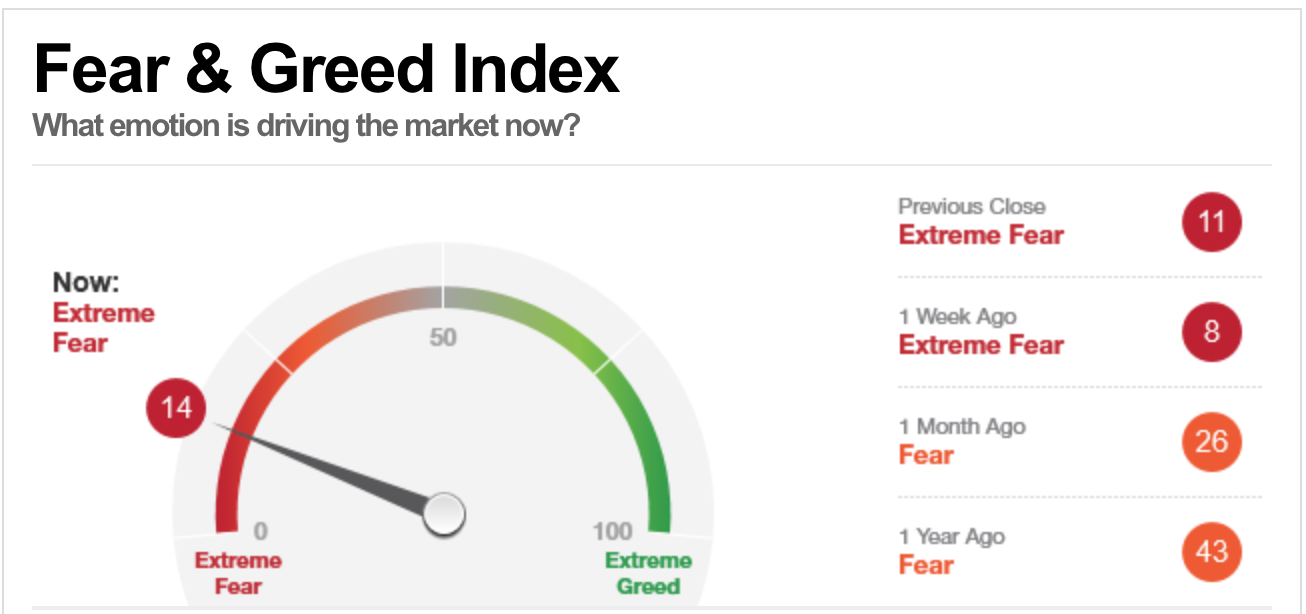

Even with the market rising 1000 points in 3 days investor sentiment is still extremely fearful and there are more bears than bulls. When there are this many bears and fearful people historically the chances are the market has seen, at the very least, a temporary bottom. R. Zurrer for Money Talks

Still More Bears Than Bulls

The weekly AAII bullish and bearish readings are meant to track individual investor sentiment towards the stock market. While bullish sentiment remained low for nearly all of 2017 (as the S&P 500 went up and up and up), it spiked up to the high 50s just as the market was peaking in January. The first 10%+ correction for the S&P 500 since early 2016 ensued, and like clockwork, the AAII bullish reading collapsed back down to the high 20s/low 30s.

AAII surveys individual investors on a weekly basis, and this week the bullish sentiment reading took a very small dip to 31.9%. At the same time, the AAII bearish sentiment ticked up very slightly to 36.64%. Given that sentiment readings are generally viewed as contrarian, it’s bullish to see more bears than bulls.