Stock Trading Alert originally sent to subscribers on August 4, 2016, 6:38 AM.

Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,210, and profit target at 2,050, S&P 500 index).

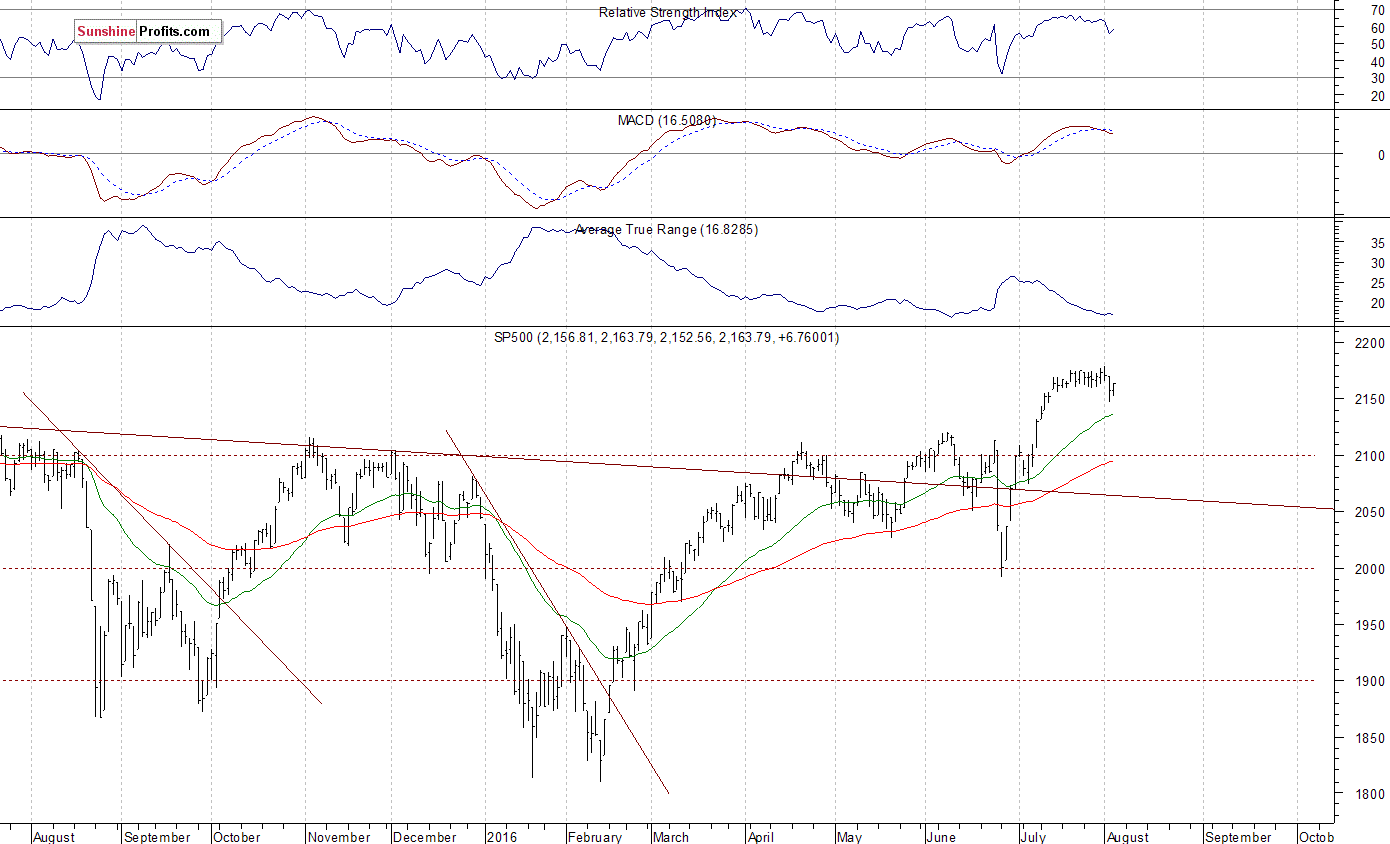

Our intraday outlook is bearish, and our short-term outlook is bearish. Our medium-term outlook is now neutral, following S&P 500 index breakout above last year’s all-time high:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): neutral

The main U.S. stock market indexes gained 0.2-0.3% on Wednesday, retracing some of their recent move down, as investors reacted to economic data, quarterly earnings releases. The S&P 500 index continues to trade within a short-term consolidation following last month’s rally. The nearest important level of support is at around 2,150, marked by Tuesday’s daily low. The next important support level is at 2,130-2,135, marked by previous level of resistance. On the other hand, resistance level is at 2,170-2,175, marked by Monday’s all-time high of 2,178.29. The next potential resistance level is at 2,200. For now, it looks like a relatively flat correction within medium-term uptrend. Will the market continue higher? Or is this some kind of a topping pattern before downward reversal?