It appears that a positive catalyst for higher uranium prices has unfolded as the citizens of Japan have voted to put the Liberal Democratic Party (LDP) back in power by a large margin. This is significant as the party has voiced support for a return to nuclear energy in the country (as well as aggressive monetary policies which should be positive for commodity demand).

Only two of the 50 reactors in Japan are currently operating, but given the high cost of importing fossil fuels (estimated to be ~ $100 million per day), once can see why a return to nuclear- generated electricity holds an appeal. Nuclear generation costs are largely sunk. Plants, though aging, have been built and the typically large up front capital expenditure for new technology and extensive regulatory delays are not a deterrent in Japan as they are elsewhere in the world.

Not So Fast!

To be clear, if and when a re-start of the Japanese reactors commences, it may take longer than many anticipate as each nuclear plant must be inspected and cleared to resume operations. Reportedly, the Japanese Nuclear Regulation Authority is actively inspecting six plants to determine if they were built on active fault lines. Additionally, there is still ardent opposition to restarting the nuclear power plants in Japan.

From a recent Bloomberg article:

“People who voted for the LDP are supporting their economic-stimulus measures, not nuclear power policy,” said Toshihiro Inoue, a member of the “Goodbye Nuclear: the Action of 10 Million” civil movement, whose online petition to stop atomic reactors in Japan has so far received about 8.2 million signatures.

The fact that there is still opposition to reactor restarts is something investors should not dismiss in formulating an opinion on investing in uranium. Could local opposition to nuclear energy be the “black swan” for the uranium business the same manner that local opposition continues to hamper Lynas in the rare earth business? While we think it is too early to know for sure, any balanced appraisal of uranium investing must consider this.

That said, we are of the belief that it’s not a matter of if but when and how many of Japan’s reactors are restarted. A country such as Japan that must generate such a large portion of its electricity via nuclear power cannot afford not to.

Two other issues with the nuclear industry circle in our minds. We are concerned that the continual “refit” of old technology is one of the most dangerous issues. This is the current case in Japan as well as the U.S. It is, of course, prohibitively capital intensive to build new large scale reactors. Modular, lower cost reactor technology in the field still seems a few years away. Second, storage of spent uranium byproducts is still a problem without a solution. Would a transition in Japan (and elsewhere) to a thorium fuel cycle make more sense?

However Other Uranium Catalysts Are Lining Up

In a recent presentation at the San Francisco Hard Assets Conference I made the case for higher uranium prices in 2013 based on a looming supply and demand imbalance comprised of:

1. The “producers” are headed to the sidelines. These include BHP Billiton, Areva, Paladin, and Cameco who are either delaying or mothballing projects due to a low U3O8 price rendering projects uneconomic.

This trend collectively removes at least 20 million pounds of uranium from the market. A higher U3O8 price will, no doubt, bring many of these companies back into the market. However will they be able to do so in time to satisfy increased demand from countries such as China, India, the UK, the UAE, Slovakia, and Poland? There are ~ 436 nuclear reactors on line globally with 63 under construction and another 150 planned. The need for additional uranium to power the existing reactor fleet plus the additional reactors coming on-stream paints, we think, a particularly bullish picture for uranium exploration and production plays in 2013 and beyond.

2. The looming end of “Megatons to Megawatts” – the agreement between Russia and the United States to use uranium from Russian nuclear warheads a fuel in the 104 nuclear reactors in the United States. The agreement is set to expire at the end of 2013 and if it is not renewed, wholly or in part, could remove 24 million pounds of U3O8 from the market. This is 50% of USA consumption in a given year (a good sign for US-based uranium producers). While we cannot speculate as to whether or not the M-to-M Agreement will be renewed under different terms or at all, one must consider the possibility of a uranium supply disruption here.

3. As we mentioned above, Japanese reactors coming back on line will require additional uranium supply – reportedly 10% of global supply (approximately 15 million pounds). Again, when, not if this occurs, this will be bullish for uranium investors.

Uranium Is One of Our Top Picks For 2013

The uranium sector has been punished since the accident in Fukushima in 2011 and we submit that investing in junior miners involved in uranium is one of the great contrarian investment themes for 2013. A beaten down sector, unloved by the investing populace at large and shunned by major producers in the space is poised for a spike in demand. How that spike

in demand will be met is unclear. The low cost exploration and near term production stories would appear best positioned to deliver above average returns in the coming months.

Ideally, choosing a basket of stocks with different risk profiles would seem to offer the optimal risk-reward profile. We have written on and still like European Uranium Resources (EUU:TSX-V) as an early stage developer in Slovakia and also view favorably UR-Energy (URE:TSE) and Uranerz (URZ:NYSEAMEX ) for their low cost near term production profiles in the Western United States.

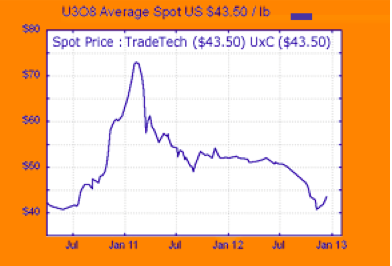

Source: u3o8.biz

As you can see above, despite the general downward trend in the U3O8 spot price, the election results in Japan have helped the price tick upwards. We think this could be the turning point in the sector many have been waiting for and reiterate our affinity for select uranium names in 2013.

Chris Berry of Discovery Investing

The material herein is for informational purposes only and is not intended to and does not constitute the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. I own shares in EUU. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.