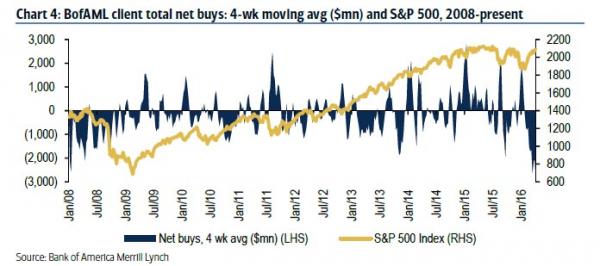

One week ago we were surprised to learn that no matter what the market was doing, whether it was going up, down or sideways, Bank of America’s “smart money” (institutional, private and hedge funds) clients, simply refused to buy anything, and in fact had continued to sell stocks for a near-record 12 consecutive weeks. In fact, the selling continued despite what we said, namely that “at this point it was about time for the selling to stock, if purely statistically, otherwise said “smart money” would be sending the clearest signal yet that the market rally from the February lows is nothing but a huge gift to sell into.”

One week later we were absolutely convinced that finally the selling would end. It has not.

related: