Fed Ups its Money Printing for 2013, Good for oil, gold and silver prices….

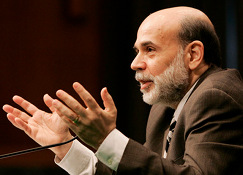

The Federal Reserve chairman Ben Bernanke yesterday moved his money printing into a higher gear with an additional $45 billion in asset purchases a month on top of the existing $40 billion program and set a target of 6.5 per cent unemployment before he would start to reverse this monetary stimulus.

The Federal Reserve chairman Ben Bernanke yesterday moved his money printing into a higher gear with an additional $45 billion in asset purchases a month on top of the existing $40 billion program and set a target of 6.5 per cent unemployment before he would start to reverse this monetary stimulus.

The unemployment target replaces the commitment to keep interest rates low until mid-2015 with a more open-ended approach. Oil, gold and silver prices jumped on the news though they later fell back.

Hard assets to gain

However, this is a very positive policy stance for oil, gold and silver in 2013. The Fed is no longer targeting inflation. Instead it is looking first to unemployment for a signal that the economy is getting better.

Therefore the US economy will now tolerate higher levels of inflation than previously expected. Hard assets like oil, gold and silver are the classic hedges against such inflation and will gain as investors reallocate their money to protect it against the coming inflation.

Interestingly a flash poll on Yahoo! Finance showed 64 per cent of respondents think the Fed should abandon all monetary easing now and let the economy reset. Not everybody is a winner in this. Savers are condemned to low returns on their deposits and those on fixed income like pensioners are suffering. There is a net transfer of wealth to the holders of oil, gold and silver.

There is also a growing appreciation that fixing the bond markets in this way is very dangerous. Already the Fed is having to buy 90 per cent of its own bond issues. The US T-bond has become the biggest Ponzi scheme of all-time and if it was to collapse the consequences would be incalculable.

Safe haven assets

That’s another reason why smart investors are going into hard assets as the last refuge from the money printers. All the central banks of the world are following the Fed’s lead even though many of them fear this is going to end very badly.

If bond markets crash then the price of gold and silver will soar against other assets in a flight to the only true money. This has actually happened many times in history, usually in revolutionary periods or when empires are in decline, and it is happening again right now.

About ArabianMoney.net

Arabianmoney.net is the first dedicated financial comment website to be published from Arabia, and provides lively and topical commentary on both local and global news. This is a free website that introduces the more detailed investment analysis and actionable investment ideas and tips available only in our paid-for subscription newsletter. Anybody seriously interested in Arabian investment should get this monthly publication (subscribe here)