Do you know why Warren Buffett recently added to his 60 million share position in Wal-Mart Stores Inc. (WMT:NYSE)? It’s not because the world’s largest retailer is an untold secret, or growing earnings at 35% annually (it’s not), or because Buffett got a sweetheart deal (he didn’t). It’s simple: Buffett bought more shares in Wal-Mart because the company is really, really big.

Yes, Wall-Mart is a solid company. But the law of large numbers tells us it is far more difficult to double profits from $17 billion than from a base of $1, $5, or even $17 million.

For Buffett, bigger is better

Toward the beginning of Buffett’s investing career, it wasn’t uncommon for the Oracle of Omaha to post 30% or 40% annual returns in Berkshire Hathaway’s (BRK-B NYSE:) equity portfolio. But as the size of the capital base at Buffett’s disposal grew larger, those stock returns began to shrink. “We do need to deploy cash, but we can’t put many billions to work every year in spectacular businesses,” Buffett said. “To move the needle at Berkshire, they have to be big transactions.”

In the aftermath of the 2009 and in recent years, Buffett’s biggest investments were in blue-chip behemoths like Johnson & Johnson (NYSE: JNJ), Wal-Mart (WMT:NYSE), and Wells Fargo (WFC:NYSE).

Those were all solid investments in great companies, to be sure, but it is unlikely they will propel Buffett’s portfolio to those 40% annual returns he generated in the past. And they certainly won’t help Buffett realize the 50% annual returns he famously stated he could achieve if he had less money to invest – and could invest in great small-cap stocks.

“Anyone who says that size does not hurt investment performance is selling. The highest rates of return I’ve ever achieved were in the 1950s. I killed the Dow. You ought to see the numbers. But I was investing peanuts then. It’s a huge structural advantage not to have a lot of money. I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that.” – Warren Buffet

Unfortunately, Buffett understands his predicament all too well. “Size is always a problem,” Buffett told The Wall Street Journal’s Jason Zweig. “With tiny sums [to invest], it’s extraordinary what you can find. Most of the time, big sums are one hell of an anchor.”

Anchors aweigh!

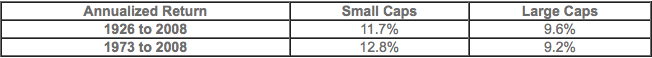

So what would Buffett buy if he weren’t relegated to the realm of blue chips? We think he’d be scooping up shares of great small-cap stocks. After all, they have historically outperformed large-cap stocks — a gap that has widened over the past 35 years:

Undoubtedly, Buffett could get these higher returns – and better. Unfortunately, it’s impossible for him to buy small-cap stocks. But before we get to why Buffett can’t buy small caps, let’s look at why small-caps outperform in the first place.

Massive potential returns

By definition, smaller companies have much more room to grow. With annual revenue of about US$480 billion, Wal-Mart probably won’t be tripling that number anytime soon. The relatively tiny independent auto repair shop operator, Boyd Group Income Fund (BYD-UN:TSX) on the other hand, one of the longest standing stocks on KeyStone’s Focus BUY List, has more than quadrupled its revenue over the past 6.5 years, increased earnings by more than 5 times, and its stock price skyrocketed as a result.

For comparison purposes, below we see that Wal-Mart was a decent buy in 2008 as the financial crisis hit and its shares traded in the $55 range. Over the past 6.5 years, the stock has returned around 75% including dividends.

But the Small-Cap’s gains are astonishing over the same period. The Boyd Group and its simple car repair business, which was recommended to KeyStone’s Premium Small-Cap Research clients in November of 2008 at $2.30, has seen it shares rocket to recently close at $46.70. In fact over that period, the company has created such strong cash flow it has distributed over $2.20 per share in distributions (dividends) to shareholders on top of the tremendous share price gains. Again it has paid us $2.20 in cash and we bought the shares for $2.30!

On top of their room to grow, small caps don’t attract much attention from Wall & Bay Street analysts. In fact in 2008, KeyStone was the only research firm covering the Boyd Group. This means savvy investors are more likely to find mispriced stocks when fishing in small-cap waters. It appears that Bay Street is finally beginning to catch on to the Boyd Group story, but there are still dozens of compelling small-cap companies monitored by just one or two analysts or zero — and many more that receive no analyst coverage at all!

Size Matters

So why doesn’t Buffett buy underfollowed small-cap stocks that could very well triple? It’s simple: He can’t.

Let’s revisit Buffett’s quote from earlier in the article: “We can’t put many billions to work every year in spectacular businesses,” Buffett said. “To move the needle at Berkshire, they have to be big transactions.”

Even after the Boyd Group had seen its’ share price rocket over 20 fold over the past six and a half years, its market cap is just $764 million. Only about $1.5 million worth of stock trades hands each day. Buffett couldn’t buy a stake in the company without driving the share price up significantly. And even if he were to buy the company outright, that $764 million purchase would barely register in Berkshire’ US$360 billion investment portfolio.

In other words, researching a small-cap company like the Boyd Group, no matter how promising its prospects, simply isn’t worth Buffett’s time.

But it’s definitely worth our time

Individuals who invest dollar amounts in the thousands should be scouring the markets every day for the next Boyd Group. It’s the only way to even approach those 30% or 40% annual returns.

But be forewarned: Just because a company is small and underfollowed does not guarantee Boyd Group -like returns. Consider the case of Canadian frac water tanks provider Poseidon Concepts Corp., a former high-flying small cap that traded to $15 but crashed to zero when the market discovered its business was more than flawed with limited barriers to entry. Thankfully, the company never met our criteria, which has grown stronger overtime.

That’s why in addition to great growth prospects and limited (or no!) analyst coverage, our team of experts at KeyStone’s Small-Cap Research seeks out small caps that have:

• A strong balance sheet

• Positive cash flow

• Attractive Valuations

• Potential for a dividend (or dividend increase)

• A management team with a significant share ownership.

• A business we can understand.

• Operations in relatively safe jurisdictions.

• A positive industry outlook or niche outlook.

• Potential for hidden assets

• Market-beating potential over the next three to five years.

One of our top picks (3 in total) from our January 2015 Cash Rich Small-Cap Report, a high growth small-cap software developer, has already seen its share price jump over 80% on news of a major contract win. We continue to see the potential for further price gains from this small-cap tech leader.