Summary

History tells us retests often occur after markets push to important new highs.

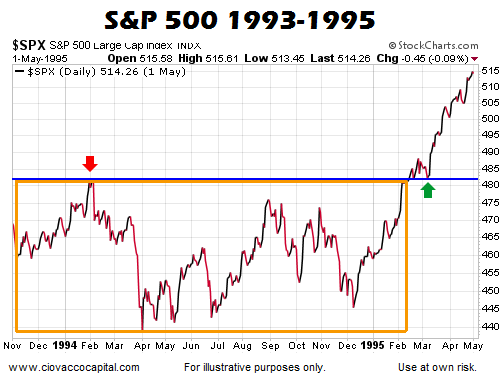

Historical example of retest after a breakout from a long-term consolidation box.

What can we learn from the S&P 500’s monthly chart?

Retests Can Occur After Breakouts

Typically, when markets (NYSEARCA:SPY) break out from long-term consolidation boxes, it tells us something has fundamentally changed. However, the fundamental drivers that kept the market contained in the consolidation box may still need one more shakeout or retest before the market can push higher.

For example, after the S&P 500 (NYSEARCA:VOO) went basically nowhere between November 1993 and February 1995, the bulls finally mustered enough conviction to push price above the orange box below. After the bullish breakout from the long-term range, sellers needed one more shakeout before the market pushed higher. The retest occurred above the green arrow.

….related: