This Critical Uranium Shutdown is Going Ahead

A brief news item yesterday may be one of the most important happenings in commodities for years.

The coming shutdown of one of the largest uranium mines on the planet.

I noted a few weeks back that workers at Cameco’s McArthur River uranium mine in northern Canada were contemplating labour action. And yesterday that threat came to fruition–with the major uranium company announcing that mineworkers’ unions have authorized a full strike.

It appears this action is going to bring McArthur River to a complete standstill. With Cameco saying it is now initiating shutdown activities at the mine, and the associated Key Lake uranium processing facility.

The strike is officially slated to begin on August 30. So it looks like production here will now taper off, leading up a full stop by that date.

As I mentioned previously, it’s hard to understate the effect this stoppage could have on uranium supply. Given that McArthur River is one of the world’s largest and richest uranium producers, currently putting out nearly 15% of global supply itself.

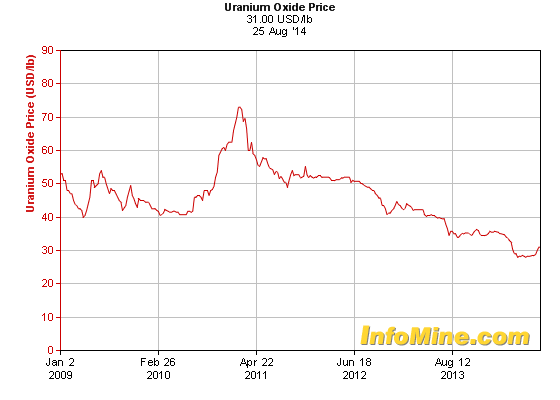

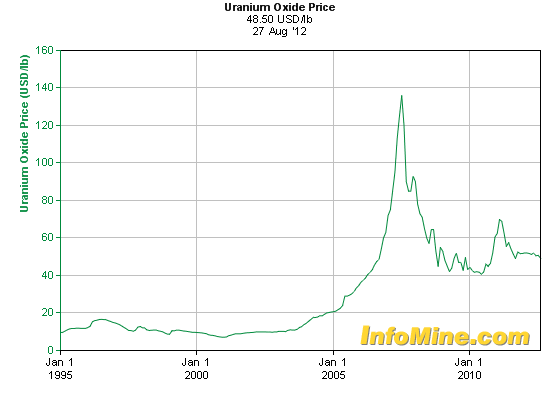

Interestingly, uranium prices have been rising the last few weeks. Up over 10% since the beginning of August, when news of the potential strike action at McArthur began to surface–currently selling for $31 per pound.

This is the most notable increase in prices the uranium market has seen for years (albeit from a very low base, with prices having recently fallen to a near-decade low of $28). Suggesting that buyers are paying close attention to the events at McArthur, and the potential effects on global uranium supply.

Cameco noted that it is continuing discussions with mineworkers over the next 72 hours leading into the strike. So a last-minute solution is still a possibility.

But absent such a five-to-midnight deal, supply and demand is about to get much tighter in this space.

Here’s to unexpected events,

Uranium Mining Companies Listed in All Countries including price history & charts – Editor Money Talks