1. Beef Up Your Portfolio With Small Cap Superior Performance

1. Beef Up Your Portfolio With Small Cap Superior Performance

by Michael Campbell & Ryan Irvine

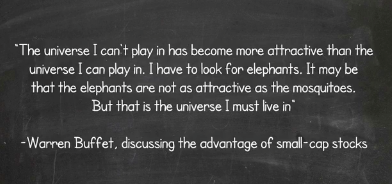

For the past 18-years Ryan Irvine has had a remarkable track record with average returns well over 30% annually over the last 4 years. Ryan tells Michael and the Money Talks audience today about the cash generating and under followed small-cap stocks that he has found. Between 1926 – 2004 Small-cap stocks averaged a 15.9% return compared to only 9.26% for Large Caps and thats the reason Warren Buffet laments he has grown to large to buy them.

2. Coal Fueled Teslas

Several countries are making proclamations that state all new cars shall be electric by a certain date. Who decided on electric cars? I know they sound “clean” but where does that electricity come from?

3. Germans Have Quietly Become the World’s Biggest Buyers of Gold

The worlds biggest investors shifted hands to Germany in 2016, with investors there ploughing as much as $8 billion into gold coins, bars and exchange-traded commodities (ETCs). This set a new annual record for the European country.