WHAT CAUGHT OUR ATTENTION THIS WEEK… & WHAT TO DO ABOUT IT

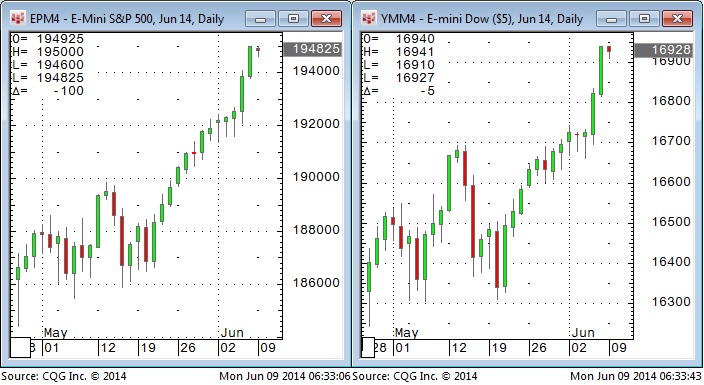

Stocks: It’s a Bull Market! The S+P 500 is up 13 of the last 15 days…up more than 5% in the last month…up 22% in the last year… up nearly 200% from its March 2009 lows.

Current action: No positions. The Vix is at 7 year lows…right at the bottom of its last 25 year range…margin usage is at extreme all-time highs…bullish sentiment is very strong…the market seems perfectly poised for a smack down…but it’s a Bull Market and skeptics and cranky bears would save themselves a lot of money and aggravation by waiting…we can’t bring ourselves to buy this runaway bull market…we’ve just been wrong in anticipating a top…the market looks like it wants to go higher still! Someday we will have an opportunity to make money on the short side…impatience may be costly!

Bonds: Got hammered in 2013 but had a great run in 2014…until last week. We’re anticipating stronger H2 economic growth in the USA than the market currently expects…which would hasten the Fed taper and bring forward the first interest rate increases. We’re anticipating another leg up in bonds on a stock market correction may give us a chance to short bonds.

Current action: no positions…patiently waiting for an opportunity to get short.

Currencies: We anticipate economic growth in the USA to increasingly outpace the Eurozone and that the ECB will have to “do a lot more.” We expect they “wouldn’t mind” seeing the Euro lower…we look for EURUSD and maybe EURYEN to weaken in the months ahead. We’ve held this view for over a year with little reward…however we maintain our view and make a little money chipping away with short dated short option trades. Currency vol (like vol across all asset classes) is at very low historical levels.

Current action: We’ve held short AUDCAD positions for 5 weeks and this past week saw a decent paper profit melt away. We will exit the trade on a clear break above 102.25. We see this trade as a simplified long USA / short China trade. Over the past few months we’ve had various short option trades on to benefit from a weaker Euro and a weaker CAD. The last of those options expired June 6. We will probably do more of the same in the weeks ahead. We recently bought more US Dollar Indices. We remain long term USD bulls and expect more currency wars…some subtle…some not-so-subtle…

Metals: We believe the gold market remains in a liquidation phase with rising volume and declining open interest on price breaks. Gentlemen obviously prefer stocks…the gold/S+P ratio is at a 6 year low…down over 60% from its 2011 highs. Copper has been in a choppy decline from it’s All Time highs made 3 years ago. In the last 3 months it has bounced about 25 cents from 4 year lows…we wrote last week that we expect it to resume its longer term downtrend…breaking this year’s lows of 295 and perhaps falling to 250 or less.

Current action: We’ve had net short positions in gold on-and-off for the past 2 years (and sometimes we’ve been net long!) We’ve been net short for the last 3 months and continue to hold those positions. We initiated net short copper positions in late May and continue to hold. We would exit on a rally through 322.

Energy: We anticipate that the net supply/demand picture over the next several months will push WTI prices lower. We’ve seen the 105 level act as a “roof” three times since WTI rallied from January into March. We see a historically large long spec position in crude being vulnerable to and perhaps exacerbating a price break. Any lessening of geo-political risks will also contribute to lower prices…the flip side of that is any significant increases in geo-political risks could take prices through 105 in a heartbeat.

Current action: We initiated net short WTI positions in late May and continue to hold. We would exit on a breakout above 105.