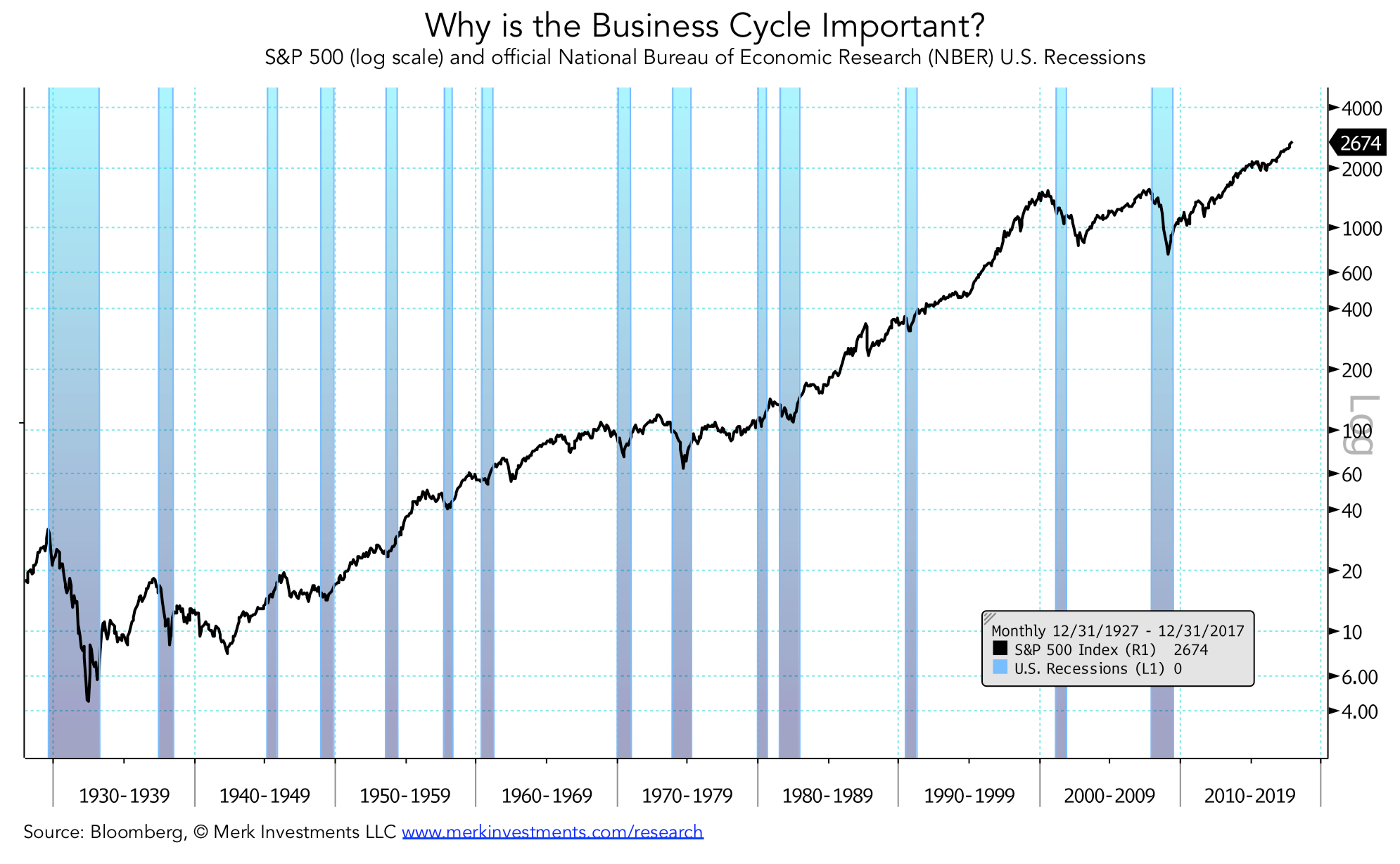

While there has been some deceleration at the margin in some of the macro data (e.g., LEIs), overall the economic expansion looks set to continue over the next few months, and in general until further notice. All of these charts or concepts are somewhat inter-related, as is the economy in general, and almost all indicators are positive: R. Zurrer for Money Talks

Analysis: Over the 90 years between 1927 and 2017, the average S&P 500 monthly return during expansions was +0.89% (889 months), compared to an average S&P 500 monthly return during recessions of -0.71% (191 months). The business cycle also has important implications for Fed policy. *Note that recessions are not announced by the NBER until well after their start dates*

…..continue for Next Chart & Analysis HERE