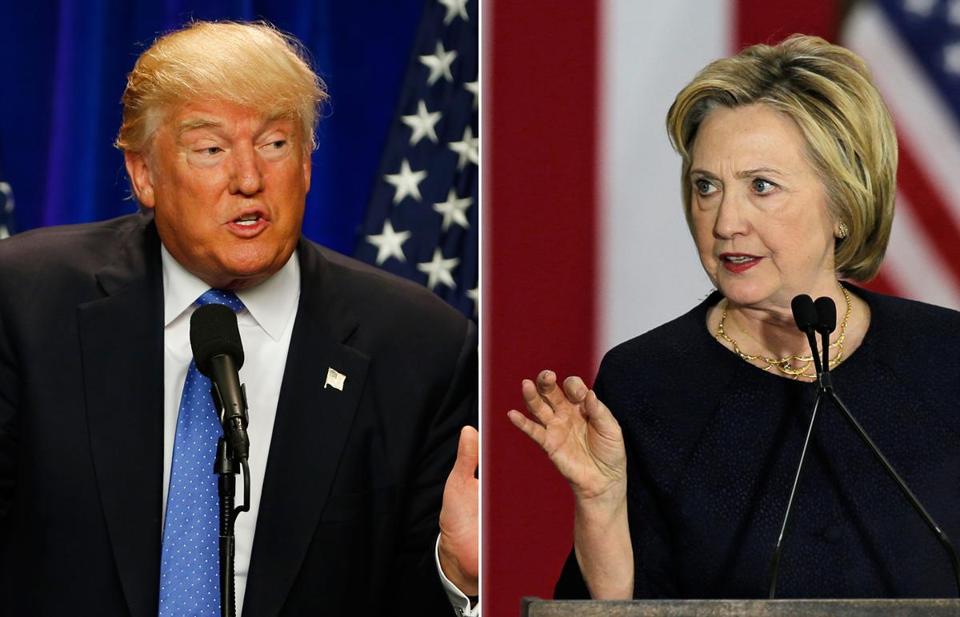

The networks say this past Monday’s first presidential debate was the most-watched TV event of all time. Over 100 million tuned in when the debate started at 9:00 pm EST.

The networks say this past Monday’s first presidential debate was the most-watched TV event of all time. Over 100 million tuned in when the debate started at 9:00 pm EST.

I think the number was much higher, perhaps 200 million or even 300 million, when counting the rest of the world and multiple people watching the same TV.

Trump is crass, rude, a liar and a BS artist. But he’s pushing the right buttons of the American population and has been all along.

I anticipated as much way back in 2013 when on the Weiss Wealth cruise, I announced the rise of my war and geopolitical cycles and warned of rebellions and antiestablishment moves, not to mention outright revolutions and wars in the years ahead.

What Trump’s popularity is telling you is precisely that for the U.S.: It’s time for a revolution. The majority of average Americans want to get rid of the old, the status quo and bring in the new, from outside the establishment.

What that “new” will be, only time will tell. And despite losing the first debate …

My Models Predict Trump Will Win the White House

It has to do with my cycle work and the convergence of several important economic and geopolitical cycles that is occurring now and will continue as a Category 5 hurricane for the entire globe heading into 2020/21.

For the world is facing the worst of times, even worse than the Great Depression. And there is only one of the two potential leaders who fits that bill, and it’s Donald.

Yes, I believe Hillary would make a better president — even though she too is full of lies, deceits, corruptions, conflicts of interest and BS.

But here’s the thing: If my models are wrong and Hillary wins the office, it won’t change things much at all. The global macroeconomic picture will look perhaps a tad better, but in reality, it won’t be.

The only thing that will change is which investment sectors will do well under either candidate and which won’t.

You can rest assured that I’ll help you with that in my Real Wealth Report and premium servicesthat aim for large speculative gains — as soon as we know who wins in November.

But as I said earlier, Trump is likely to win the White House. Either way, it will be a one-term job, for come 2020, there will be yet another change, probably one that sees the true rise of a third party altogether, the Libertarian Party.

Now, to the markets. It’s already late September and nearly every market my AI models digest continue to point lower into October 6/7.

But we’re running out of time. If we don’t soon see further moves lower in the metals, in stocks and foreign currencies …

Then it will be back to the long side, buying dips and looking for a rally into year-end. Even if Donald wins the debates and the election.

Why? It’s simple. Even with one of the two worst candidates in American history on the edge of taking the White House …

The U.S. economy, property and investment markets will remain magnets for foreign capital fleeing parts of the world that are in much worse shape than the U.S.

Think Europe, who’s going down the toilet with a hair-brained currency experiment, with its strongest economy, Germany, now weakening.

Think Europe, who’s going down the toilet with a hair-brained currency experiment, with its strongest economy, Germany, now weakening.

With its huge Deutsche Bank now on the verge of collapsing, and a population now rising up against its once hugely popular Angela Merkel …

And where just over a week ago, German Chancellor Angela Merkel and her Christian Democratic Union (CDU) had its worst-ever election in Berlin when the party was voted out of power.

And replaced locally by the surging nationalist party Alternative für Deutschland (AFD).

Think the Middle East, Syria, Iran, Iraq, Jordan, Turkey, Libya and more. A cesspool of problems. Would you want to keep any money or investments there?

Think Japan, the most vulnerable economy of all.

Or even think China, whose economy remains fine, but whose rich now want to diversify their money out of China as Beijing opens its capital account and currency.

And many other troubled parts of the world, including Africa and Venezuela — a petri dish of what could happen to what I call the “third-world crisis in the first world…”

Or the end of Western-style socialism in Europe, Japan and the U.S.

I told everyone I could almost three years ago that the war and geopolitical cycles were showing a steep rise into 2020/21.

And last year, I showed you how major, proven macroeconomic cycles were also converging to make for a global economic crisis far worse than the Great Depression.

It’s all started, right on time. Either you are going to be prepared for it, or you’re not. If it’s the latter, you stand to lose a majority of your wealth. If it’s the former, not only can you protect your wealth, but you can also grow it over and over again.

Best wishes, as always …

Larry

http://www.moneyandmarkets.com

….also from Martin Armstrong: