Investors are fast discovering that stocks go down as well as up.

Investors are fast discovering that stocks go down as well as up.

They’re also discovering why stock investors get paid: to shoulder risk.

It’s not for nothing that there is something known as the “equity risk premium.”

This is Wall Street speak for the excess return the stock market provides over supposedly “risk free” bonds.

On average, this has worked out at about 3% a year.

That’s the deal.

In return for the risk of owning stocks over bonds, shareholders earn higher returns than bondholders.

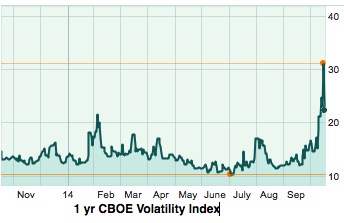

And even though it can sometimes seem that way – take 2013, for example – this isn’t a free lunch. Sometimes the bill comes due. Sometimes shareholders have to stomach a lot of nerve-rattling volatility.

That’s why it makes no sense to get upset when stocks start to bounce up and down. If they didn’t from time to time become so volatile, they wouldn’t pay so well.

The secret is to get used to the rollercoaster ride.

This isn’t just an opinion, either.

Fidelity Investments ran a study to see which of their account holders performed best over time.

The winner: folks who’d forgotten they had an account. In other words, folks who didn’t watch the market… didn’t try to beat the market… didn’t try to time the market… and didn’t trade.

They just let their accounts compound over time.

That’s why Bill Bonner’s investment motto is: “Think a lot. Do very little.”

Sure, you want to invest intelligently. You want to buy when assets are on sale and sell when they rise back to fair value. You want to own a diversified portfolio. You want to keep your costs low.

But these are all proactive decisions.

What you want to avoid is reacting to every bump in the road. This will not only give you sleepless nights, it will also almost certainly leave you poorer.