In our previous article PART I (Delinquencies Pile Up – Will Commodities Make A Massive Move Soon?) we explained and showed you the delinquencies rising in various areas of the credit market and what it means.

Now, we get to the fun part of our research. Assuming our Head-n-Shoulders Top formation continues to play out and the US and Global markets continue to play the Credit/Debt game (and we are really watching China as recent news from the IMF and others is that China is trying to hide massive debt defaults), what do we expect the markets will do and how can we profit from these moves?

In short, we are cautiously watching the global markets for signs of continued weakness and signs of a debt contagion situation. There has been quite a bit of news that global debt is an issue with China, Italy, Venezuela, Greece, Puerto Rico and others. Our concern is this debt issue turns into a cancer like disease for the rest of the globe. And in our opinion, it would be rather easy for government, banking or corporate institutions to become a “black hole” that creates another crisis event.

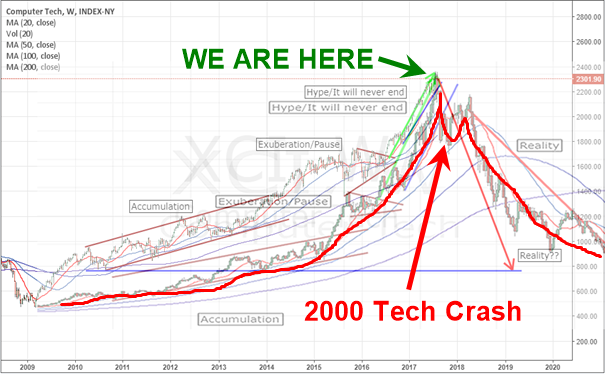

Our recent article reviewing the potential of a Technology “DOT COM Do-Over” clearly illustrated the hype that is current found within the global technology markets. Technology has been on fire for the past 3+ year because global ROI has languished and the global FANGS have provided a much greater ROI opportunity than almost anything else. This focus on technology may setup to become an issue that drives a substantial market correction.