The month of March typically marks the beginning of Spring. This weekend will also mark the loss of an hour of sleep as we set our clocks forward an hour in observance of daylight savings time.

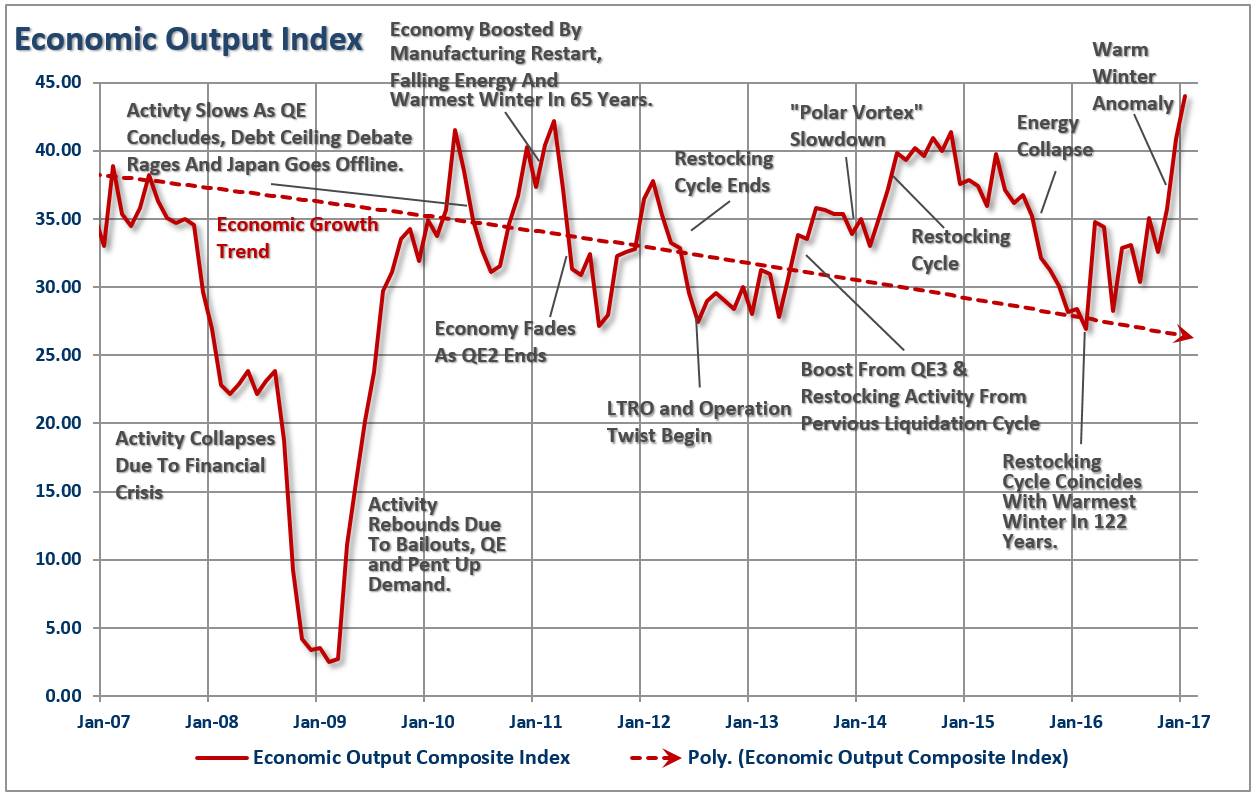

As we will discuss momentarily, the month of March begins following an unseasonably warm winter period that allowed for manufacturing activity to occur during a period where inclement weather normally abounds. This is an interesting point because two years ago, the BEA adjusted the “seasonal adjustment”factors to compensate for the cold winter weather over the previous couple of years which had suppressed first quarter economic growth rates. (The irony here is that they adjusted adjustments for cold weather that generally occurs during winter.) However, the problem with “tinkering” with the numbers comes when you have an exceptionally warm winter. The new adjustment factors, which boosted Q1 economic growth during the last two years now creates a large over-estimation of activity during the first quarter of a year where winter weather is unseasonably warm.

This anomaly has boosted “bullish hope” as the fear of an economic slowdown has been postponed. At least temporarily until the over-estimations are revised away over the course of the coming months. Of course, with the spread between “hope” and “reality” currently at some of the highest levels ever, it is worth paying attention to what happens.