A few years ago, TINA was everywhere … she was the life of the party. Whenever people wondered why stocks kept rising, she’d show up and people would scream, TINA!

But I haven’t heard anyone mention her recently … did she take off? Or did she drink so much from the punch bowl that she’s passed out, sleeping somewhere?

Of course, I’m talking about TINA the acronym, not Tina your old drinking buddy. As in, There Is No Alternative … to stocks.

Let’s be clear. Choosing your investments by process of elimination is not the best way to approach things. After all, you shouldn’t invest in something just because everything else looks worse. That investment could also have little intrinsic value and a poor risk to reward ratio.

But TINA is not a way of investing, it’s a narrative … one that’s been with us for years and may be here for a while longer. So far, this narrative has helped investors achieve substantial returns. Will it continue to do so moving forward?

For most investors, the highest level asset allocation decision typically involves deciding between stocks, bonds, and cash. Let’s begin with these three and then we’ll expand our discussion to encompass alternative asset classes such as precious metals, real estate, and currencies.

Since stocks are the shoe-in here, let’s take a look at cash and bonds to see what type of case can be made for investments there. First cash.

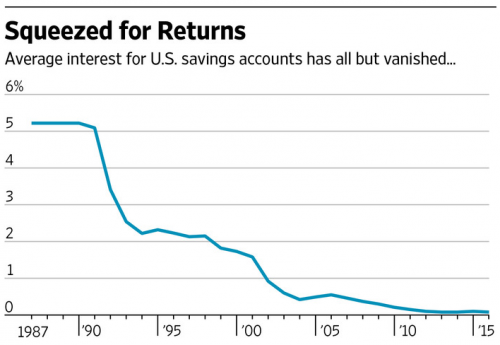

As you well know, the returns on cash have dropped to zero over the past couple of decades. The chart below exemplifies this, showing how the return on savings accounts has dwindled since the early 90’s.