Summary

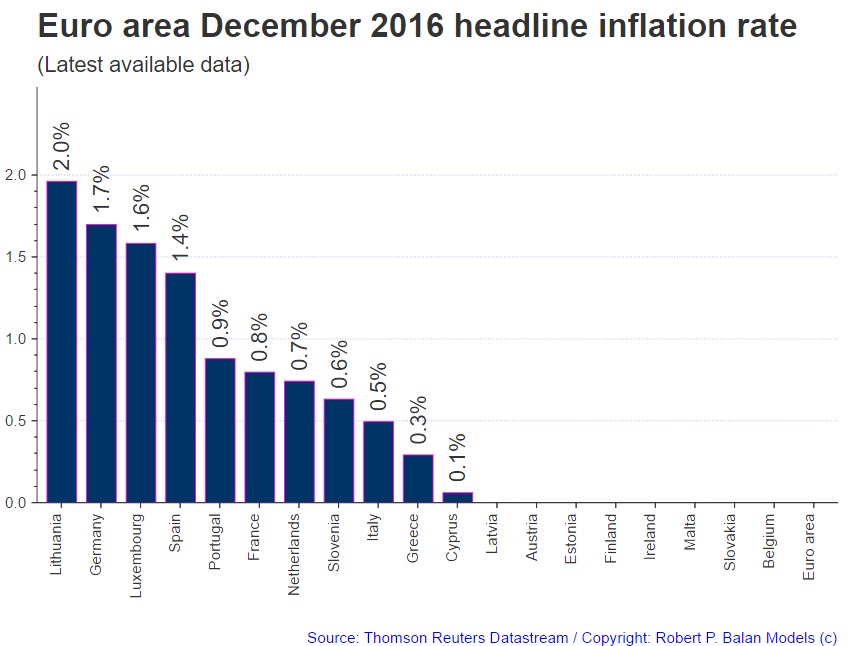

- Latest Eurozone data indicate a substantial jump in inflation in Germany in December , eliciting calls that ECB president Mario Draghi, end his ultra-loose policy and raise the policy rate.

- The reality is that with energy costs rising quickly, the strong disinflationary pulse that the globe had seen in 2015-2016 has been neutralized. The deflation meme is dead.

- The overwhelming impact of rate differentials still favor the USD, but there comes a time when significantly higher inflation rates in the US vs. Row starts to hurt the currency.

- The universal outlook of higher crude oil prices in the medium term has the potential effect of limiting future USD gains, if not weakening it outright against the euro.

- Our short-term outlook is for the US Dollar to strengthen until mid-February, after which the US currency should weaken significantly against the euro and other major currencies.

…related from Jack Crooks: